Cosmax-Artlab Merger: What Happened?

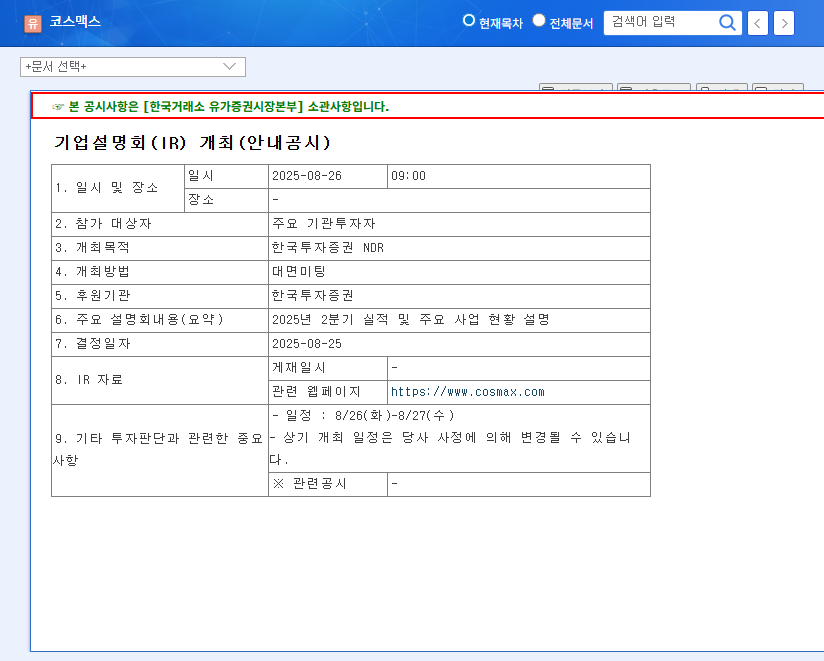

Cosmax signed a merger agreement on September 1, 2025, to absorb its IT subsidiary, Artlab. The merger date is set for November 4, 2025, and Cosmax’s stock is currently suspended from trading.

Merger Rationale: Why Merge?

Cosmax states that the merger aims to improve management efficiency and strengthen business competitiveness. However, given the disparate nature of cosmetics manufacturing and IT, the specific synergy strategies remain unclear. Possibilities include digital transformation leveraging IT and the introduction of AI-based solutions, but concrete plans have yet to be revealed.

Merger Impact and Stock Outlook: What Should Investors Do?

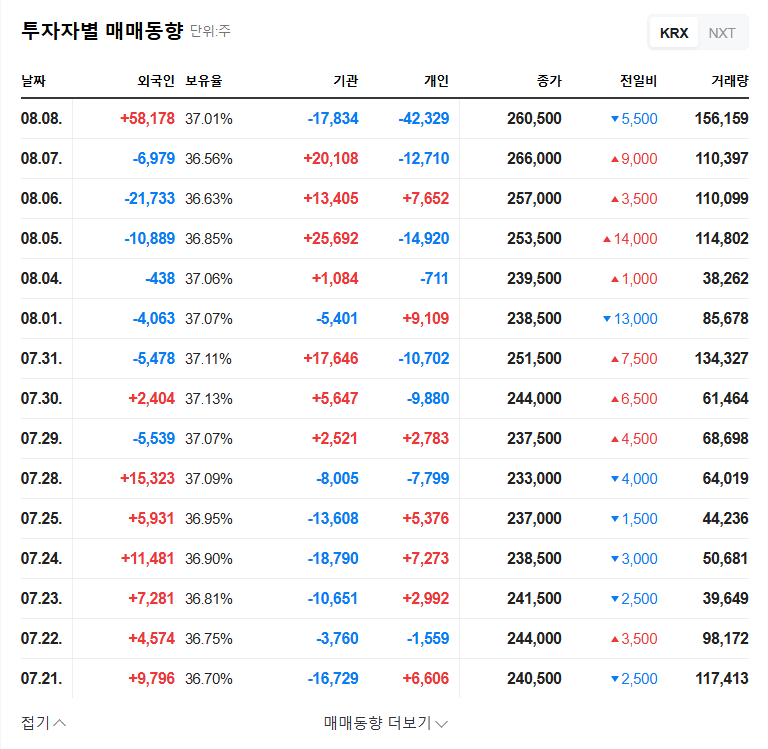

As Artlab is currently operating at a loss, the merger could negatively impact Cosmax’s financial indicators in the short term. Considering Cosmax’s already high debt ratio, the financial burden is likely to increase. The stock price upon trading resumption will depend on the market’s assessment of potential synergies and financial risks. In the medium to long term, the success of business innovation leveraging IT will be the key factor determining the stock’s direction.

- Short-term outlook: High uncertainty, closely monitor market reaction upon trading resumption.

- Medium to long-term outlook: Synergy creation is key; managing financial risks is crucial.

Investor Action Plan

The current investment recommendation is ‘Neutral.’ It is essential to closely monitor Cosmax’s future business plans and earnings announcements, continuously assessing the synergy effects of the merger and financial risk management.

FAQ

What is the purpose of the merger between Cosmax and Artlab?

Cosmax has stated that the merger aims to improve management efficiency and strengthen business competitiveness.

How will the merger affect Cosmax’s stock price?

In the short term, increased uncertainty may lead to higher stock volatility. In the medium to long term, the success of the merger’s synergies will significantly impact the stock price.

What should investors pay attention to?

Investors should closely monitor Cosmax’s business plans, earnings announcements, and changes in financial status after the merger. Continuous assessment of synergy effects and financial risk management is crucial.