1. What is Daewon Pharmaceutical’s Convertible Bond Issuance?

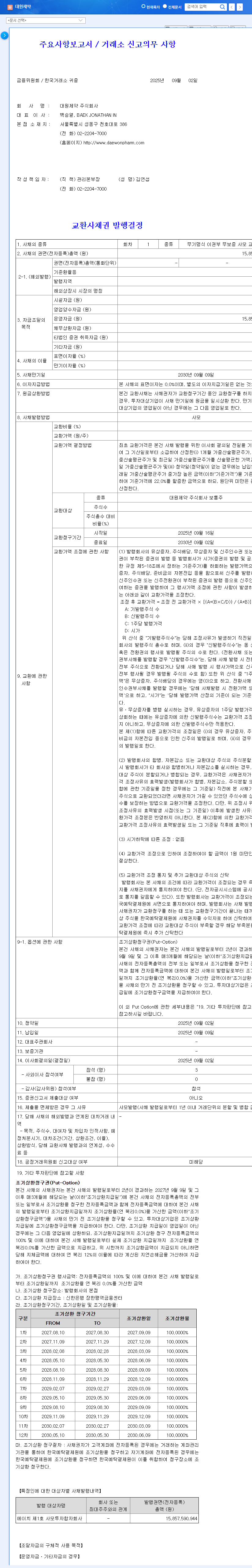

On September 2, 2025, Daewon Pharmaceutical announced the issuance of ₩15.9 billion in convertible bonds. These bonds give the holder the right to convert them into company shares after a specified period. Key terms of the issuance are as follows:

- Issuance Method: Private placement

- Conversion Price: ₩15,951 (approximately 3.3 times the current market price of ₩4,789)

- Coupon Rate & Maturity Rate: 0%

- Payment Date: September 9, 2025

- Conversion Start Date: September 16, 2025

- Conversion End Date: September 2, 2030

2. Why the Convertible Bond Issuance?

Daewon Pharmaceutical aims to secure funds for R&D investment, facility expansion, and other future growth initiatives. The private placement method minimizes the direct burden on existing shareholders.

3. How Will This Impact Daewon’s Stock Price?

The bond issuance presents both opportunities and risks. The influx of capital can fuel growth, which is positive. However, the 3.3x conversion premium requires a significant share price appreciation for conversion to be attractive. Failure to reach this price could negatively impact the stock. Additionally, conversion could lead to dilution of share value due to increased outstanding shares.

4. What’s the Right Investment Strategy?

Investors should carefully analyze Daewon Pharmaceutical’s growth potential, financial health, and competitive landscape before making any investment decisions. Critically evaluating the likelihood of reaching the conversion price and preparing for potential price volatility is essential. Staying informed through company IR materials, public disclosures, and expert opinions is highly recommended.

Frequently Asked Questions (FAQ)

What are convertible bonds?

Convertible bonds are debt securities that give the holder the option to convert them into company shares after a certain period.

How do convertible bonds affect stock prices?

They can positively impact growth through funding but also negatively through share dilution or if the conversion price isn’t met.

What should investors consider?

Carefully analyze the company’s growth potential, financials, and the likelihood of the stock reaching the conversion price, and be prepared for volatility.

Leave a Reply