The recent announcement of the HIGEN RNM self-stock disposal has sent ripples through the investment community. As a key player in the burgeoning robotics sector, HIGEN RNM CO., LTD (하이젠알앤엠) is at a critical juncture. The company has detailed a plan to dispose of 1,000,000 treasury shares, a move valued at approximately ₩57.1 billion, with the transaction scheduled for October 20, 2025. This decision presents a classic dilemma for shareholders: is this a strategic masterstroke to fund next-generation growth in the robot actuator business, or does it carry an unavoidable risk of share dilution for existing investors?

This comprehensive guide will dissect the announcement, explore the strategic rationale, weigh the potential upsides against the inherent risks, and provide actionable insights for anyone with HIGEN RNM stock in their portfolio. We will delve into the nuances of this significant financial maneuver to determine its true impact on the company’s future value.

The Core Details of the Treasury Share Disposal

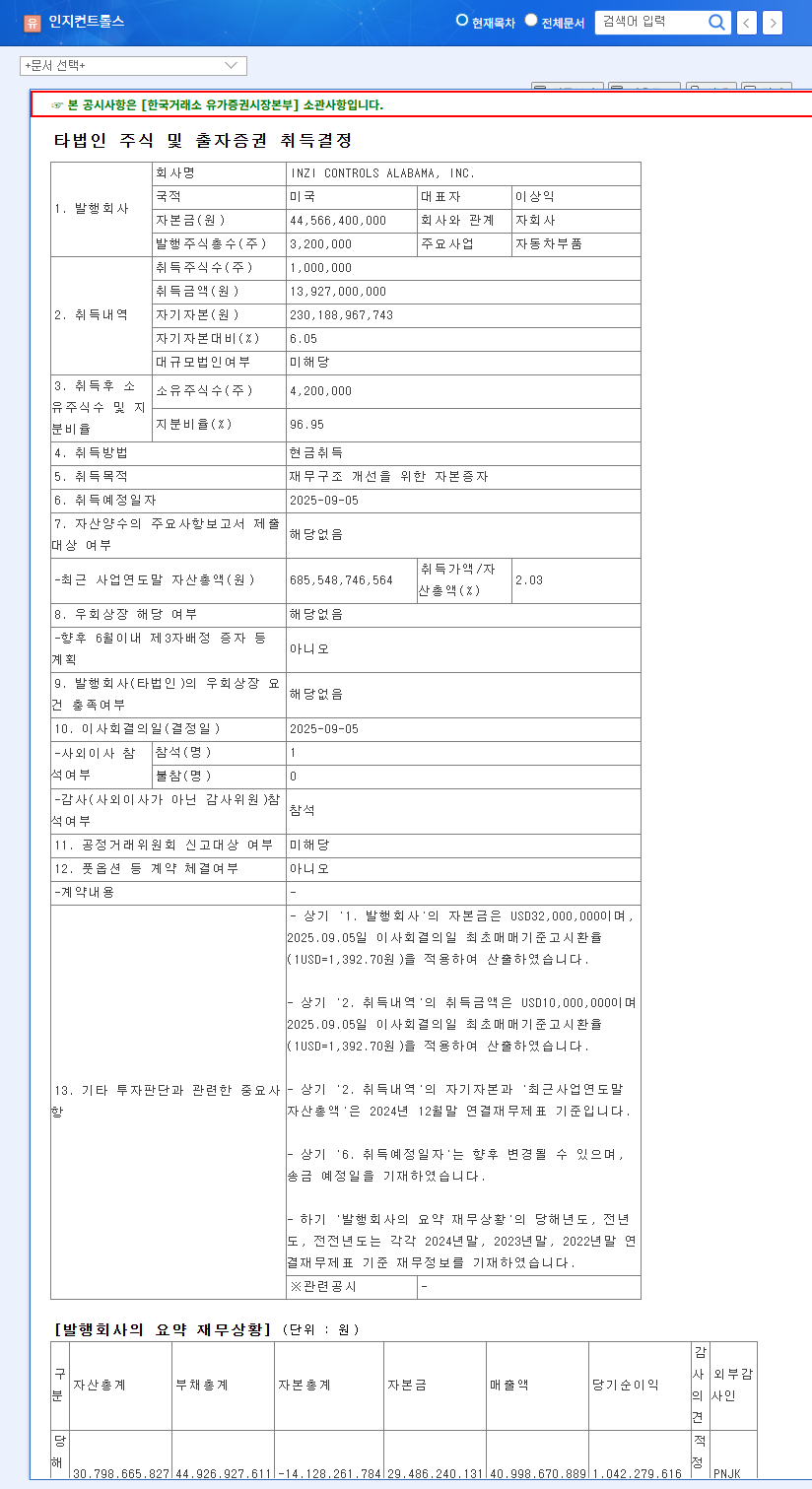

On October 27, 2023, HIGEN RNM made its intentions clear through a public disclosure. The plan to offload 1,000,000 treasury shares is not merely a financial transaction but a strategic signal of the company’s future direction. The full details were published in their official filing. (Official Disclosure: Click to view DART report). The stated purpose of this capital infusion is multi-faceted and directly tied to cementing their leadership in the robotics market.

Strategic Objectives of the Capital Raise

This treasury share disposal is a clear commitment to ambitious growth. The funds are earmarked for several key areas:

- •Expanding Robot Actuator Production: A significant portion of the capital will be used to scale up production facilities. This proactive investment aims to meet the soaring demand from the global robotics industry, which is a crucial part of our comprehensive analysis of the robotics industry.

- •Fueling Research & Development (R&D): To maintain a competitive edge, continuous innovation is paramount. This funding will bolster R&D efforts in advanced actuator technology, ensuring HIGEN RNM stays ahead of the curve.

- •Strengthening Operational Liquidity: Securing additional operating funds enhances financial stability, allowing the company to navigate market volatility and seize new business opportunities without constraint.

The transaction is set to be managed by Macquarie Securities (Korea) Ltd., whose global expertise could facilitate an efficient and successful disposal process.

For HIGEN RNM, this isn’t just about raising cash; it’s a strategic robot actuator investment designed to secure long-term market leadership and create sustainable shareholder value.

Analyzing the Impact: Growth Engine vs. Dilution Risk

Any significant corporate action like a treasury share disposal is a double-edged sword. Investors must carefully weigh the potential for long-term rewards against the short-term risks.

The Bull Case: A Catalyst for Growth

The upside is directly linked to the company’s ability to execute its growth strategy. By investing heavily in production capacity and R&D, HIGEN RNM can increase its market share and enhance its technological moat. According to recent market analysis from industry experts, the demand for high-precision robotics components is expected to grow exponentially. This capital injection positions HIGEN RNM to capture that growth, potentially leading to significantly higher revenues, improved profitability, and ultimately, a higher stock valuation in the long run.

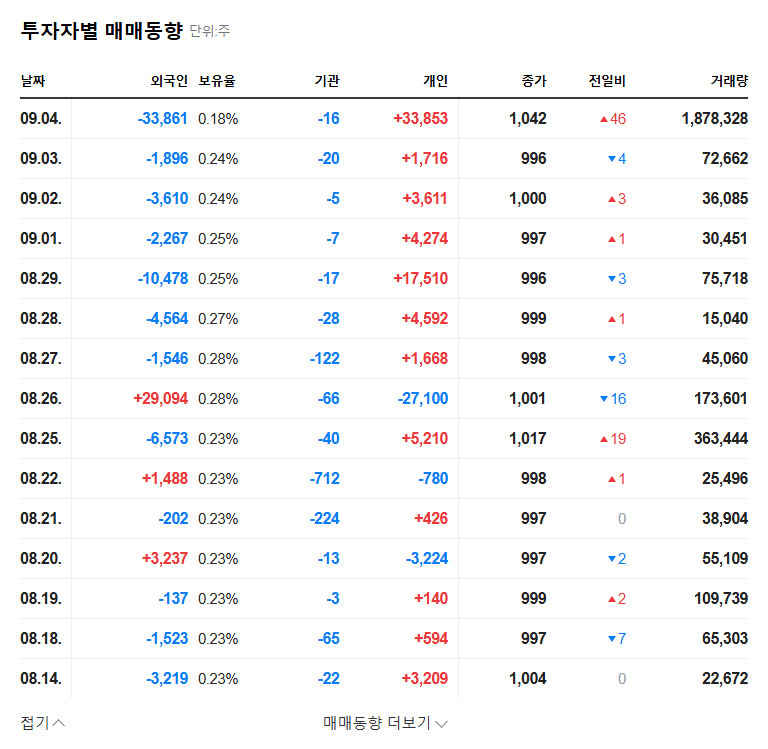

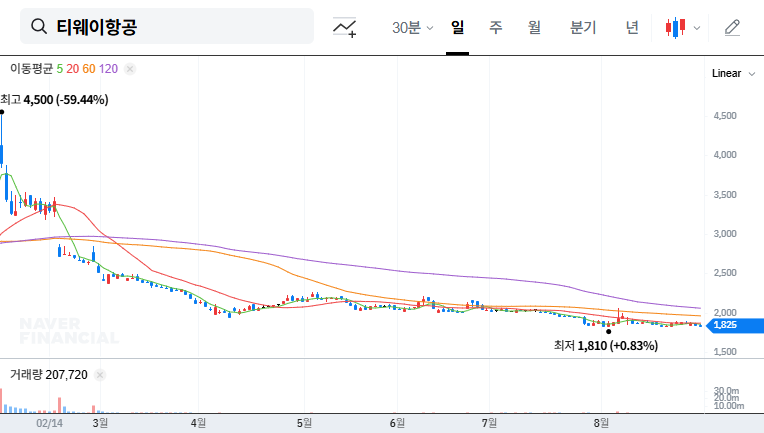

The Bear Case: The Specter of Share Dilution

The primary concern for current shareholders is the share dilution risk. When treasury shares are sold back into the market, the total number of outstanding shares increases. This means each existing share represents a smaller percentage of ownership, which can dilute earnings per share (EPS) and put downward pressure on the stock price. The specific disposal method—be it a block deal to an institutional investor, a public offering, or a third-party allocation—will be critical. A poorly executed disposal at a price below market expectations could amplify negative sentiment and lead to short-term price volatility.

Investor Strategy: Key Factors to Monitor

Given the HIGEN RNM self-stock disposal, a prudent investor should adopt a watchful and analytical approach. Your investment decision should not be based on the announcement alone, but on the evolving details and the company’s subsequent performance.

- •Confirm Disposal Method & Price: The most crucial upcoming information will be the exact method and price of the sale. This will determine the immediate impact on shareholder value. A strategic placement with a long-term partner is far more favorable than a broad market sale at a discount.

- •Track Capital Allocation: Scrutinize future quarterly reports to ensure the secured funds are being deployed effectively as promised. Look for tangible progress in facility expansion and new product developments stemming from R&D.

- •Assess Company Fundamentals: Continue to monitor core business performance, market trends in the robotics industry, and overall financial health. The success of this capital raise will ultimately be reflected in the company’s fundamental growth.

In conclusion, HIGEN RNM’s decision is a bold, forward-looking move. While the share dilution risk is real and requires careful consideration, the potential for this robot actuator investment to fuel substantial long-term growth is compelling. Cautious optimism and diligent monitoring are the recommended course of action for investors.

![(011810) STX Financial Crisis: Can a New Investment Bid Avert Delisting? [In-Depth 2025 Analysis]](https://note12345-images.s3.ap-southeast-2.amazonaws.com/wp-content/uploads/2025/10/01065205/011810.png)

![(011810) STX Financial Crisis: Can a New Investment Bid Avert Delisting? [In-Depth 2025 Analysis] 관련 이미지](http://note12345-images.s3.ap-southeast-2.amazonaws.com/wp-content/uploads/2025/10/01065211/011810_%EA%B3%B5%EC%8B%9C.png)