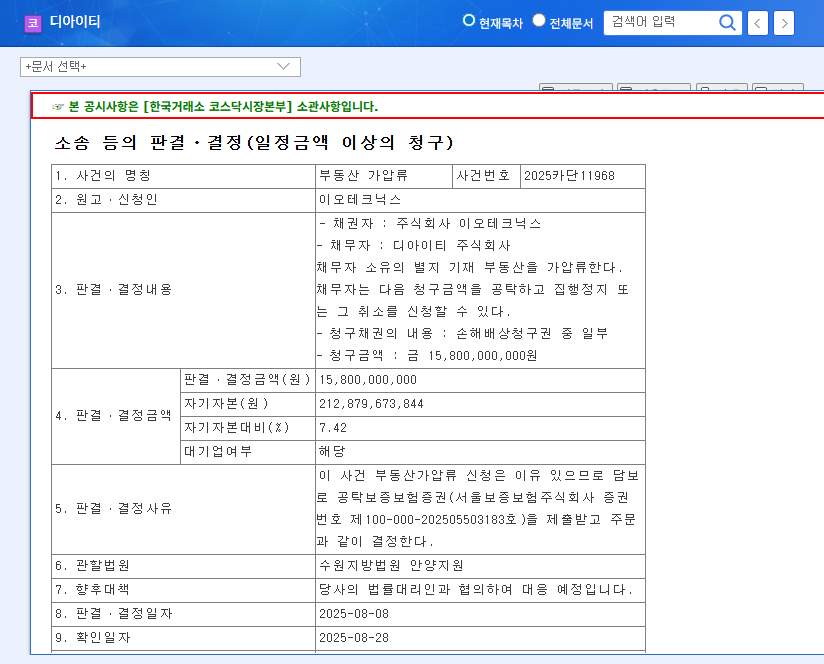

1. What Happened? The ₩15.8B Lawsuit Explained

EO Technics filed a ₩15.8 billion damage claim lawsuit against DIT, resulting in a court order to seize DIT’s property. This represents a significant 7.42% of DIT’s assets. While the specific details of the suit haven’t been disclosed, it’s speculated to involve technology leaks or contract disputes.

2. Why Does It Matter? The Lawsuit’s Impact on DIT

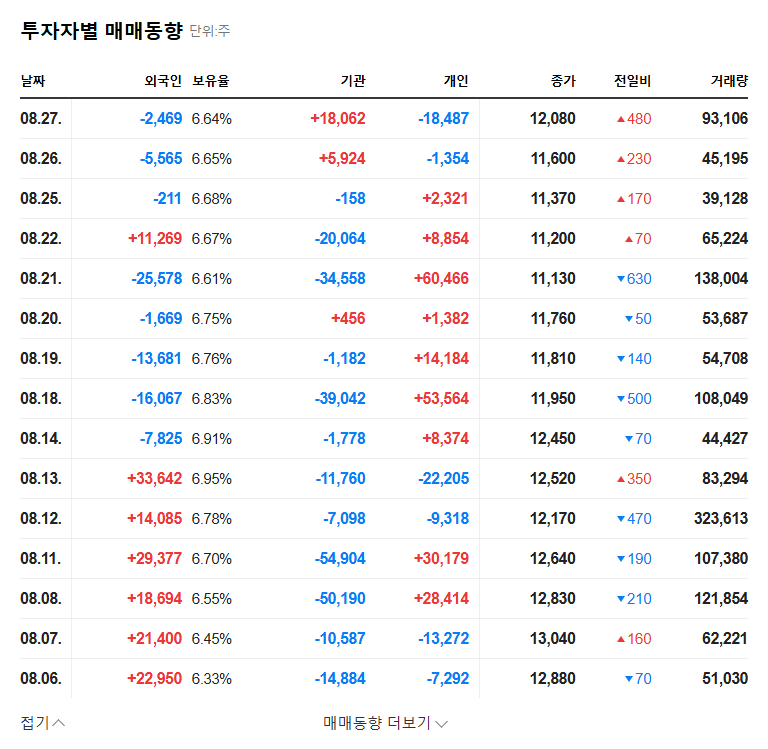

This lawsuit could negatively affect DIT’s financial health and investor sentiment. The ₩15.8 billion represents about 31% of DIT’s recent half-year revenue, posing a potential financial burden. The property seizure also restricts DIT’s asset utilization, with the possibility of further losses depending on the final judgment. This uncertainty could amplify investor concerns, leading to a stock price decline.

3. Is DIT Financially Sound? Fundamental Analysis

DIT is expanding its business in growing markets like semiconductors, displays, secondary batteries, and laser application equipment, with notable growth in its LASER Solution segment. However, the decline in sales and profitability in the first half of 2025 presents a short-term challenge. Despite this, DIT maintains a healthy debt ratio of 11.09%.

4. What Should Investors Do? Investment Strategies

A conservative approach to DIT investment is recommended at this time. The litigation risk is likely to put downward pressure on the stock price in the short term. Investors should continuously monitor the lawsuit’s progress and outcome. For a mid-to-long-term perspective, carefully consider the growth potential of the LASER Solution segment and DIT’s efforts to reduce its dependence on major clients. Staying informed about lawsuit-related disclosures and news, and adjusting investment strategies based on the lawsuit’s progress is crucial.

What are the details of the DIT lawsuit?

Currently, the publicly available information pertains to the ₩15.8 billion damage suit filed by EO Technics and the court order for property seizure against DIT. Specific details haven’t been disclosed, but speculation points to potential technology leaks or contract disputes.

How will the lawsuit affect DIT’s stock price?

The lawsuit is likely to negatively impact the stock price in the short term. The ₩15.8 billion amount could strain DIT’s finances and dampen investor sentiment. The final judgment and the company’s response will determine the long-term impact.

Should I invest in DIT?

Caution is advised for investing in DIT at this time. It’s recommended to postpone investments until the uncertainty surrounding the lawsuit is resolved or to closely monitor the lawsuit’s progress while formulating your investment strategy.