1. What Happened? : Major Shareholder Stake Change Analysis

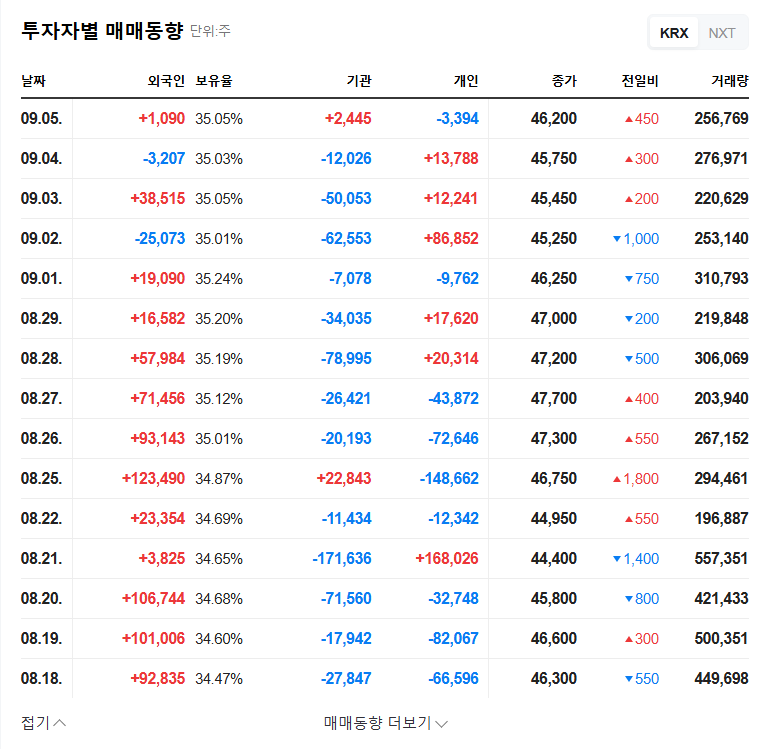

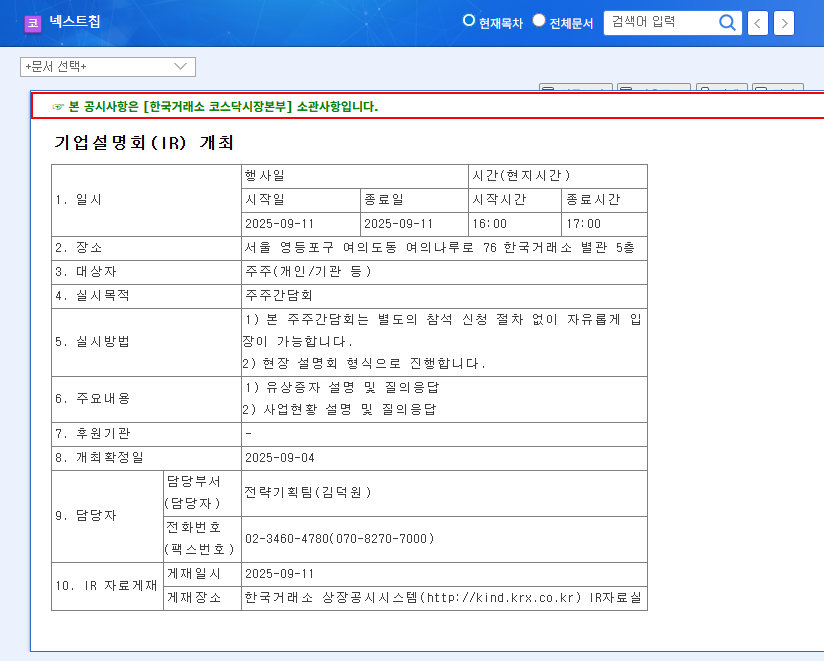

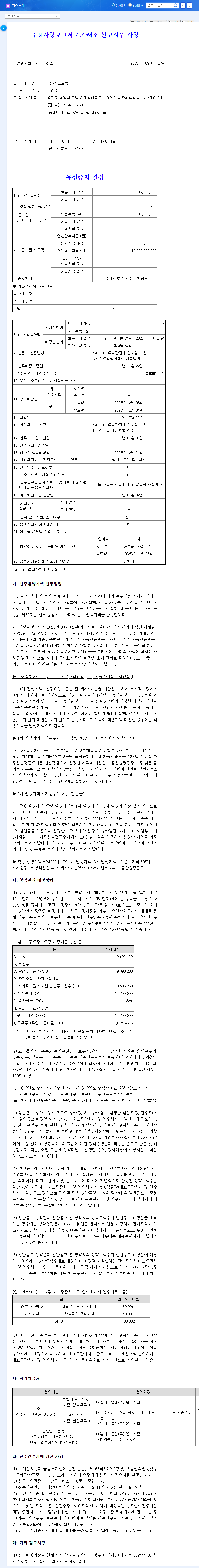

The stake held by Go Beom-gyu et al. decreased from 45.36% to 45.31%, a 0.05%p drop. The primary cause was a gift transfer (-80,000 shares) by Kim Yoon-jung. While the stated intention is to maintain influence over management, investors should remain vigilant given HYDEEP’s current predicament.

2. Why Does It Matter? : Deepening Fundamental Crisis

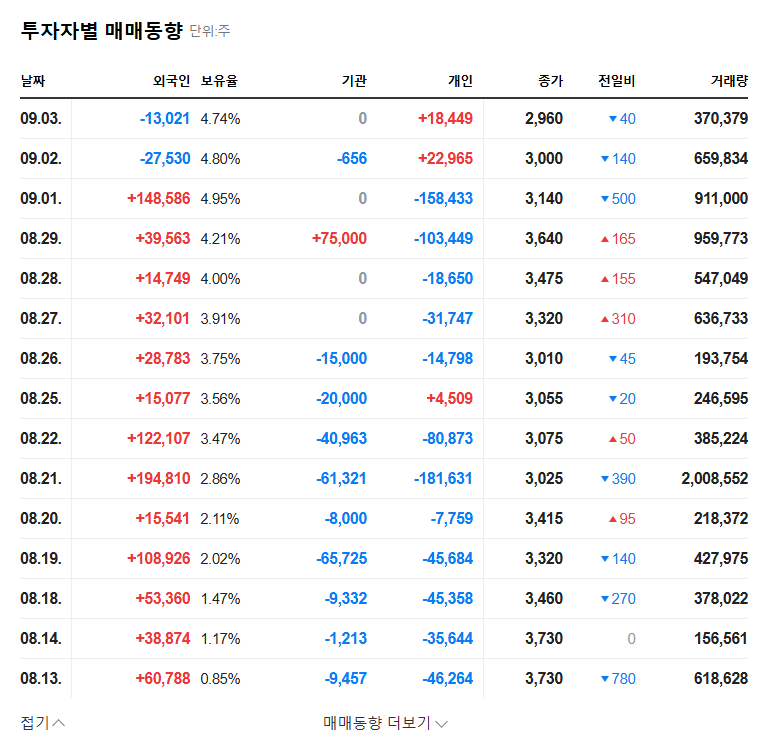

HYDEEP’s performance in the first half of 2025 has been dismal, with a sharp decline in revenue and an increase in operating losses. More alarmingly, the company is now in a state of complete capital impairment. A high debt ratio further fuels concerns about its financial health. This context makes the major shareholder’s stake change even more unsettling for investors.

3. What Should Investors Do? : Reviewing Investment Strategies

HYDEEP possesses a unique selling point with its battery-less stylus technology, but it has yet to translate this into profit. Potential investors should closely monitor the company’s efforts to improve its financial structure and the progress of its technology commercialization. A cautious, long-term approach is crucial, rather than reacting to short-term price volatility.

4. Investor Action Plan

- Short-term investors: HYDEEP’s stock price could be highly volatile in the short term. Closely monitor further stake changes, public announcements, and earnings releases, and proceed with caution.

- Long-term investors: Focus on long-term fundamental changes, such as improvements in the financial structure, new technology commercialization, and new business ventures.

Why is HYDEEP’s major shareholder stake change significant?

This stake change, coupled with HYDEEP’s precarious financial situation, could heighten investor concerns. A change in the major shareholder’s stake suggests the possibility of a management shift, which could significantly impact the company’s future.

What is the state of HYDEEP’s fundamentals?

HYDEEP is currently experiencing a sharp decline in revenue, increased operating losses, and is in a state of complete capital impairment. A high debt ratio adds to the concerns about its financial health.

Should I invest in HYDEEP?

Investment decisions should be made cautiously. While HYDEEP’s technology and market potential are attractive, the current financial situation and business uncertainties pose significant risks. Potential investors should closely monitor the company’s efforts to improve its financial structure and the progress of its technology commercialization.