1. What Happened? Analyzing DASCO’s Pledge Agreement Changes

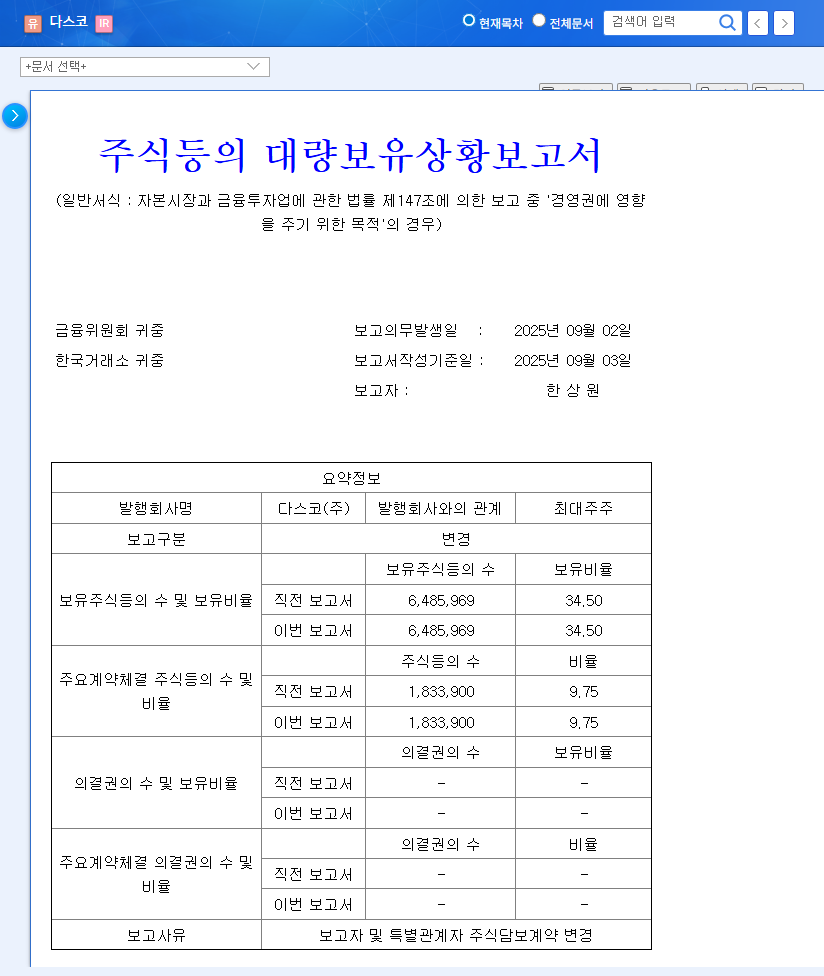

On September 3, 2025, DASCO disclosed changes to its major shareholder report. The key takeaway is that Han Nam-chul and related parties maintain a 34.50% stake for “management influence” purposes, with alterations made to their share pledge agreement. While no change in ownership occurred, the phrase “management influence” is enough to draw market attention.

2. Why Does It Matter? Management Issues Compounded by Weakening Fundamentals

DASCO’s first-half 2025 results were disappointing. Declining sales and operating losses across major business segments, including building materials, energy, and steel, have weakened the company’s fundamentals. Combined with this, management-related issues further fuel investor anxieties. The pledge agreement changes, specifically the possibility of pledge releases, additional pledges, or execution of pledge rights, warrant close monitoring. Moreover, holding shares for “management influence” suggests the potential for future management changes or further stake acquisitions.

3. What’s Next? Short-term Volatility vs. Long-term Fundamentals

In the short term, the disclosure itself is unlikely to significantly impact the stock price. However, the management-related issues and low stock price could attract investor attention, potentially increasing short-term volatility. In the long run, improvements in fundamentals are crucial. The recovery of the construction market, new orders in the energy business, and a reduction in debt ratio hold the key to DASCO’s share price recovery.

4. What Should Investors Do? Prudent Approach, Continuous Monitoring

- Short-term Investment: The current investment appeal is low. A wait-and-see approach is recommended over speculative bets on short-term volatility.

- Long-term Investment: Closely monitor improvements in fundamentals and developments related to management issues. Exercise caution until tangible improvements in business performance and financial structure are observed.

Frequently Asked Questions

What do DASCO’s share pledge agreement changes mean?

Changes in share pledge agreements indicate that certain parties are using their shares as collateral for financial transactions, and there have been alterations to those agreements. While this doesn’t directly affect the company’s financials, it warrants attention due to the possibility of pledge releases, additional pledges, or execution of pledge rights.

What is the state of DASCO’s fundamentals?

Based on the first-half 2025 results, DASCO’s fundamentals are weak. The company faces challenges such as declining sales, operating losses, and a rising debt ratio.

Should I invest in DASCO?

DASCO is currently facing high uncertainty due to its weak fundamentals and management issues. Short-term investments should be approached with caution. For long-term investment considerations, closely monitor improvements in fundamentals and developments related to management issues.