1. What Happened? Background of the Stake Increase

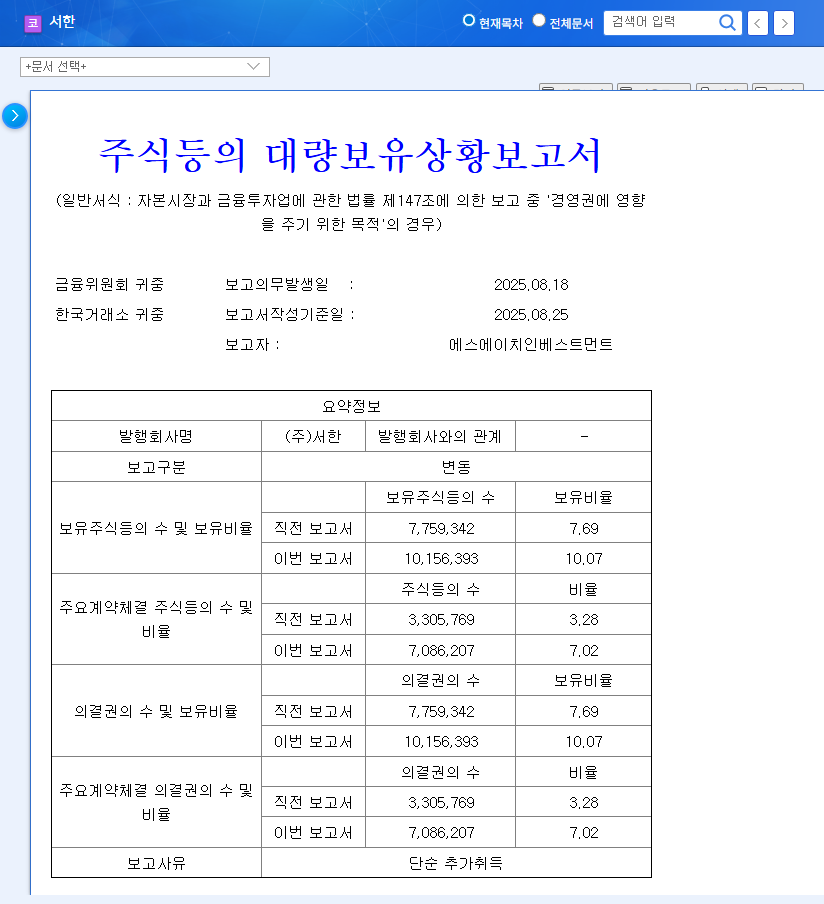

On August 25, 2025, SeoHan’s major shareholders, SH Investment and Mr. Kim Byung-jun, acquired additional shares through after-hours trading, reaching a total ownership of 10.07%. This was disclosed as a simple additional acquisition for the purpose of influencing management rights.

2. Why Does it Matter? Implications of the Stake Increase

The increase in stake by major shareholders can be interpreted as a move to strengthen management control or demonstrate active participation in management. In an unstable business environment, this can be seen as a signal of commitment to the company’s operations. It’s particularly noteworthy as a potential indication of their willingness to tackle the challenges SeoHan currently faces.

3. What’s Next? Short-term and Long-term Impact Analysis

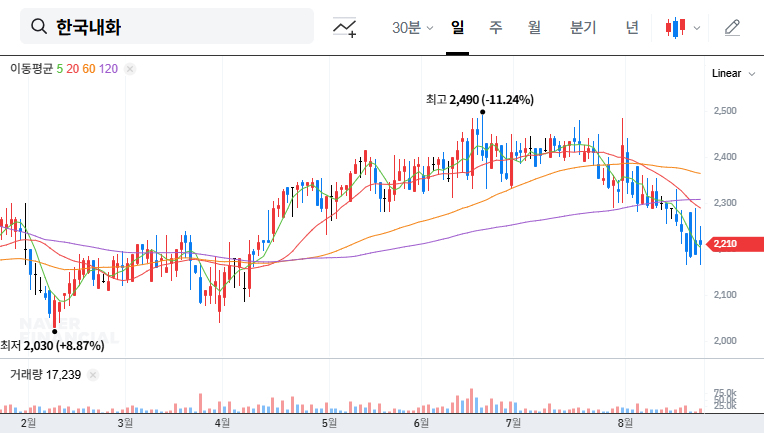

- Short-Term Impact: Increased stock price volatility and heightened market attention. The after-hours acquisition may lead to short-term stock price gains.

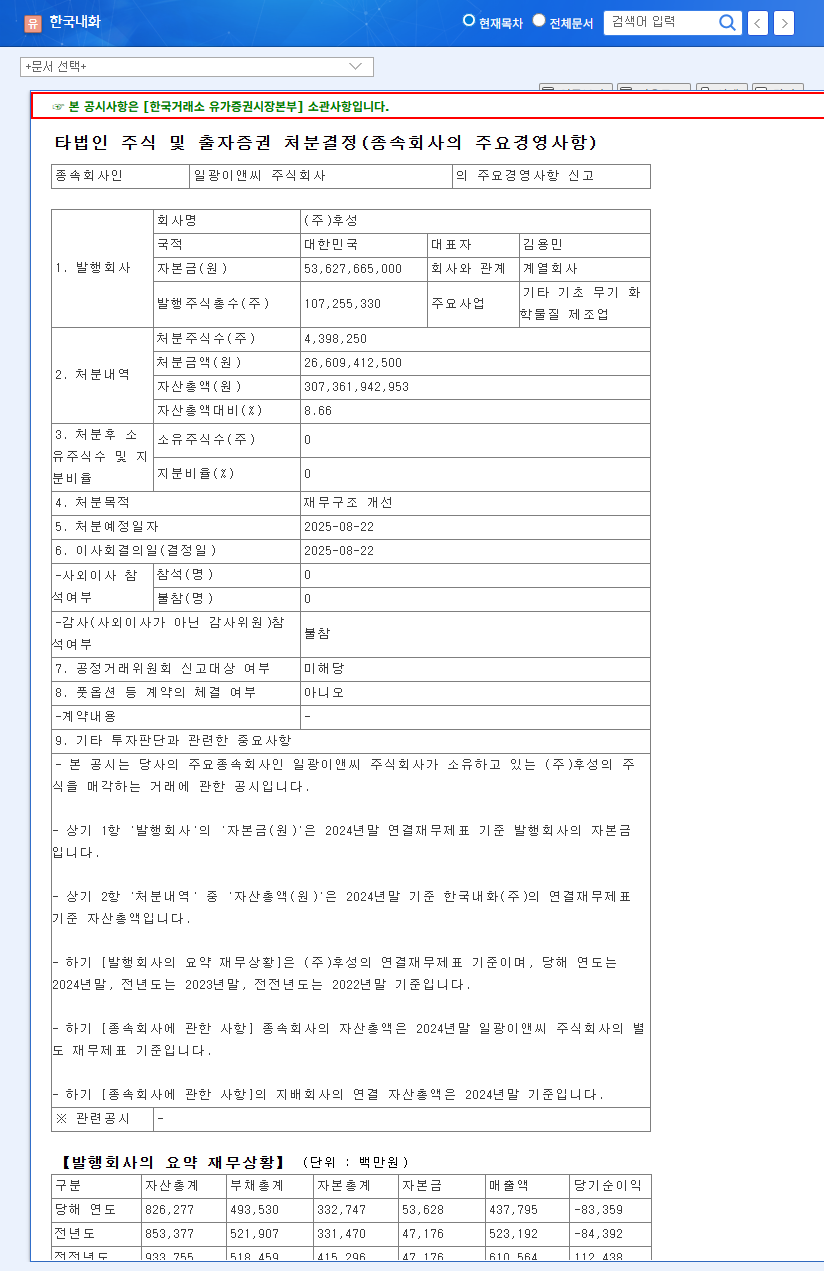

- Long-Term Impact: Enhanced management stability and potential improvement in fundamentals. However, addressing existing financial risks like declining sales, high inventory levels, and contingent liabilities is crucial.

4. What Should Investors Do? Investment Strategy

While short-term stock price momentum can be anticipated, a neutral stance and cautious approach are recommended, considering the fundamental issues. Investors should closely monitor the major shareholder’s plans for business normalization, the real estate market recovery, and efforts to mitigate financial risks.

FAQ

Does an increase in major shareholder stake always positively affect the stock price?

Not necessarily. Various factors, such as the purpose of the stake increase, the company’s fundamentals, and market conditions, influence stock prices.

What are the main financial risks for SeoHan?

Declining sales, high inventory levels, and substantial contingent liabilities are key risk factors.

What should investors be aware of?

Carefully monitor the major shareholder’s business normalization plans, efforts to mitigate financial risks, and be mindful of changes in the real estate market.