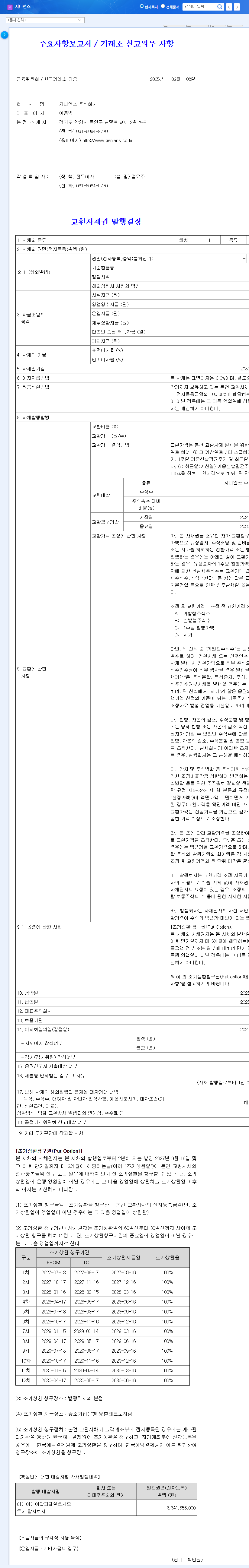

1. What Happened?: ₩3 Billion Convertible Bond Issuance

Xecure Hightron announced the issuance of ₩3 billion convertible bonds with a payment date of September 18, 2025. This is a private offering to Sangsangin Plus Savings Bank and Sangsangin Securities, with a conversion price of ₩692, higher than the current stock price of ₩673.

2. Why?: Funding Acquisition and Financial Structure Improvement

Xecure Hightron aims to secure funds for new business investments and operations, as well as improve its financial structure through this bond issuance. This is due to the company’s financial difficulties, including expanding operating losses and increasing debt ratios, despite the growth of its information and communications business.

3. What’s Next?: Opportunities and Risks Coexist

- Positive Aspect: Short-term liquidity improvements could provide financial breathing room.

- Negative Aspect: The conversion price is higher than the current stock price, leading to potential stock dilution. Increased interest expenses and future repayment obligations could exacerbate the financial burden.

4. What Should Investors Do?: Proceed with Caution

Investors should carefully consider Xecure Hightron’s fundamentals, market environment, and past stock price patterns before making investment decisions. Closely monitoring the possibility of future bond conversion and the company’s profitability improvement is crucial. While short-term funding is positive, long-term investment value is uncertain without fundamental improvements in profitability.

What are convertible bonds?

Convertible bonds are a type of debt security that can be converted into shares of common stock under certain circumstances.

How does issuing convertible bonds affect stock prices?

When conversion rights are exercised, the number of outstanding shares increases, leading to stock dilution. The issuance itself can also be interpreted as a negative signal about the company’s financial health, potentially causing the stock price to decline.

What are the key investment points for Xecure Hightron?

The growth of the information and communications business and the potential of the AI security market are positive factors. However, investors should proceed with caution, considering the deteriorating financial health and the risks associated with the convertible bond issuance.