1. What Happened? – Dismissal of YOUM’s Shareholder Registry Lawsuit

The Busan High Court (Changwon) dismissed the appeal filed by the plaintiffs (Yoo Hyung-seok and 19 others) in the case concerning access to YOUM’s shareholder registry. In other words, access to the shareholder registry has been denied.

2. Why Does It Matter? – Intensifying Conflict Between Minority Shareholders and Management

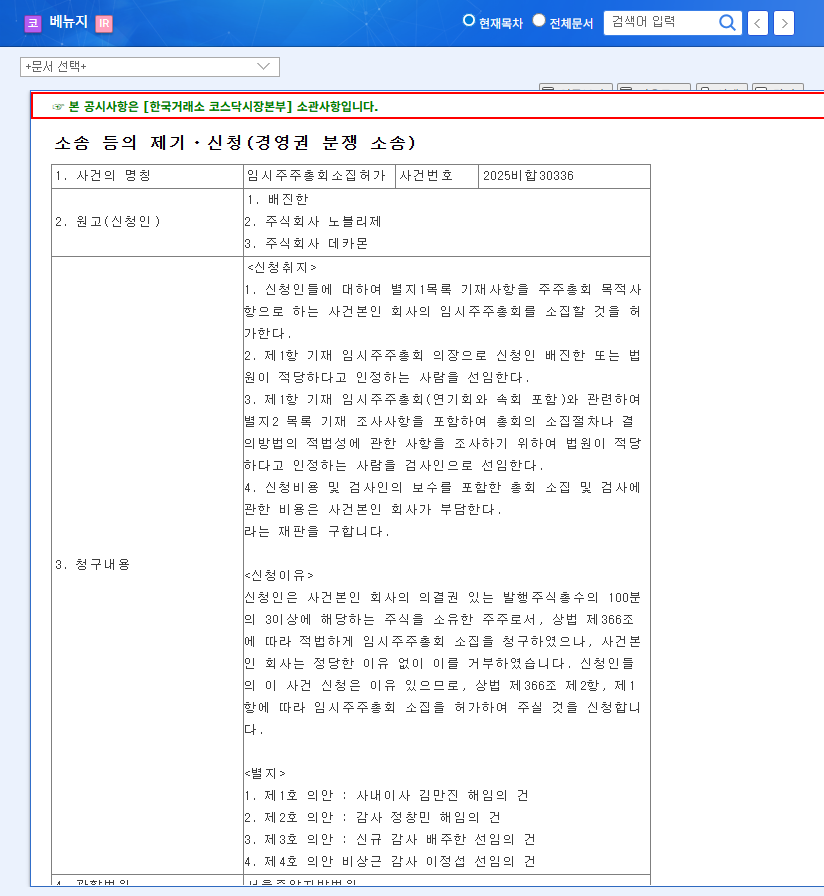

This lawsuit goes beyond a simple legal procedure; it exemplifies the conflict between minority shareholders and management within YOUM. Factors such as past issues with internal accounting controls and the net loss recorded in 2024 may have further strengthened minority shareholders’ demands for greater involvement in management. This situation raises questions about the company’s corporate governance transparency and respect for shareholder rights.

3. What’s Next? – Impact on Investment Value

The ruling itself doesn’t directly impact YOUM’s fundamentals. Accessing the shareholder registry is merely a procedure for shareholders to obtain company management information or exercise voting rights; it doesn’t affect the company’s core business. However, it’s important to consider the possibility that this could lead to more active voting by minority shareholders at future general meetings.

- Positive Aspect: From the company’s perspective, the court’s decision could be interpreted as a procedural brake on minority shareholders’ information requests.

- Negative Aspect: It may negatively affect long-term communication with shareholders and corporate governance transparency.

4. What Should Investors Do? – Key Points to Watch

Investors should closely monitor the following:

- The company’s efforts to improve corporate governance and strengthen internal controls

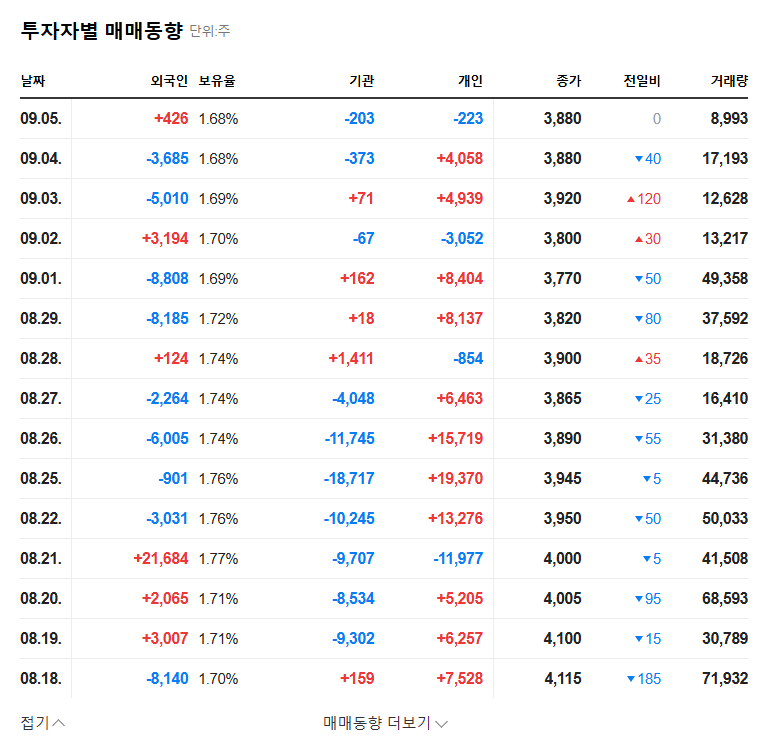

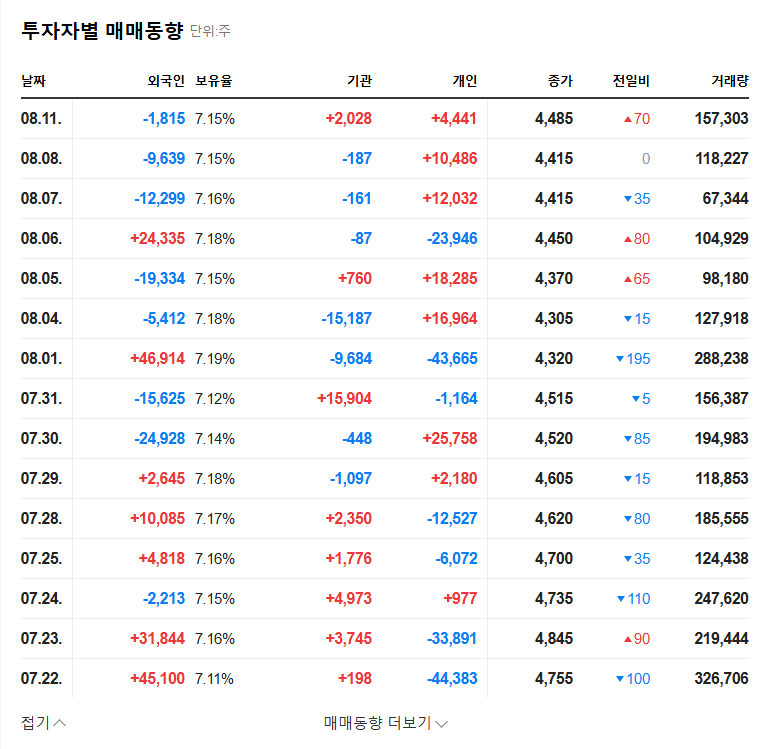

- Voting trends of minority shareholders at general meetings

- Profitability and growth of the PE business, and its response to macroeconomic variables (raw material prices, exchange rates, interest rates, international oil prices)

Investment Opinion: Neutral

FAQ

Why is the outcome of YOUM’s shareholder registry lawsuit important?

This lawsuit highlights the conflict between minority shareholders and management and suggests a potential increase in the influence of minority shareholders at future general meetings.

How will this ruling affect YOUM’s stock price?

While the short-term impact is expected to be minimal, the long-term impact will depend on the company’s corporate governance improvement efforts and shareholder relations. The current investment opinion is neutral.

What should I be aware of when investing in YOUM?

Continuous monitoring of the company’s corporate governance improvements, general meeting trends, PE business performance, and macroeconomic variables is essential.