Investors are closely watching as MGEN SOLUTIONS CO., LTD. (032790) navigates a critical financial event: the conversion of its 21st series convertible bonds. This development raises pivotal questions about the future of MGEN SOLUTIONS stock and its underlying value. This comprehensive analysis will unpack the implications of the MGEN SOLUTIONS convertible bond conversion, offering a clear-eyed view of the risks and opportunities to help you formulate a well-informed investment strategy.

We will go beyond the surface-level announcement to provide a deep fundamental analysis, examining both the promising growth drivers and the significant financial headwinds facing the company. Let’s explore what this means for your portfolio.

The Announcement: Unpacking the Bond Conversion Details

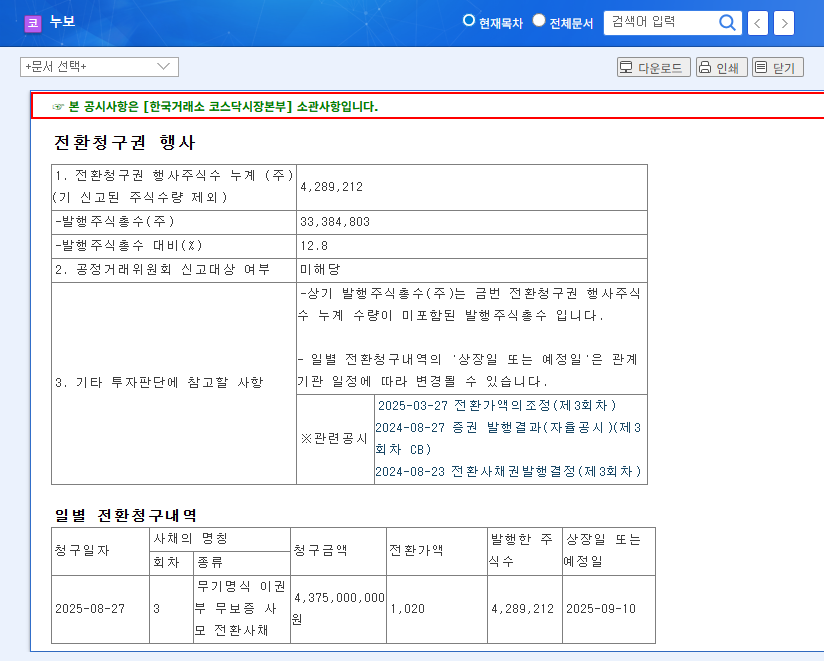

On November 7, 2025, MGEN SOLUTIONS formally announced the exercise of conversion rights for its 21st convertible bonds (CBs). According to the Official Disclosure, this event entails the following key details:

- •Number of Shares: 1,060,445 new shares will be issued.

- •Dilution Impact: This represents approximately 2.23% of the total outstanding shares.

- •Conversion Price: The conversion price is set at 943 KRW per share.

- •Listing Date: The new shares are scheduled to be listed and available for trading on November 21, 2025.

With the stock currently trading around 999 KRW, the conversion price is attractive to bondholders, signaling a high probability of profit-taking once the new shares are listed.

In-Depth Fundamental Analysis of MGEN SOLUTIONS

To truly understand the convertible bond conversion impact, we must look at the company’s complete financial picture—the good, the bad, and the uncertain.

Positive Factors: Engines of Future Growth

- •Dominant ICT Business: MGEN SOLUTIONS holds the #1 market share in domestic local government self-networks. Its AI-based video analysis solutions are perfectly positioned to capitalize on the global expansion of smart cities and AI integration.

- •Efficient Electrical & Electronics Arm: By utilizing production bases in Vietnam and proprietary automation, the company maintains a competitive edge in the global TV market, reflected in its significant revenue growth.

- •High-Potential New Ventures: Emerging businesses, including EV charging station fire detection systems and AI-powered fire solutions, are tapping into modern, high-demand markets.

- •Long-Term Bio-Business Upside: Though a longer-term play, its development of musculoskeletal disorder treatments could become a significant growth driver if clinical milestones are met.

Negative Factors: Significant Financial Risks

- •Persistent Operating Losses: The company reported a widening operating loss of 3,556 million KRW and a net loss of 6,921 million KRW in the first half of 2025, indicating ongoing profitability challenges.

- •Large Accumulated Deficit: A substantial accumulated deficit of 14,195 million KRW severely impacts financial soundness and investor confidence.

- •Lingering Convertible Bond Overhang: With 11 billion KRW in unredeemed CBs remaining, the threat of future stock dilution and financial burden persists. For more on this, you can read our guide to financial statement analysis.

- •Worsening Cash Flow: Operating cash flow was negative (-3,748 million KRW) in H1 2025, a critical red flag indicating the company is spending more cash than it generates from its core operations.

Stock Price Impact: The Push and Pull of Conversion

The exercise of a MGEN SOLUTIONS convertible bond creates two opposing forces that will battle for control of the stock’s direction.

The core conflict for MGEN SOLUTIONS stock is short-term selling pressure from new shares versus the long-term benefit of a cleaner balance sheet.

The Bear Case: Short-Term Selling Pressure

The most immediate effect will likely be negative. With the stock price (999 KRW) above the conversion price (943 KRW), bondholders have a built-in incentive to convert their bonds to stock and immediately sell for a risk-free profit. This arbitrage activity increases the supply of shares on the market, creating downward pressure. This dilution also reduces the earnings per share (EPS) for existing shareholders, potentially lowering the stock’s perceived value.

The Bull Case: Long-Term Financial Improvement

On the other hand, converting debt to equity has a significant long-term benefit. By eliminating a portion of its bond debt, MGEN SOLUTIONS reduces its interest expense and lowers its debt-to-equity ratio. This deleveraging can improve the company’s financial profile, making it more attractive to institutional investors and potentially leading to a credit rating upgrade. This signal of financial housekeeping can foster positive sentiment about management’s ability to normalize operations.

Investment Strategy: A Neutral Stance with a Watchful Eye

Given the conflicting signals, a Neutral investment opinion is warranted for MGEN SOLUTIONS at this time. The company has clear growth potential but is weighed down by serious financial weaknesses. The key is to wait for confirmation that its growth initiatives are translating into tangible profits.

Key Indicators to Monitor:

- •Quarterly Earnings Reports: Watch for a definitive turnaround to operating profit over the next two to three quarters.

- •Revenue Growth in Key Segments: Monitor sales figures from the ICT, Electrical, and Fire & Electrical businesses. Are they meeting or exceeding projections?

- •Cash Flow Statements: A shift from negative to positive operating cash flow would be a powerful buy signal.

- •Macroeconomic Factors: Keep an eye on factors like exchange rates and interest rates, which can impact profitability. Authoritative sources like Reuters’ economic data can provide valuable context.

Disclaimer: This 032790 stock analysis is for informational purposes only and is based on publicly available information. Market conditions can change rapidly. All investment decisions should be made based on your own research and risk tolerance.