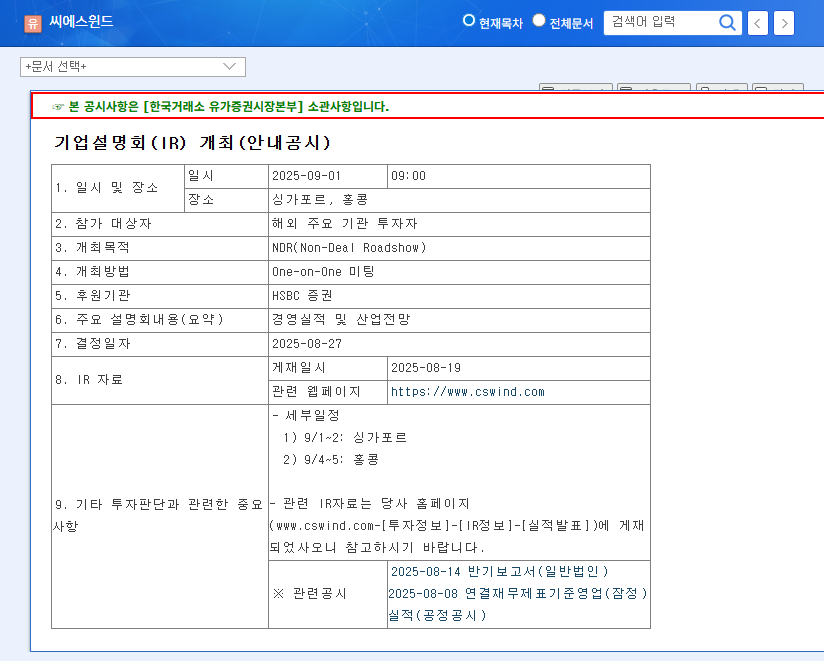

1. What will the CS Wind IR cover?

CS Wind is holding an NDR (Non-Deal Roadshow) style IR on September 1, 2025, to share its business performance and industry outlook. Explanations for the recent sluggish performance and future growth strategies are expected. In particular, attention is focused on whether there will be specific explanations regarding the effects of the Bladt Industries acquisition and efforts to strengthen competitiveness in the North American market.

2. Why is CS Wind holding an IR?

CS Wind has recently experienced a decline in performance, including a shift to an operating loss. This IR is expected to be used as a platform for communication to alleviate investor concerns and enhance corporate value. The intention is to improve investor sentiment by presenting the growth potential of the offshore wind power market and CS Wind’s future vision.

3. What is the outlook for CS Wind’s stock price after the IR?

If the IR presents a positive business outlook and concrete plans for performance improvement, it could provide positive momentum for the stock price. However, if there are no clear solutions to the sluggish performance, investor concerns may grow. In the short term, there is a high possibility that stock price volatility will increase depending on the IR results, and the mid- to long-term stock price trend will depend on actual business performance and financial improvement.

4. What should investors do?

- Carefully review the IR content, analyze management comments and Q&A sessions, and use this information to make investment decisions.

- Continuously monitor the impact of macroeconomic conditions, such as high interest rates and exchange rate volatility.

- Given the continued sluggish performance, it is advisable to maintain a conservative investment strategy.

When is the CS Wind IR being held?

It will be held on September 1, 2025, at 9:00 AM.

What are the key topics of the CS Wind IR?

The meeting is expected to cover business performance, industry outlook, the impact of the Bladt Industries acquisition, and efforts to strengthen competitiveness in the North American market.

What investment strategies should be considered for CS Wind after the IR?

Analyzing the IR content, monitoring the macroeconomic environment, and maintaining a conservative investment approach are important.