A significant development is capturing the attention of investors monitoring the CJ Freshway stock market. VIP Asset Management, a prominent domestic asset firm, has notably increased its holdings in CJ Freshway to 7.16%. This move, detailed in an Official Disclosure, goes beyond a simple share report, prompting a crucial question: What does this mean for the future of CJ Freshway’s valuation and your investment portfolio?

In this comprehensive CJ Freshway analysis, we will unpack the implications of this institutional investment, examine the company’s core fundamentals, assess the challenging macroeconomic landscape, and provide a clear, actionable investment outlook to guide your decisions.

The Event: VIP Asset Management Doubles Down on CJ Freshway

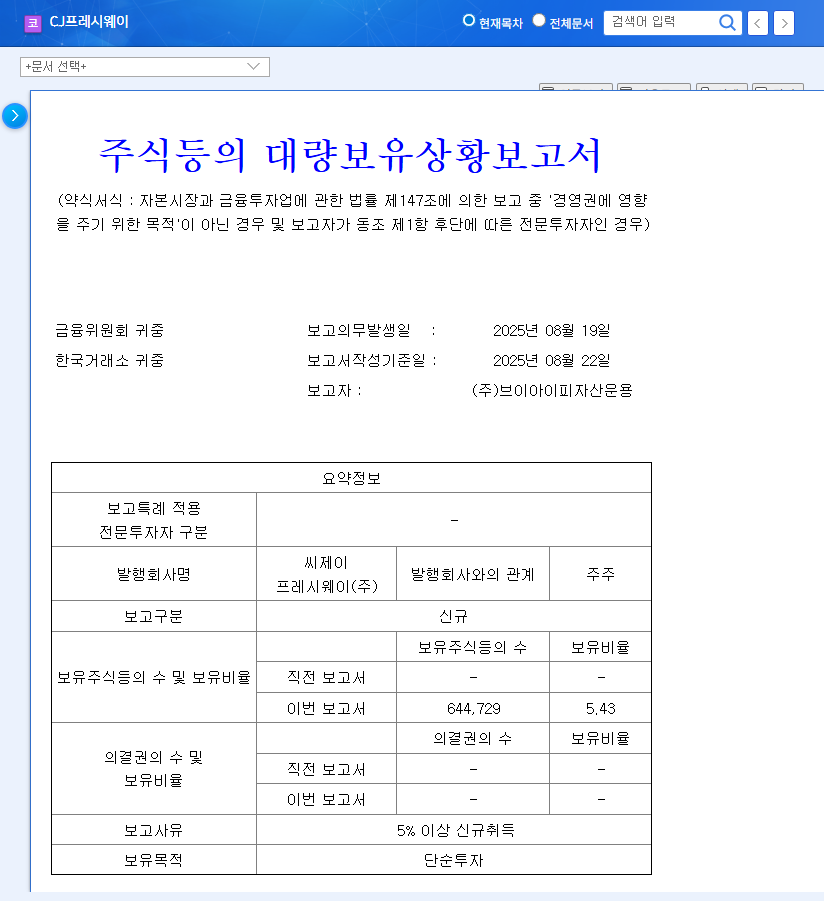

Between September 26 and October 2, 2025, VIP Asset Management executed a series of open market purchases, aggressively boosting its stake in CJ Freshway from 5.43% to 7.16%. This 1.73 percentage point increase represents a strong vote of confidence from a major institutional player. While the stated purpose is ‘simple investment,’ such a concentrated buying period often signals a belief in the company’s long-term value proposition, even amidst market uncertainty.

This isn’t just a portfolio adjustment; it’s a strategic accumulation that suggests VIP Asset Management sees untapped potential in CJ Freshway’s future, making a deeper look into the company’s health essential for any prospective investor.

Fundamental Analysis: The Core of CJ Freshway’s Value

To understand this CJ Freshway investment, we must look beyond the headlines and into its operational and financial health. The company presents a mixed but compelling picture of robust growth paired with notable financial challenges.

Strengths: Dominant Business Segments & Growth Initiatives

- •Food Ingredient Distribution: This core segment remains a powerhouse, with sales climbing 11.76% to KRW 1.2678 trillion. Growth is fueled by enhanced online platforms and strategic initiatives like contract farming.

- •Food Service (Catering): Showing steady growth of 5.76% to KRW 401.5 billion, this division leverages the extensive CJ Group infrastructure and is expanding its lucrative concession business.

- •Future Growth Engines: The company is actively diversifying with new ventures in freight brokerage, liquor distribution, and e-commerce, signaling a proactive approach to long-term sustainability.

Weaknesses: Financial Burdens and Regulatory Hurdles

Despite strong operational performance, investors must be aware of significant financial pressures. The company’s debt-to-equity ratio stands at a high 264.68%, creating a considerable financial burden. Furthermore, a recent fine for violating the Fair Trade Act, while not immediately impacting liquidity, introduces a compliance risk that could cloud investor sentiment. For more on evaluating financial health, see our guide on analyzing company balance sheets.

Macroeconomic Headwinds Facing CJ Freshway Stock

No company operates in a vacuum. Several external factors are currently exerting pressure on CJ Freshway’s profitability and, consequently, its stock performance.

- •Currency Fluctuations: With high reliance on imported raw materials, the rising KRW/USD exchange rate directly increases costs and poses a risk of foreign exchange losses.

- •Commodity and Logistics Costs: Volatility in international oil prices and shipping rates, which you can track on platforms like Bloomberg Markets, can inflate logistics expenses and squeeze profit margins.

- •Interest Rate Environment: Potential rate hikes could increase the company’s interest expenses on its significant debt, further pressuring cash flow and profitability.

Investment Outlook: A ‘Neutral’ Stance with Key Monitors

Considering all factors, the current investment opinion for CJ Freshway stock is ‘Neutral.’ The positive signal from VIP Asset Management’s investment is balanced by the prevailing fundamental and macroeconomic risks.

Short-Term Strategy (Cautious Approach)

The increased institutional demand could provide a short-term lift to the stock price. However, without concrete improvements in the company’s financial structure or a more favorable economic climate, any significant, sustained rally is unlikely. A cautious, observant approach is recommended.

Mid-to-Long-Term Strategy (Watch for Catalysts)

A long-term re-evaluation of the stock hinges on several key developments:

- •Successful execution and monetization of new business ventures.

- •Demonstrable progress in improving the financial structure, specifically in debt reduction and cash flow enhancement.

- •A clear and final resolution of the legal issues surrounding the Fair Trade Act violation.

In conclusion, while VIP Asset Management’s increased stake is a noteworthy and positive signal, it should be viewed as one piece of a much larger puzzle. Prudent investors will weigh this against the company’s financial liabilities and the broader economic pressures before making a commitment to CJ Freshway stock.