1. What Happened to CCS?

CCS was designated as a company subject to delisting review due to inaccurate disclosures and submitted an improvement plan on August 25th. The exchange will decide whether to delist or grant an improvement period by September 22nd.

2. Why is CCS in this Situation?

Business downturn: Decline in cable TV subscribers, unclear new business prospects

Financial deterioration: Declining sales, continuous operating losses, increasing deficit

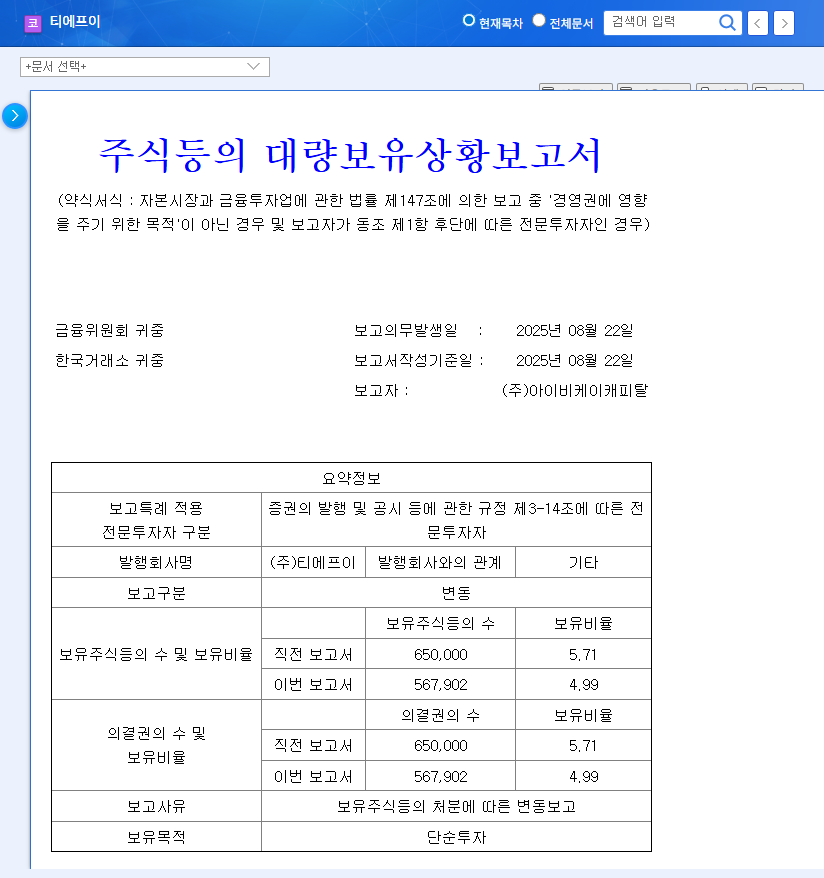

Management instability: Frequent changes in major shareholders, management disputes, past embezzlement allegations

3. Can the Improvement Plan Offer Hope?

Positive factors: Possibility of maintaining listing and normalization, expectation of trading resumption

Negative factors: Deteriorating fundamentals, ongoing management uncertainty, history of inaccurate disclosures

4. What Should Investors Do?

Investment Opinion: Sell / Hold (High Risk)

CCS’s situation is highly risky, with a high probability of principal loss. Investors should closely monitor the improvement plan’s details and the exchange’s decision and make cautious investment choices.

Can CCS avoid delisting after submitting the improvement plan?

Submitting the improvement plan is a positive sign, but considering CCS’s severe fundamental deterioration and management uncertainty, the possibility of delisting cannot be ruled out. We need to wait for the exchange’s final decision.

Is it a good time to invest in CCS stock now?

Investing in CCS is currently very risky. Given the possibility of delisting, the risk of principal loss is very high. Investment decisions should be made cautiously.

What is the future outlook for CCS?

The future outlook for CCS will depend significantly on the content of the improvement plan and the exchange’s decision. Even with a positive outcome, fundamental improvement is essential.