Kakao Pay IR: What to Expect

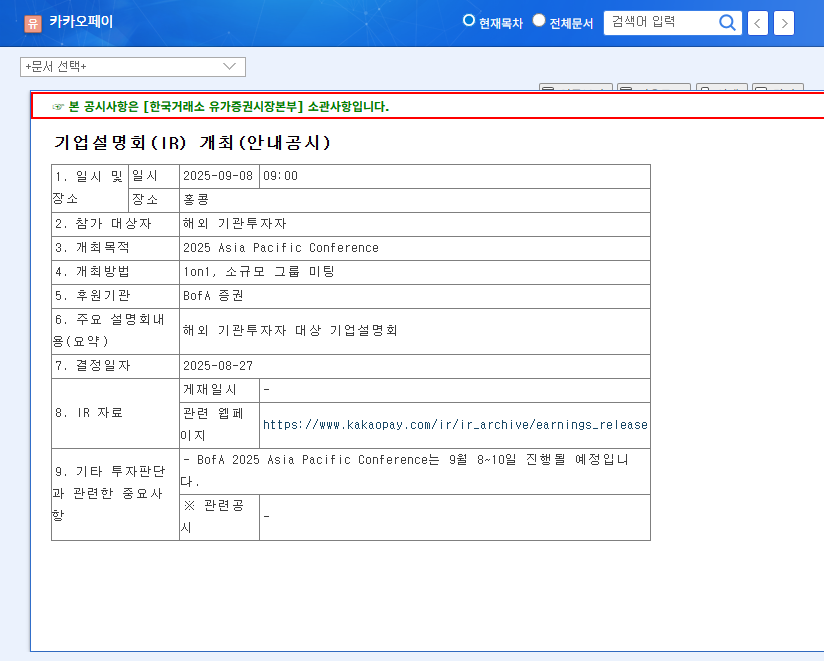

Scheduled for 09:00 on September 8, 2025, this IR targets overseas institutional investors. The primary objectives are to share Kakao Pay’s growth strategies and vision and explore opportunities for increased investment.

Capital Adequacy Ratio Adjustment: Cause for Concern?

The recently announced capital adequacy ratio has been adjusted downwards from 1,012.29% to 949.02%. While a decrease, this figure still significantly exceeds regulatory requirements, indicating healthy financial soundness. However, analysis of the reasons for this decrease and ongoing monitoring are necessary.

Market Expectations

This IR is expected to positively impact corporate value and investor sentiment. It presents a valuable opportunity to showcase Kakao Pay’s growth potential to global investors. However, depending on the IR’s outcome and the content presented, there is a potential for stock price volatility.

Investor Action Plan

- Closely monitor the IR announcements and market reactions.

- Pay attention to Kakao Pay’s mid- to long-term growth strategies and any changes to its fundamentals.

- Continuously analyze the impact of macroeconomic variables such as interest rates and exchange rates.

Why is the Kakao Pay IR important?

It’s a key event for attracting overseas investment and enhancing corporate value. It’s also an opportunity to hear about the recent changes in the capital adequacy ratio.

Is the decrease in Kakao Pay’s capital adequacy ratio a problem?

While adjusted down to 949.02%, it’s still well above regulatory requirements, indicating sound financial health. However, further analysis and monitoring are needed.

What should investors be aware of?

Market volatility is possible depending on the IR’s outcome and announcements, so close monitoring is recommended.