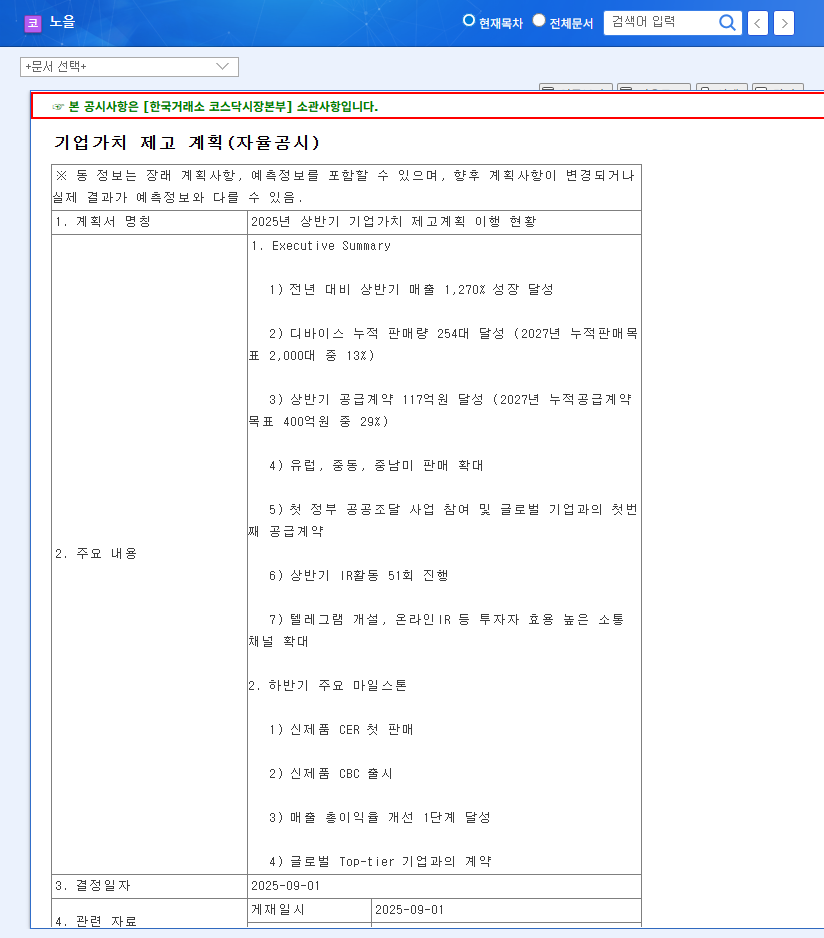

1. What Happened? : Noel Announces 1,270% Revenue Growth

Noel announced a remarkable 1,270% revenue growth for the first half of 2025 in its corporate value enhancement plan released on September 1, 2025. The company presented positive indicators such as 254 cumulative device sales and KRW 11.7 billion in supply contracts. It also demonstrated proactive business expansion by targeting European, Middle Eastern, and Latin American markets and participating in government procurement projects.

2. Why It Matters? : Growth Potential and Risks Coexist

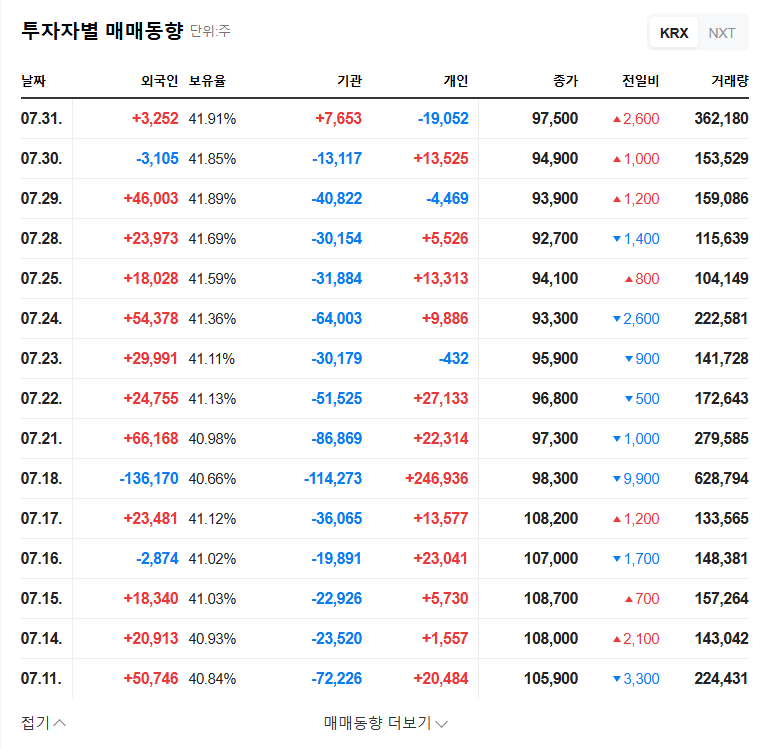

This announcement confirms Noel’s high growth potential while also revealing risks that investors should be aware of. While explosive revenue growth is positive, the company’s continued losses, lower-than-target sales, and contract achievements compared to 2027 goals are crucial factors to consider when investing.

- Positive Factors: Explosive revenue growth, global market expansion, new product launch plans

- Negative Factors: Continued operating losses, pressure from high expectations, intensifying competition

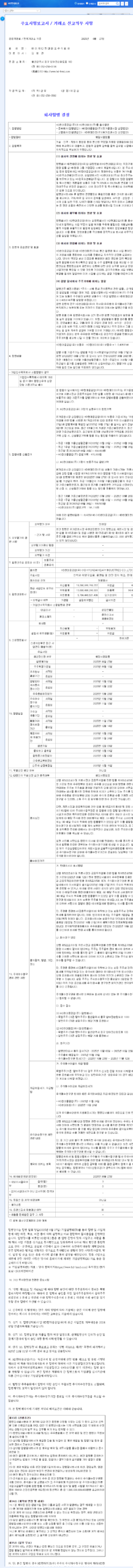

3. What Should Investors Do? : Careful Observation and Prudent Investment

Investors considering Noel should focus on the long-term fundamentals of the company rather than short-term stock price fluctuations. It is crucial to carefully review future earnings announcements, focusing on continued revenue growth, profitability improvement, and global business performance before making investment decisions.

4. Investor Action Plan

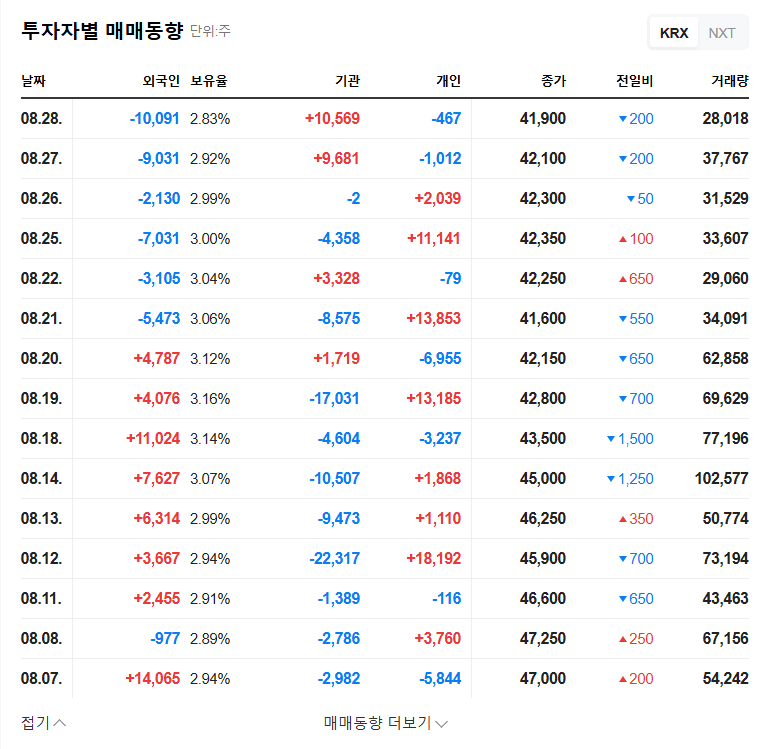

- Short-term Investors: Be mindful of high volatility and consider strategies that capitalize on short-term upward momentum.

- Long-term Investors: Carefully review future earnings announcements to assess sustained revenue growth, profitability improvements, and global business performance before making investment decisions.

Frequently Asked Questions (FAQ)

What is Noel’s main business?

Noel is a healthcare company that provides innovative technology for blood diagnostics. Its miLab™ Platform offers quick and accurate blood diagnostic solutions.

What was Noel’s revenue growth rate in the first half of 2025?

Noel achieved a remarkable 1,270% revenue growth rate year-over-year in the first half of 2025.

What are the key considerations when investing in Noel?

Despite its high growth potential, Noel is still a loss-making company, and the pressure from high market expectations is a significant concern. Investors should closely monitor future earnings announcements to confirm continued revenue growth and profitability improvement.