The latest POONGSAN CORPORATION Q3 2025 earnings report has sent a clear and concerning signal to the market. The company’s provisional results for the third quarter revealed a significant underperformance against market consensus, raising critical questions about its immediate future and long-term trajectory. This deep-dive financial analysis unpacks the factors behind the earnings slump, examines the health of each business segment, and provides a strategic outlook for concerned investors. All data is based on the company’s official filing. (Source: Official DART Disclosure)

The Q3 2025 Earnings Shock: A Numbers Breakdown

POONGSAN CORPORATION’s provisional operating results for Q3 2025 fell drastically short of market forecasts, confirming that previously identified business risks have now fully materialized. The extent of the miss was significant across all key financial metrics.

- •Revenue: KRW 871.4 billion, a staggering 29% below the expected KRW 1,229.9 billion.

- •Operating Profit: KRW 42.4 billion, a 45% plunge from the anticipated KRW 77.2 billion.

- •Net Profit: KRW 32.6 billion, missing the forecast of KRW 53.4 billion by 39%.

The nearly 50% drop in operating profit is the most alarming figure. It signals that the company’s issues are not just about slowing top-line growth but point to a severe and rapid deterioration in core profitability.

Why the Underperformance? In-depth Segment Analysis

The poor results were not isolated to one area. Both of POONGSAN’s core business segments faced significant and compounding challenges during the quarter.

Non-Ferrous Metals (Shindong) Hit by Market Slump

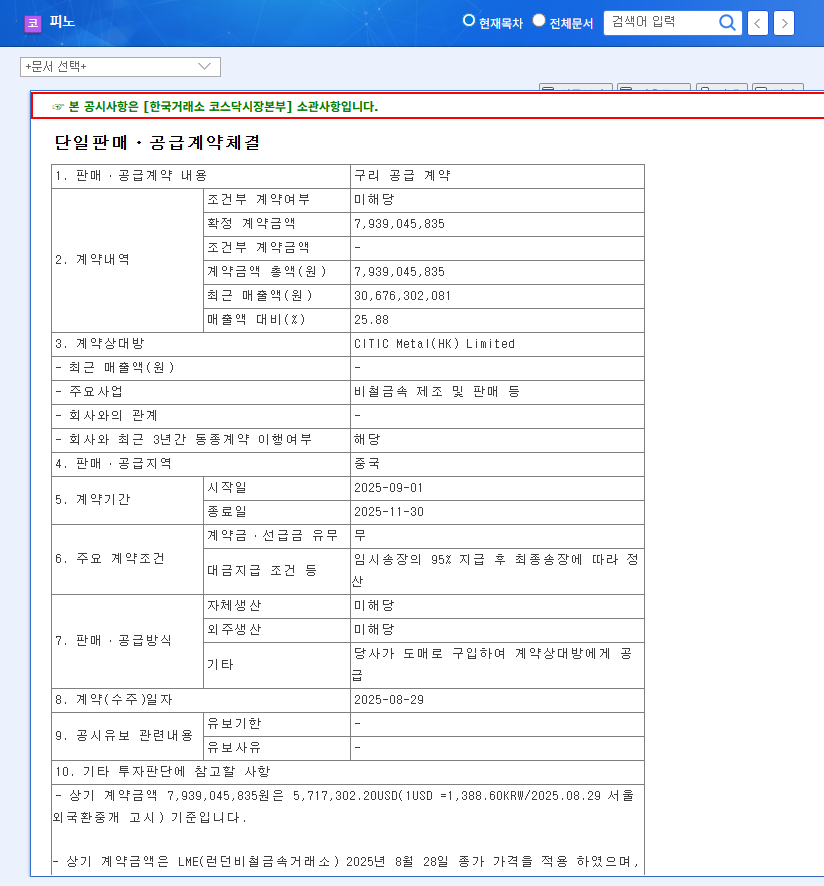

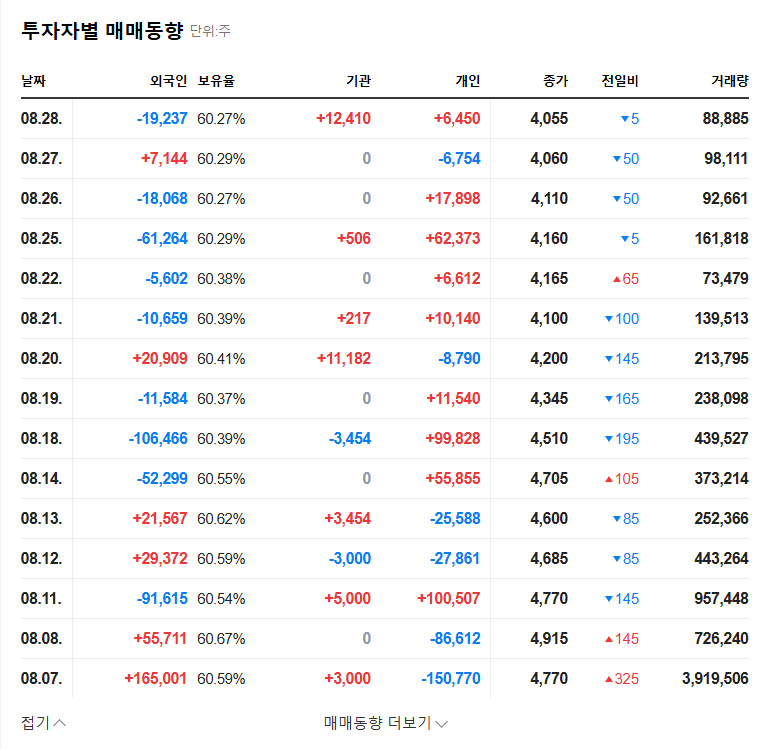

The non-ferrous metals division, a cornerstone of the Poongsan earnings report, was directly impacted by the persistent downturn in the construction industry. This long-feared risk led to a marked decrease in sales of high-volume products like rods and wires. Compounding this issue was the volatility in the price of copper, a key raw material. After a period of fluctuation, a sustained decline or stagnation in copper prices throughout Q3 likely suppressed revenue growth and squeezed margins. For a comprehensive view on global metal markets, resources like the London Metal Exchange provide essential context.

Defense Business Suffers Deepening Export Decline

The defense segment also continued its negative trend, with a notable decline in export sales. This slump can be attributed to heightened uncertainty in the global defense market and increasingly fierce competition. While the ‘K-Defense’ brand remains strong, securing new international contracts has become more challenging. A slight uptick in domestic sales provided a minor cushion but was insufficient to offset the significant drop in more lucrative export revenues, impacting the overall Poongsan stock outlook.

Financial Health and Future Outlook

While the quarterly performance is concerning, it’s crucial to assess the company’s underlying financial stability to understand its capacity to navigate this turbulent period.

Is POONGSAN’s Financial Position Stable?

Despite the profit squeeze, POONGSAN’s balance sheet remains relatively stable. As of the first half of 2025, the company reported a debt-to-equity ratio of 88.63% and a current ratio of 201.4%. These figures suggest that while short-term cash flow may be pressured, a severe liquidity crisis is unlikely. However, a rising trend in total borrowings, coupled with a high-interest-rate environment, presents a risk that demands careful monitoring. Investors can learn more about understanding key financial ratios to better perform their own analysis.

Investor Action Plan & Key Monitoring Points

Given this challenging POONGSAN CORPORATION Q3 2025 Earnings release, a prudent and cautious approach is warranted. The company is at a critical juncture, and its recovery depends on several key factors.

Factors to Watch for Recovery

- •Construction Market Rebound: A recovery in construction is the primary catalyst needed for the non-ferrous metals business to bounce back.

- •New Defense Contracts: Securing new, large-scale export orders is essential to reverse the decline in the defense segment.

- •Profitability Initiatives: Look for aggressive cost management, a shift towards high-value-added products, and reductions in SG&A expenses.

- •Macroeconomic Management: How the company hedges against volatility in currency exchange rates and raw material prices will be crucial.

In conclusion, this Q3 report serves as a major test for POONGSAN’s management. Regaining investor confidence will require not only a more favorable market environment but also decisive internal strategies to improve efficiency and competitiveness. For now, Poongsan investors are advised to remain cautious, closely monitor the key risks, and await clearer signs of a fundamental business turnaround before making new investment decisions.

Disclaimer: This report is for informational purposes only and does not constitute investment advice. All investment decisions should be made based on personal research and consultation with a qualified financial advisor.