What Happened? AbClon Secures $300,000 Contract with KDCA

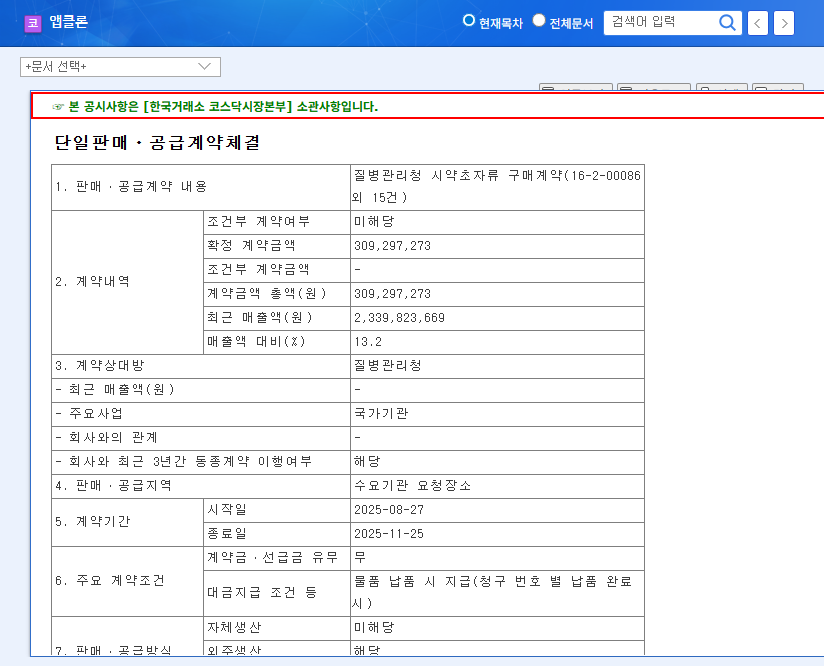

AbClon announced a $300,000 contract with the KDCA on August 27, 2025, for the supply of reagents and glassware. The contract duration is three months, representing 13.2% of AbClon’s revenue.

The Significance: Short-term Boost vs. Long-term Uncertainty

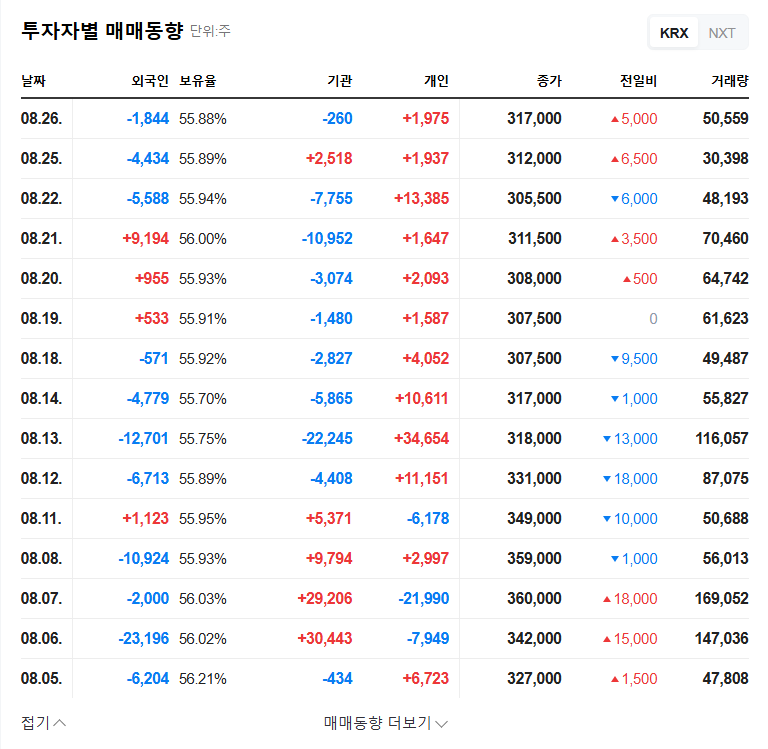

This contract is expected to contribute to AbClon’s short-term revenue growth and secure order stability. It could also alleviate financial burdens, especially given the company’s current operating losses. However, the relatively small contract size may limit its impact on the stock price. In the long term, this experience with a public institution could lead to further contracts, but some argue that AbClon should maintain focus on its core business: drug development.

What Should Investors Do? AbClon Investment Strategy

Investors should focus on AbClon’s core business—its new drug pipeline development and clinical trial results—rather than this short-term contract. The clinical results of key pipelines like AC101 and AT101, and potential licensing agreements, will significantly influence AbClon’s future. Efforts to improve sales and profitability to resolve its designated management status are also crucial investment considerations.

Investor Action Plan

- Avoid overreacting to short-term contracts and maintain a long-term investment perspective.

- Pay close attention to new drug development progress and clinical trial announcements.

- Monitor AbClon’s efforts and achievements in resolving its designated management status.

Frequently Asked Questions

Will this contract significantly impact AbClon’s stock price?

While a dramatic short-term surge is unlikely due to the contract’s size, it could contribute to positive investor sentiment.

What is AbClon’s core business?

AbClon is a biopharmaceutical company focused on developing antibody-based drugs and CAR-T cell therapies.

What are the key risks to consider when investing in AbClon?

AbClon is currently designated as a company under management, and there are inherent uncertainties in new drug development. Careful analysis is crucial before investing.