What Happened?

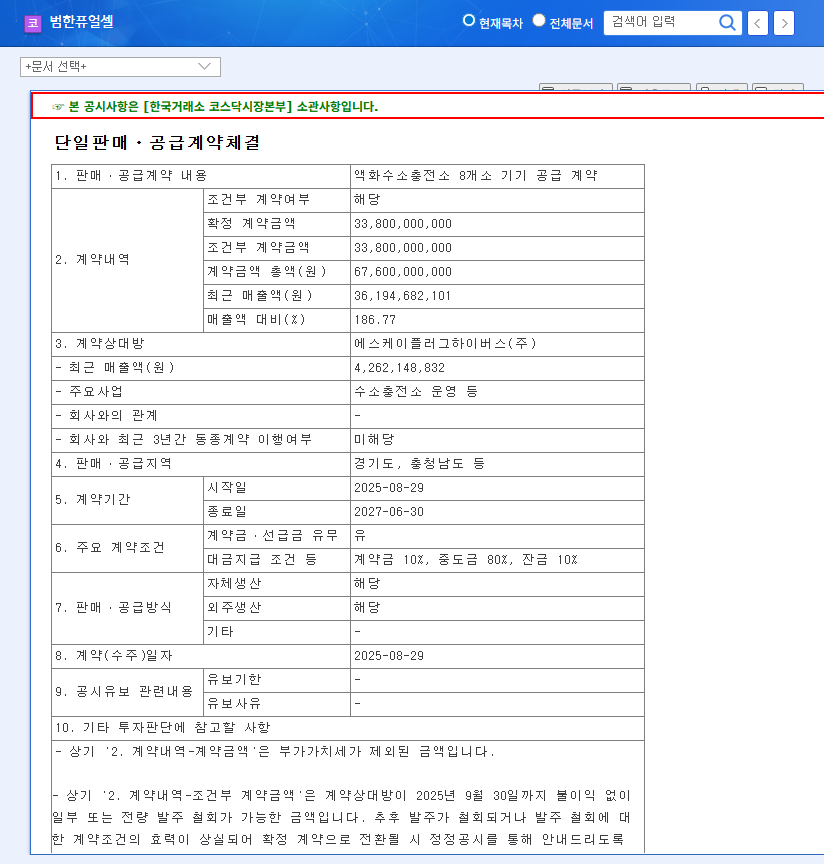

Bumhan Fuel Cell signed a contract to supply equipment for eight liquid hydrogen refueling stations from August 2025 to June 2027. The contract is worth a substantial ₩33.8 billion.

Why is This Contract Important?

This contract signifies more than just increased revenue; it’s a crucial step in securing Bumhan Fuel Cell’s future growth.

- Early Mover Advantage in Liquid Hydrogen: Liquid hydrogen is poised to be the future of hydrogen refueling. This contract positions Bumhan Fuel Cell for a competitive edge in this emerging market.

- Validation of Technology: Securing a contract of this size with a major player validates Bumhan Fuel Cell’s technology and operational capabilities.

- Growth Momentum: The deal increases the likelihood of further contracts and contributes to the company’s potential for increased valuation.

What Should Investors Do?

This contract is positive news for potential investors in Bumhan Fuel Cell. However, careful consideration of several factors is crucial before making any investment decisions.

- Profitability: While the contract is large, actual profitability hinges on cost management and efficiency during implementation.

- Financial Health: Continuous monitoring of debt-to-equity and current ratios is essential.

- Competitive Landscape: The increasing competition in the hydrogen market requires assessing Bumhan Fuel Cell’s ability to maintain its competitive advantage.

A prudent investment decision requires a comprehensive evaluation of both the positive aspects and the risks.

What is the value of the contract?

The contract is worth approximately ₩33.8 billion.

What is a liquid hydrogen refueling station?

It’s a refueling station for hydrogen-powered vehicles that uses liquid hydrogen. It offers advantages over gaseous hydrogen stations, including greater storage capacity and faster refueling times.

What are Bumhan Fuel Cell’s main business areas?

They specialize in hydrogen-related businesses, including fuel cells for submarines, buildings, and hydrogen mobility.