Decoding Corpus Korea’s Warrant Exercise

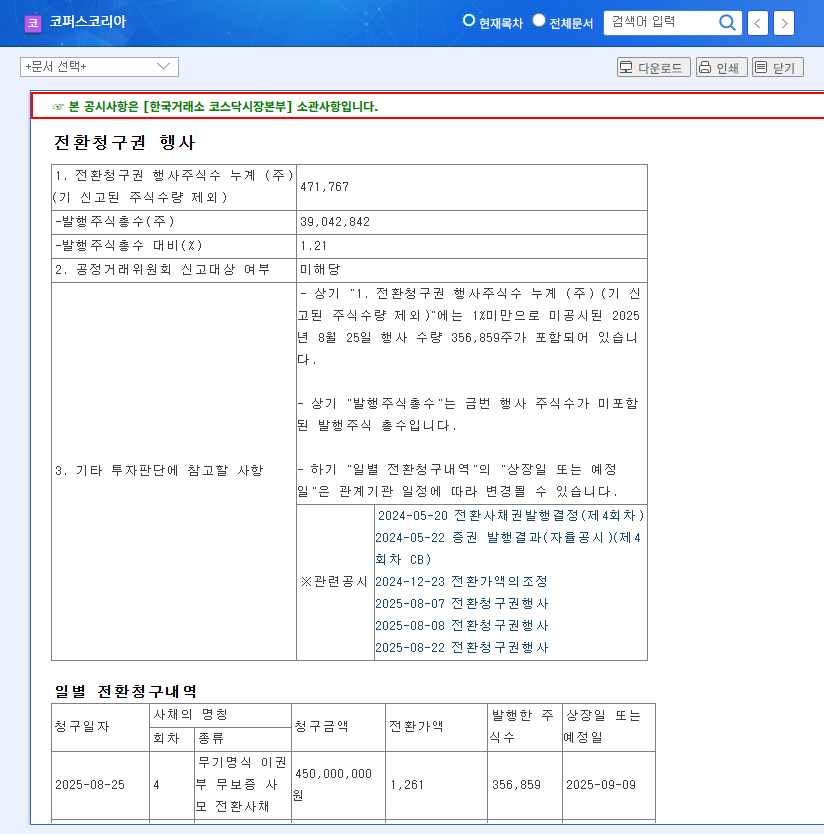

Corpus Korea will issue new shares following the exercise of warrants for 472,877 shares. This represents approximately 1.18% of the market capitalization, with an exercise price of KRW 1,261. The new shares are scheduled to be listed on September 19th, 26th, and 12th.

Why the Warrant Exercise Matters

Warrant exercises can significantly impact a company’s financial structure and stock price. While this exercise can reduce Corpus Korea’s debt and increase its capital, it also raises the possibility of EPS dilution due to the increased number of shares. Investors need to consider these factors comprehensively.

Impact Analysis: Opportunities and Risks

Positive Aspects:

- • Potential improvement in financial structure through debt reduction and capital increase

- • Short-term liquidity boost

Negative Aspects:

- • Weak H1 2025 performance (declining sales, operating loss)

- • Potential for EPS dilution and increased stock price volatility

- • Continued high debt-to-equity ratio and derivative liabilities

Action Plan for Investors

Avoid being swayed by short-term stock price fluctuations and focus on the company’s fundamentals and long-term growth potential. Carefully consider the following factors before making investment decisions:

- • Potential for future earnings improvement

- • Efforts to strengthen financial health

- • New business performance and market competitiveness

- • Macroeconomic environment (exchange rate and interest rate fluctuations)

Frequently Asked Questions

Will the warrant exercise positively impact the stock price?

While the warrant exercise offers positive elements like debt reduction and capital increase, potential EPS dilution and recent poor performance must also be considered. Therefore, the impact on the stock price can be complex.

What is Corpus Korea’s current financial status?

Based on the H1 2025 report, the company’s financial health has deteriorated due to declining sales and an operating loss. High debt-to-equity ratio and derivative liabilities remain risk factors.

What are the key investment considerations?

Focus on the company’s fundamentals, potential for earnings improvement, efforts to strengthen its financial position, and new business performance rather than short-term stock movements. Macroeconomic factors should also be taken into account.