A significant move in the financial sector has caught the attention of market watchers. An updated F&Guide investment analysis is crucial following the news that Box Holdings LP, a notable U.S.-based investment firm, has increased its stake in the financial data company to 8.50%. This action, disclosed as a ‘simple investment,’ raises a critical question for current and potential shareholders: Is this a vote of confidence signaling a rebound, or simply a strategic play in a company facing headwinds? Amid stagnant earnings and governance questions, we will explore the implications of this development.

This comprehensive report delves into the fundamentals of F&Guide stock, analyzing the potential impacts of Box Holdings LP’s increased position. We provide a multi-faceted view to help you formulate a prudent investment strategy based on the company’s current financial health, restructuring efforts, and market sentiment.

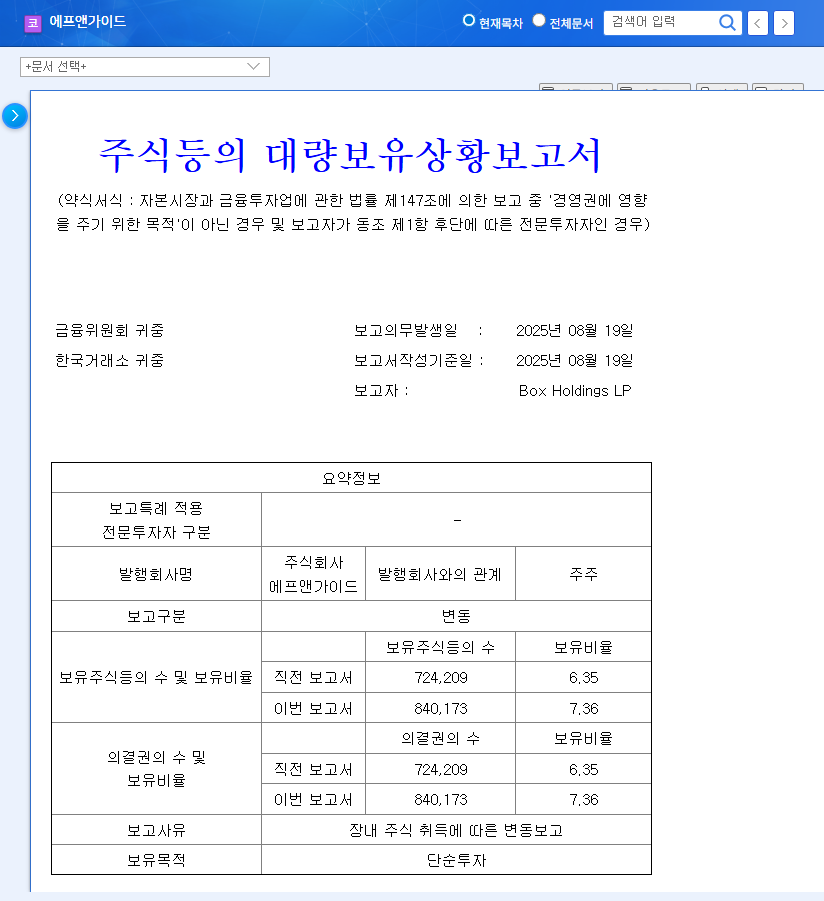

The Core Event: Box Holdings LP Increases Its F&Guide Stake

On October 1, 2025, an official disclosure confirmed that Box Holdings LP had bolstered its position in F&Guide. The firm acquired an additional 92,000 shares on the open market, elevating its total stake from 7.36% to a significant 8.50%. The information comes directly from the Official Disclosure filed with the regulatory authorities. While the stated purpose is ‘simple investment,’ such a substantial increase by an institutional investor is rarely without deeper implications. It often suggests a belief in the company’s long-term value, a potential undervaluation, or an anticipated positive catalyst on the horizon.

An increase in institutional ownership can be a powerful signal, suggesting that sophisticated investors see untapped potential or a turning point for the company. However, it’s essential to verify this signal against the company’s underlying fundamentals.

Analyzing the F&Guide Fundamentals: A Mixed Picture

To understand the context of this F&Guide investment, a thorough examination of the company’s current financial state is necessary. The data reveals a story of contrast: deteriorating profitability versus a stable financial foundation.

The Challenge: Declining Profitability

Recent performance metrics paint a concerning picture. Revenue and operating profit have been in a consistent downtrend from 2022 through 2024 estimates. The projection of negative profit margins for 2024 is a significant red flag that cannot be ignored.

- •Revenue Decline: From ₩91.2B (2022) to an estimated ₩31.6B (2024).

- •Operating Profit Collapse: From ₩10.3B (2022) to a projected loss of -₩15.9B (2024).

- •Margin Erosion: Operating profit margin is expected to fall to -50.29% in 2024.

The Silver Lining: Solid Financial Health

Despite the profitability issues, F&Guide’s balance sheet shows resilience. The company has actively managed its debt, and its liquidity ratios are robust, suggesting it has the financial stability to navigate this challenging period. For more on what these metrics mean, you can review this guide on analyzing a company’s financial health.

- •Decreasing Debt-to-Equity Ratio: A key indicator of lower financial risk, falling from 17.15% to a projected 7.90%. You can learn more about this ratio at Investopedia.

- •Strong Current Ratio: Increasing significantly, indicating ample short-term assets to cover liabilities.

Strategic Shifts and Lingering Risks

F&Guide is not standing still. The company is actively reorganizing its business portfolio, aiming to shed non-core operations—like the ‘personal credit information management business’—to focus on its core competencies. This strategic pivot could unlock efficiency and improve long-term profitability.

However, a notable risk factor is corporate governance. The rejection of two director candidates following a change in the largest shareholder in early 2024 hints at potential instability or conflict at the board level. This uncertainty can deter investors and hinder effective decision-making, a crucial aspect to monitor for anyone considering an F&Guide investment.

Investor Action Plan: A Prudent Path Forward

Given the complex mix of positive signals and underlying risks, a cautious and well-researched approach is essential.

- •Acknowledge the Signal: The Box Holdings LP stake increase is a bullish signal that should prompt a closer look, potentially improving short-term sentiment.

- •Focus on the Turnaround: The long-term value of F&Guide stock hinges on the successful execution of its business restructuring. Monitor upcoming earnings reports for signs that profitability is returning.

- •Monitor Governance: Keep a close eye on any news related to the board of directors and management stability. Resolution of these issues would be a significant positive catalyst.

- •Manage Risk: With a projected loss for 2024, the current stock price may be vulnerable. Investors should consider the high valuation burden and implement proper risk management strategies.

In conclusion, while the increased stake by Box Holdings LP is an intriguing development, it is not a standalone reason to invest. It serves as a catalyst for deeper due diligence. The future of F&Guide’s stock will be written by its ability to translate strategic restructuring into tangible financial results and resolve its governance uncertainties.