Daewon Pharmaceutical Raises 15.9 Billion KRW – What Happened?

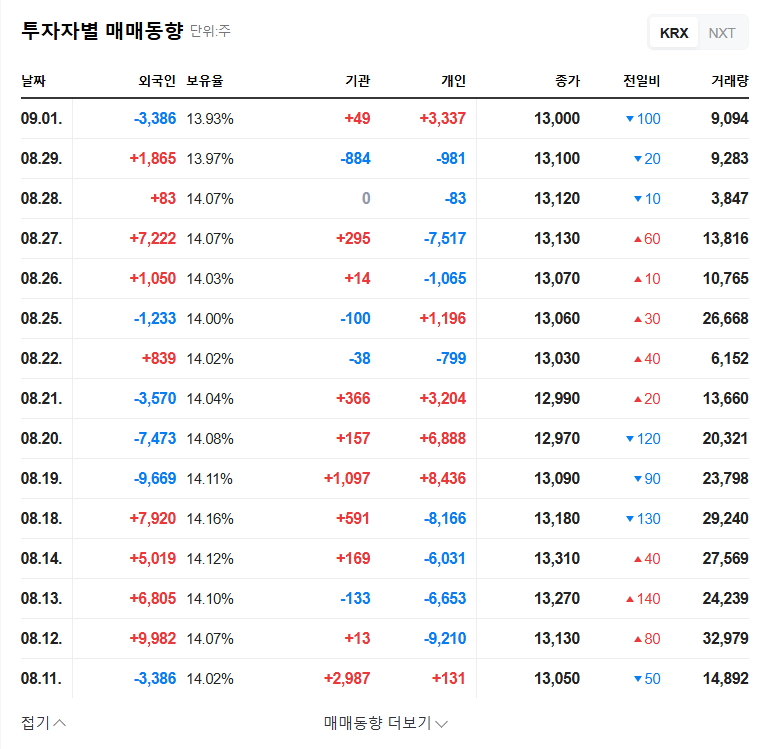

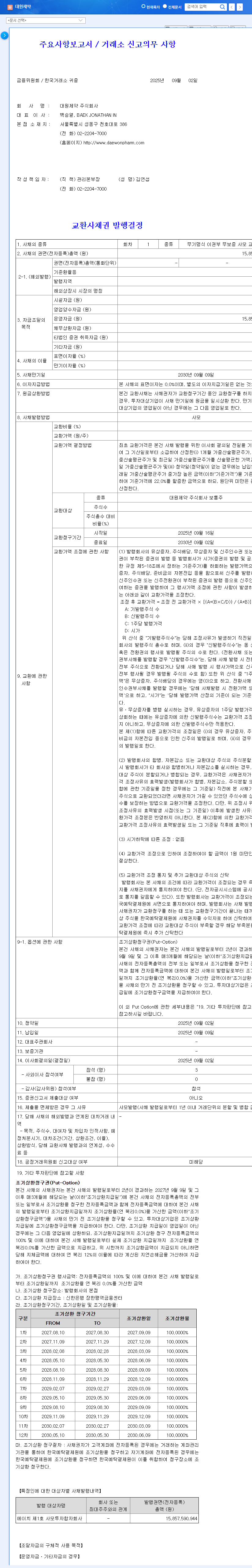

On September 2, 2025, Daewon Pharmaceutical announced the disposal of 994,144 treasury shares (approximately 15.9 billion KRW) to issue exchangeable bonds. This effectively translates to raising capital.

The Rationale Behind the Capital Raise – Why?

According to the 2025 semi-annual report, despite growth in the pharmaceutical sector, Daewon Pharmaceutical experienced declining profitability due to sluggish performance in the cosmetics sector and increased R&D investment. This capital raising is expected to be used for expanding R&D investment, strengthening new pipelines, and restructuring the underperforming cosmetics business.

Impact on Investors – So What?

- Positive Impacts: The capital raised is expected to strengthen new drug development and enhance business competitiveness. It also presents the possibility of improving the financial structure.

- Negative Impacts: There is a risk of stock dilution if the exchangeable bonds are converted into shares, and short-term stock price volatility is also expected. The improvement in profitability remains uncertain.

Investor Action Plan

- Carefully review the terms of the exchangeable bond issuance (conversion price, conversion period, interest rate, etc.).

- Continuously monitor the company’s plans for utilizing the funds, R&D investment performance, and improvement in the profitability of the cosmetics business.

- Be mindful of short-term stock price volatility and consider investment from a mid-to-long-term perspective.

FAQ

How will the disposal of treasury stocks impact Daewon Pharmaceutical’s stock price?

In the short term, concerns about stock dilution and the possibility of increased supply in the market may put downward pressure on the stock price. However, in the long term, strengthening business competitiveness through capital raising could have a positive impact on the stock price.

What are exchangeable bonds?

Exchangeable bonds are bonds that give the holder the right to exchange them for the issuing company’s shares after a certain period.

What is Daewon Pharmaceutical’s core business?

Daewon Pharmaceutical is primarily a pharmaceutical company that manufactures and sells medicines. They also operate in the cosmetics and health functional foods businesses.