This comprehensive IS DONGSEO analysis unpacks the upcoming Q3 2025 earnings investor relations (IR) call, scheduled for November 18, 2025. In a complex economic climate marked by a persistent construction market downturn, IS DONGSEO has managed a surprising feat: improving operating profit despite a dip in overall revenue. This performance has captured the attention of investors, who are keen to understand the underlying drivers.

The key to this resilience appears to be the company’s strategic diversification, with robust growth in its concrete and environmental business segments, including the high-potential waste battery recycling division. This report provides an in-depth examination of the IS DONGSEO Q3 2025 earnings, offering critical insights into the opportunities and risks that will shape investor sentiment following the IR event.

Unpacking the IS DONGSEO Q3 2025 Earnings Performance

IS DONGSEO reported consolidated revenue of KRW 905.3 billion and an operating profit of KRW 95.2 billion for the third quarter of 2025. While the revenue figure marks a year-over-year decline, the improved operating profit signals effective cost management and successful performance in high-margin sectors. This divergence highlights the success of the company’s diversification strategy amidst significant headwinds in its traditional construction business.

Construction Segment: Navigating a Market Slump

The construction division faced predictable challenges, with its revenue decline attributed to a perfect storm of macroeconomic factors. Persistently high interest rates, rising material costs, and reduced public construction investments have created a challenging environment. Investors will be closely watching the upcoming IS DONGSEO investor relations call for detailed strategies on mitigating project financing (PF) risks and navigating this prolonged slump. Understanding their approach to project selection and cost control will be vital. For more context on these economic pressures, reports from institutions like the World Bank offer valuable macroeconomic analysis.

Growth Engines: Concrete and Environmental Services

In stark contrast to the construction slump, the concrete and environmental businesses have emerged as powerful growth drivers. The concrete segment’s revenue growth was fueled by increased orders for specialized, high-margin products. However, the company must still navigate intense market competition.

The environmental division, which includes waste treatment and the burgeoning IS DONGSEO waste battery recycling business, shows immense potential. As the global transition to electric vehicles (EVs) accelerates, the demand for sustainable battery recycling solutions is set to skyrocket. This positions IS DONGSEO to capitalize on a major secular trend. Nonetheless, this segment is not without its challenges, as operating profit can be sensitive to fluctuations in the prices of core recycled minerals like lithium and cobalt.

The pivotal question for investors is whether the high-growth environmental and waste battery segments can scale quickly enough to not only offset the cyclical downturn in construction but also redefine the company’s long-term value proposition.

Financial Health and Investor Outlook

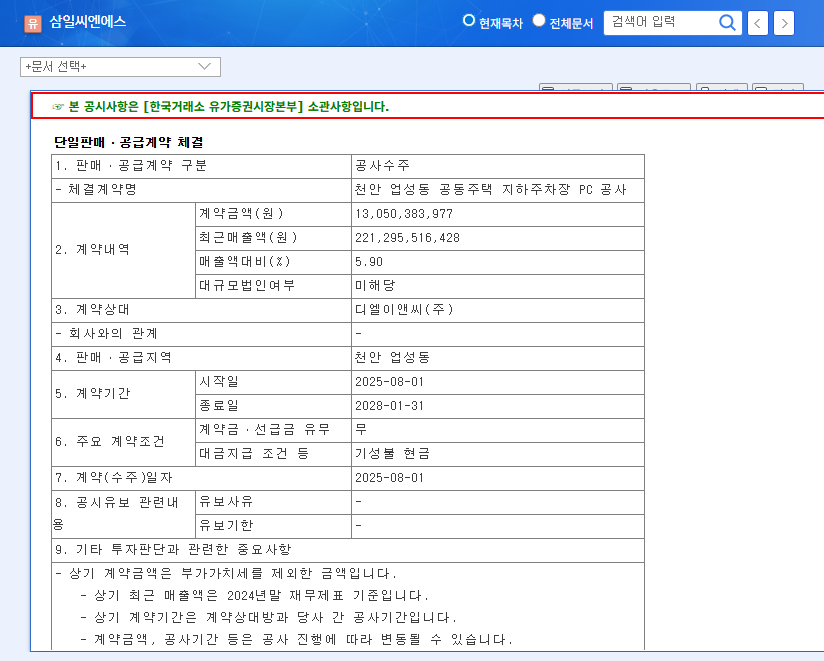

From a financial standpoint, IS DONGSEO maintains a solid foundation. With total assets of KRW 3,520.3 billion against liabilities of KRW 1,988.5 billion, the company’s debt-to-equity ratio stands at a very stable 44.48%. While operating cash flow has improved, a decrease in cash reserves reflects strategic investments and debt repayments—a healthy sign of capital allocation for future growth. The full details can be reviewed in the Official Disclosure from DART.

Key Questions for the IR Call

The upcoming IR event is a critical moment for management to build investor confidence. The market will be looking for clear, detailed answers to several key points. This IS DONGSEO analysis suggests focusing on the following areas:

- •Construction Risk Management: What specific strategies are in place to manage project financing exposure and improve profitability in the construction sector? Explore our guide on understanding real estate PF risks for deeper insight.

- •Waste Battery Vision: What is the long-term roadmap for the waste battery recycling business? How does the company plan to hedge against mineral price volatility and secure its position in the EV value chain?

- •Sustainable Growth & ESG: How will the growth of the environmental business contribute to the company’s ESG (Environmental, Social, and Governance) profile and long-term shareholder value?

- •Shareholder Returns: What are the company’s mid-to-long-term plans for dividends and other forms of shareholder returns, reflecting confidence in its future cash flow?

Conclusion: A Pivotal Moment for IS DONGSEO Growth

The IS DONGSEO Q3 2025 earnings demonstrate a successful strategic pivot towards new growth drivers. The company has proven its ability to generate profit even when its legacy business faces severe headwinds. The upcoming IR is management’s opportunity to articulate a clear and compelling vision for how its environmental and waste battery businesses will power future growth and create sustainable, long-term value for shareholders. A transparent and confident presentation could significantly bolster investor confidence, while any ambiguity could leave lingering doubts about the company’s ability to navigate the uncertain road ahead.