What Happened?

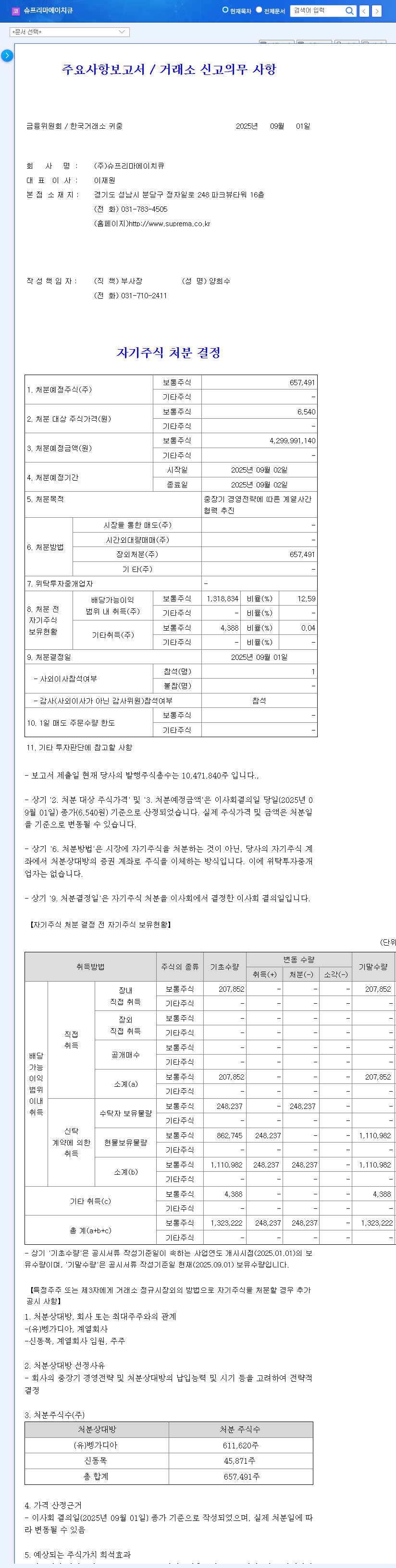

On September 1, 2025, Suprema HQ announced its decision to dispose of 657,491 common shares (worth 4.3 billion KRW) for ‘cooperation between affiliates according to mid- to long-term management strategies.’

Why the Disposal?

The official purpose is to ‘promote cooperation between affiliates.’ This suggests an intention to generate synergy by securing funds for affiliate investments, new business ventures, and technological collaboration. However, given the company’s past underperformance, the possibility that this disposal is aimed at raising funds to address management difficulties cannot be ruled out.

What’s the Potential Impact?

- Positive Scenario: Synergy between affiliates could lead to new business opportunities and strengthen core business competitiveness. The funds could also be used for R&D investment, securing future growth engines.

- Negative Scenario: Disposal of treasury stock can dilute shareholder value. Inefficiencies in the collaboration process or failed investments could worsen the financial structure and lead to a decline in stock price. The company’s high customer concentration makes weakening of its core business particularly risky.

Action Plan for Investors

Investors should consider the following:

- Monitor Information Disclosure: Verify that the company transparently discloses the specific purpose of the disposal, target affiliates, details of the collaboration, and plans for fund utilization.

- Track Performance: Closely monitor the actual results of the collaboration between affiliates and their financial contribution after the disposal.

- Maintain a Long-Term Perspective: Do not be swayed by short-term stock price fluctuations, and focus on assessing the company’s long-term growth potential.

Frequently Asked Questions

What is treasury stock disposal?

Treasury stock disposal is when a company sells its own shares that it holds back into the market.

How does treasury stock disposal affect stock prices?

Generally, treasury stock disposal can lead to a decrease in stock prices due to an increase in the number of outstanding shares. However, depending on the purpose of the disposal and how the funds are utilized, it could also have a positive effect.

What is the outlook for Suprema HQ’s stock price?

The future direction of the stock price will depend on the success of the collaboration between affiliates and whether the company can strengthen its core business competitiveness. Investors should continue to monitor relevant information.