Daewoong Co., Ltd. recently filed a correction regarding its treasury stock holdings, a move that initially appears to be a simple administrative update. However, for astute investors, such disclosures can offer deeper insights into a company’s financial health and strategic direction. This comprehensive analysis will explore the specifics of the Daewoong treasury stock adjustment, its potential impact on corporate fundamentals, and how it fits within the broader macroeconomic landscape to help you formulate a sound investment strategy.

While the disclosure is a correction of past data, it raises the total treasury stock to over 31% of issued shares, a significant figure that warrants a closer look at the company’s capital strategy and shareholder value initiatives.

Deconstructing the Daewoong Treasury Stock Correction

On October 1, 2025, Daewoong Co., Ltd. filed a corrective report to amend its treasury stock status as of December 31, 2024. The primary goal was to enhance informational accuracy. The full details can be reviewed in the Official Disclosure (Source: DART). The key changes are as follows:

- •Direct Acquisitions: An increase of 32,774 common shares, primarily due to employee stock option exercises.

- •Other Acquisitions: An increase of 1,060,055 shares, reflecting the incorporation of merger-related treasury stock and dispositions from the employee stock ownership association.

- •Total Change: The total number of treasury shares rose by 1,092,829, bringing the new total to 18,344,099 shares.

This adjustment increases the company’s treasury stock ratio from 29.67% to approximately 31.55% of total issued shares. This is a significant holding and understanding its implications is key to a proper Daewoong Co., Ltd. investment analysis.

Beyond the Numbers: Fundamental and Strategic Implications

Contrary to what a ‘correction’ might imply, this update is not a negative signal for Daewoong fundamentals. In fact, it can be interpreted positively from several angles. The use of treasury stock is a common corporate finance strategy used to return capital to shareholders or manage stock price volatility.

Boosting Transparency and Shareholder Value

By promptly correcting reporting errors, Daewoong enhances its corporate transparency and reliability, which builds investor trust. Furthermore, the components of the increase—employee stock options and association dispositions—are tied to shareholder-friendly policies. Aligning employee incentives with stock performance often leads to better long-term corporate value.

The High Ratio: A Double-Edged Sword

A treasury stock ratio of over 31% is notable. On one hand, it significantly reduces the number of shares available for public trading (the ‘float’), which can increase stock price volatility. On the other, it gives management a powerful tool. These shares can be re-issued for future M&A activities, used for employee compensation, or retired to boost earnings per share (EPS), all of which can be beneficial for long-term investors.

Macroeconomic Context and Investor Strategy

No stock exists in a vacuum. The current macroeconomic environment presents both challenges and opportunities for Daewoong. Rising interest rates increase borrowing costs, while exchange rate volatility (especially USD/KRW) can impact profitability for a global player. Conversely, falling commodity prices could lower production costs. Investors must weigh these external factors against the company’s internal strategy for managing its Daewoong treasury stock.

An Action Plan for Investors

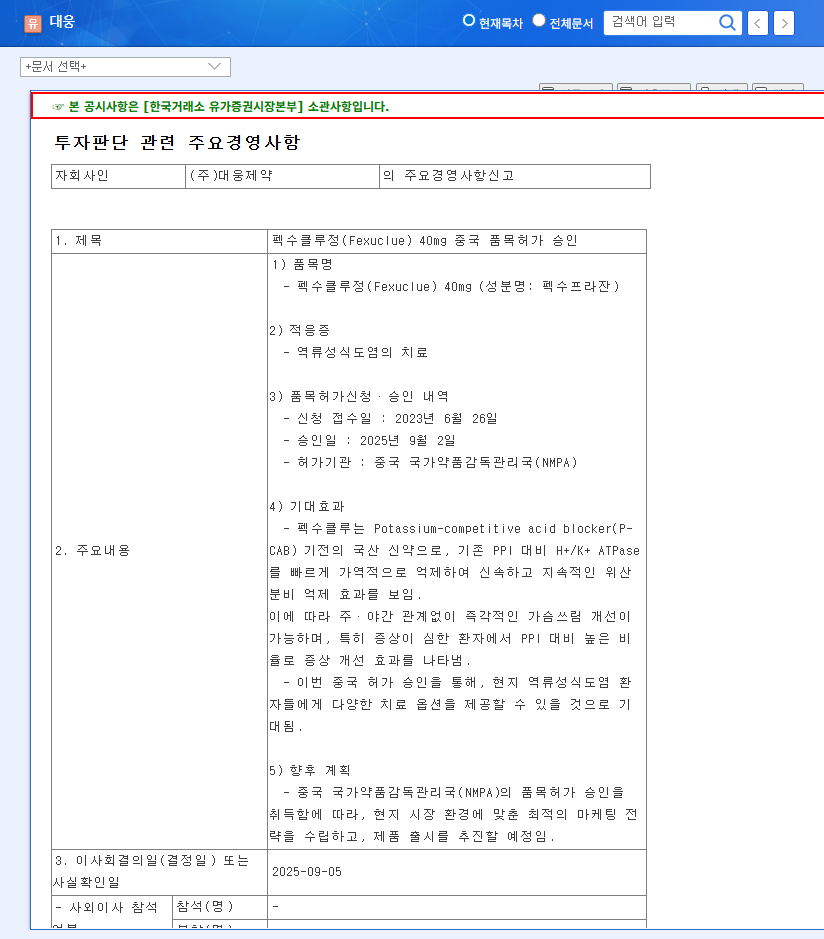

- •Focus on Core Business: The ultimate driver of the Daewoong stock price is the performance of its key pharmaceutical products like Nabota and Fexuclue. Monitor their global sales and the progress of the R&D pipeline. Our internal report on Daewoong’s Pharmaceutical Pipeline provides further details.

- •Monitor Treasury Stock Policy: Keep an eye out for future announcements regarding the use of these treasury shares. Any large-scale disposal or retirement will be a significant market event.

- •Maintain a Balanced View: This disclosure is not a direct catalyst for immediate price action. Given the macroeconomic uncertainties, a ‘Hold’ or ‘Observe’ stance is prudent. Base long-term investment decisions on sustained improvements in earnings and business fundamentals.

In conclusion, the Daewoong treasury stock correction is more than an accounting formality; it’s a reaffirmation of the company’s commitment to transparency and provides a window into its capital management strategy. While not an immediate buy signal, it reinforces the need for investors to monitor core business performance and future strategic uses of this substantial treasury shareholding.