1. Amorepacific IR: What’s it about?

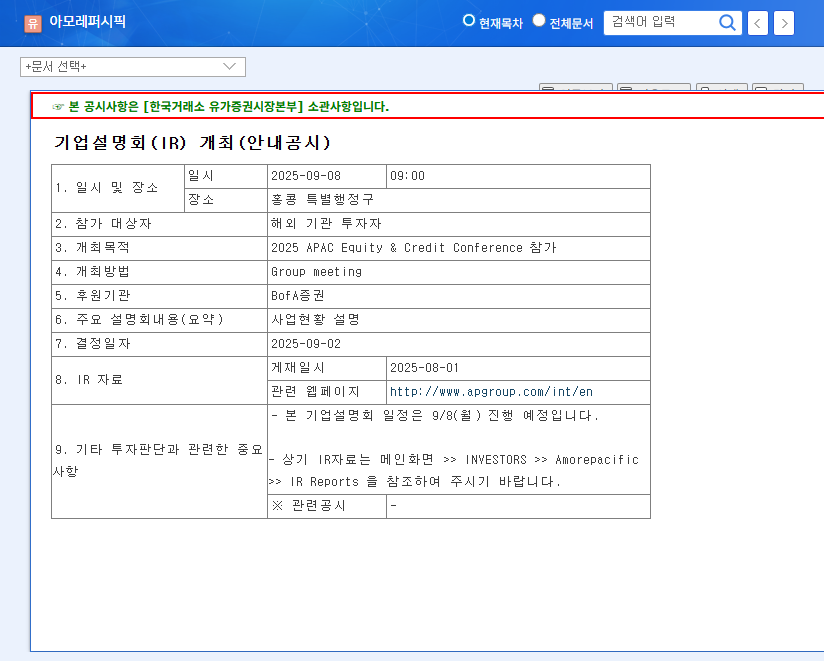

Amorepacific will hold a business briefing at the 32nd CITIC CLSA Investors’ Forum on September 9, 2025. This IR will disclose information on H1 2025 performance analysis, future management strategies, and future growth engines. Investors are expected to pay particular attention to the details of overseas market growth and the Cosrx acquisition effect.

2. How did Amorepacific perform in the first half of 2025?

Amorepacific recorded a consolidated operating profit of KRW 191.4 billion in the first half of 2025, showing remarkable growth of 149.1% year-on-year. The solid growth of overseas businesses, centered on the Americas and EMEA, and the Cosrx acquisition effect acted as key growth drivers. Domestic business also maintained stable sales through strengthened channel competitiveness.

3. Carefully consider the positive factors and risks

- Positive factors: Overseas business expansion, Cosrx acquisition synergy, improved profitability, solid financial structure

- Risk factors: Slowdown in the Chinese market, volatility of raw material prices, increase in logistics costs, low ROE

4. Post-IR, how should I plan my investment strategy?

This IR is an important opportunity to confirm Amorepacific’s growth potential and review investment strategies. It is crucial to analyze the IR announcements and market reactions carefully before making investment decisions. Pay close attention to any mention of China market risks and ROE improvement plans.

FAQ

When will the Amorepacific IR be held?

It will be held at 9:00 AM on September 9, 2025.

What are the key topics of this IR?

The main topics are the announcement of the first half of 2025 results, future management strategies, and future growth engines.

What should investors be aware of?

Investors should pay close attention to risk factors such as a slowdown in the Chinese market and raw material price volatility, as well as details on plans to improve ROE.