Ecopro HN’s ₩23.6B Investment – What’s Happening?

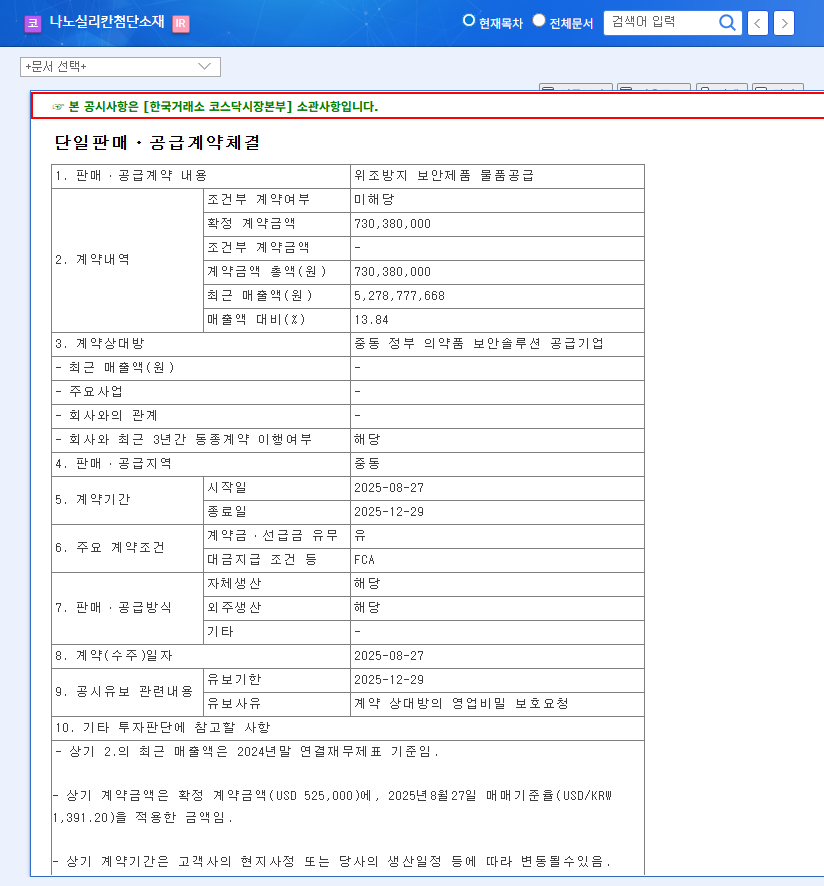

Ecopro HN is investing ₩23.6 billion (8.0% of its capital) to build a next-generation PFC catalyst (honeycomb catalyst, composite heat storage body) production plant at its second campus (Chopyeong). The investment period is from September 3, 2025, to October 31, 2026.

Why the Investment? – Background and Objectives

The market for catalysts that reduce PFCs, greenhouse gases generated during semiconductor and display manufacturing processes, has high growth potential. Ecopro HN is investing in this next-generation PFC catalyst production facility to preemptively capture this market and secure future growth engines. This is part of a strategy to diversify its portfolio with new high-value-added businesses in addition to its existing businesses (greenhouse gas reduction equipment and wastewater treatment plants).

Investment Outcomes – Opportunities and Risk Analysis

- Opportunities:

- Securing future growth engines and business diversification

- Expected increase in sales and profitability due to PFC catalyst market growth

- Strengthening technological and business competitiveness through entry into high-value-added businesses

- Risks:

- Initial investment burden and impact on cash flow

- Uncertainty of new business success (market demand, competitive environment, technology development, etc.)

- Possibility of a downturn in the semiconductor/display industry and dependence on related industries

- Risk of profit fluctuations due to exchange rate fluctuations

What Should Investors Do? – Action Plan

From a long-term perspective, securing future growth engines is positive. However, in the short term, financial burdens due to investment execution and uncertainties in initial business performance should be considered. Make cautious investment decisions by referring to the following monitoring points.

- PFC catalyst market growth and competitive landscape changes

- Progress of new plant construction and stabilization of mass production

- New orders and sales visualization related to next-generation PFC catalysts

- Investment trends in the semiconductor/display industry

- Fluctuations in exchange rates and raw material prices

FAQ

What are Ecopro HN’s main businesses?

Supplying greenhouse gas reduction equipment (RCS), delivering and installing wastewater treatment plants, and preparing to enter the secondary battery materials and electronic materials businesses.

What is the size and duration of this investment?

₩23.6 billion, from September 3, 2025, to October 31, 2026 (approximately 1.2 years).

What is the purpose of the investment?

To secure future growth engines and diversify the business portfolio by entering the next-generation PFC catalyst market.

What are the risks associated with the investment?

Initial investment burden, uncertainty of new business success, dependence on related industries, and exchange rate fluctuations.