1. Biotoxtech’s Share Buyback: What Happened?

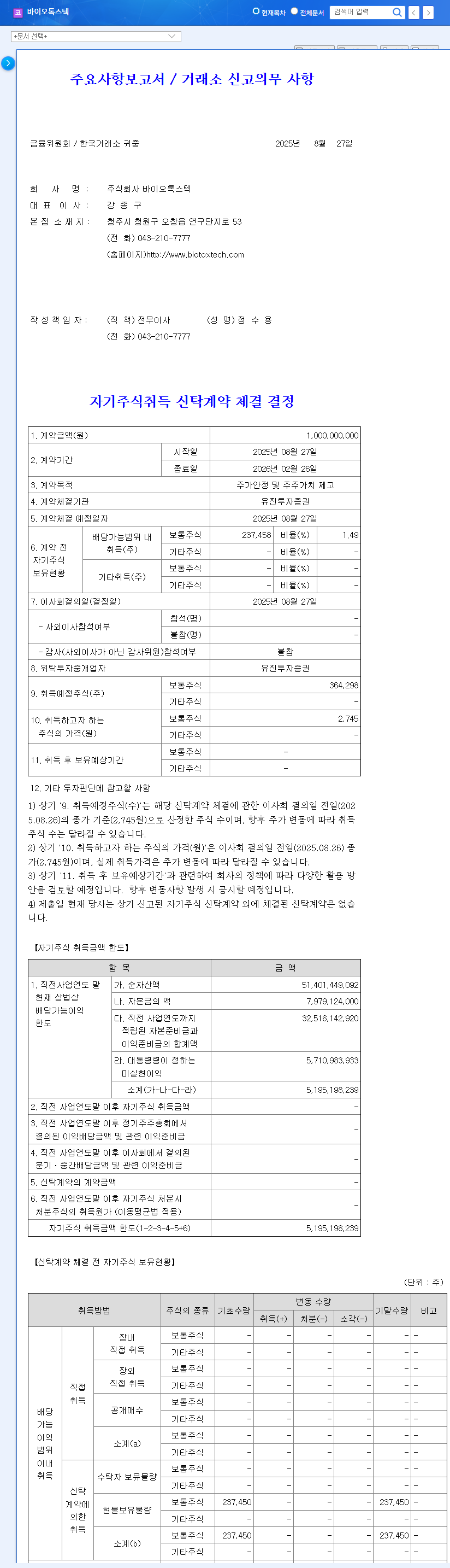

On August 27, 2025, Biotoxtech entered into a trust agreement with Eugene Investment & Securities for a ₩1 billion share buyback. The agreement runs until February 26, 2026, with the aim of stabilizing stock prices and enhancing shareholder value.

2. Why the Buyback?: Background and Implications

Biotoxtech is currently grappling with declining sales and sustained operating losses. The share buyback is interpreted as an attempt to defend against falling stock prices and improve investor sentiment. However, it’s crucial to consider that sustainable stock price growth is unlikely without fundamental improvements in profitability.

3. Buyback Impact: Outlook and Analysis

- Positive Aspects: Short-term stock price momentum, potential improvement in investor sentiment.

- Negative Aspects: Weakening fundamentals, macroeconomic uncertainties, possibility of a lukewarm market response.

While positive factors like the growth potential of the CRO market and new business ventures exist, macroeconomic variables such as interest rates and exchange rates, along with intensifying competition, could pose risks.

4. Investor Action Plan: What Should You Do?

- Short-term Investors: Pay close attention to short-term stock price volatility and closely monitor any improvements in fundamentals.

- Long-term Investors: Analyze long-term growth drivers, such as the performance of new drug pipelines and the ability to generate revenue from new businesses.

- All Investors: Continuously monitor potential risk factors, including operating losses, debt ratios, and macroeconomic variables. It’s also essential to seek out additional information on management strategies and plans for performance improvement.

Frequently Asked Questions

What is the size of Biotoxtech’s share buyback?

₩1 billion, which represents 2.28% of its market capitalization.

What is the purpose of the share buyback?

To stabilize the stock price and enhance shareholder value.

How long will the share buyback program last?

From August 27, 2025, to February 26, 2026.

What is Biotoxtech’s current financial situation?

The company is facing difficulties due to declining sales and continued operating losses.

What should investors be aware of?

Investors should consider short-term price volatility, potential improvements in fundamentals, and macroeconomic variables.

Leave a Reply