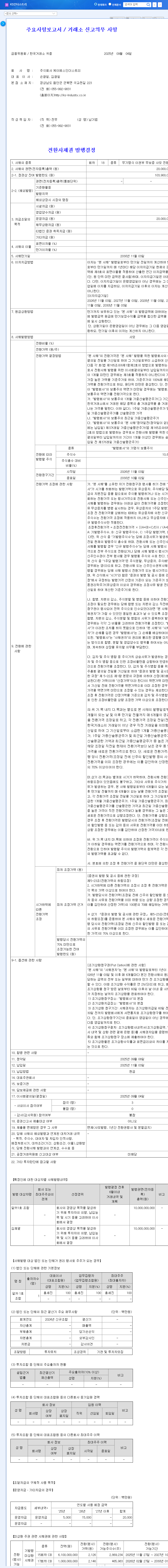

1. MDvice’s ₩25 Billion CB Issuance: What Happened?

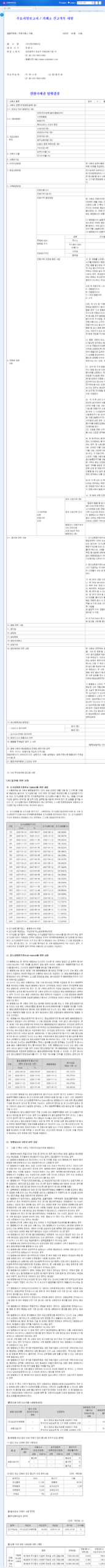

On September 11, 2025, MDvice officially announced the issuance of ₩25 billion in convertible bonds. This substantial amount, representing 20.54% of the total capital, will be issued privately. The conversion price is set at ₩11,450, with both coupon and maturity rates at 0%.

2. Why the CB Issuance? Securing Growth Momentum and Business Expansion

MDvice aims to secure funds for new business investments, including the Advanced Package (AVP) business, and strengthen its existing SSD business competitiveness. The 0% interest rate minimizes short-term financial burdens. While experiencing growth with sales and operating profit increasing by 84% and over 40 times respectively in the first half of 2025, negative operating cash flow necessitates external funding.

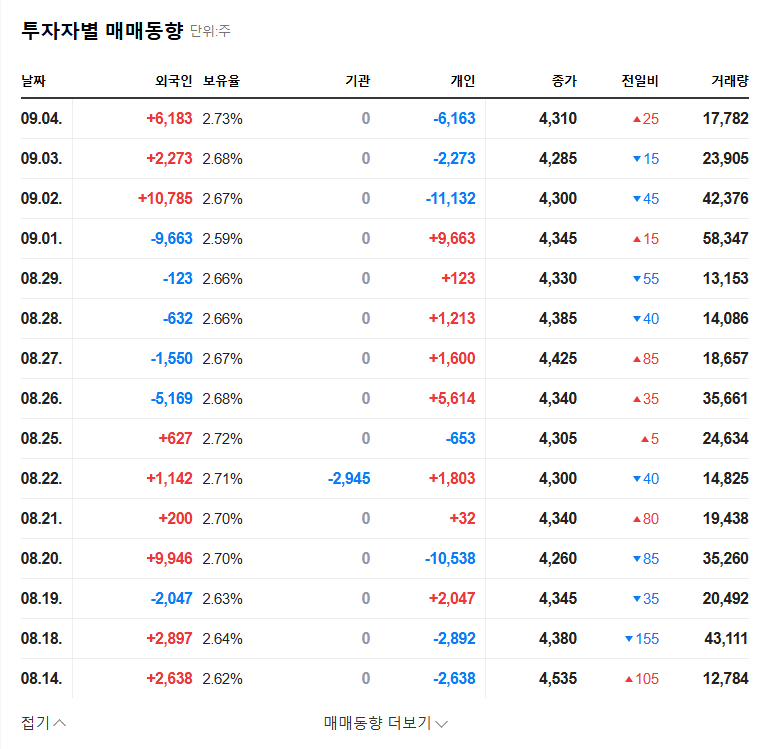

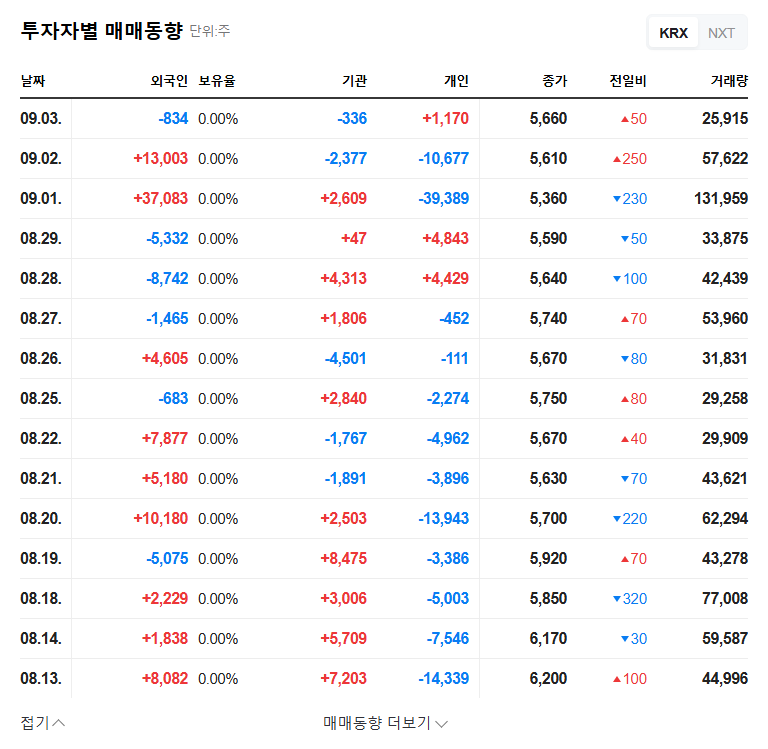

3. Impact on Investors: Opportunity and Risk Coexist

This CB issuance presents both opportunities and risks. The conversion price is close to the current stock price, suggesting a high probability of conversion if the stock price rises, potentially leading to dilution. Furthermore, the heavy reliance on a single Chinese client (H Co., 93.24% of sales) remains a key concern.

4. Action Plan for Investors: Long-Term Perspective and Continuous Monitoring

- Maintain a Long-Term View: Focus on MDvice’s long-term growth potential rather than short-term stock fluctuations.

- Monitor CB Conversion Trends: Track the conversion rate and timing to assess potential stock dilution.

- Verify Reduction in Dependence on H Co.: Monitor efforts and results in diversifying the customer base.

- Monitor Macroeconomic Conditions: Analyze the impact of changes in exchange rates, interest rates, and raw material prices.

Frequently Asked Questions (FAQ)

What are convertible bonds?

Convertible bonds (CBs) are debt instruments issued as bonds but with the option to convert them into shares of the issuing company’s stock after a specific period.

How will the MDvice CB issuance affect the stock price?

Short-term, it may increase stock volatility. Long-term, conversion can lead to stock dilution and downward pressure on the price. However, successful business expansion funded by the CBs may drive stock price appreciation.

What should investors be cautious about?

Investors should carefully monitor the conversion trends, MDvice’s efforts to reduce its dependence on H Co., changes in macroeconomic conditions, and maintain a long-term investment perspective.