The upcoming DSdanseok IR (Investor Relations) conference, scheduled for October 17, 2025, is a pivotal event for investors. As a key player in the eco-friendly circular economy, DSdanseok’s presentation will offer critical insights into its bioenergy, battery recycling, and plastic recycling divisions. This deep dive will analyze the company’s fundamentals, the potential impact of the IR on DSdanseok stock, and provide a comprehensive DSdanseok investment strategy for both current and prospective shareholders. Understanding the nuances of this event is essential for making an informed decision in a rapidly evolving market.

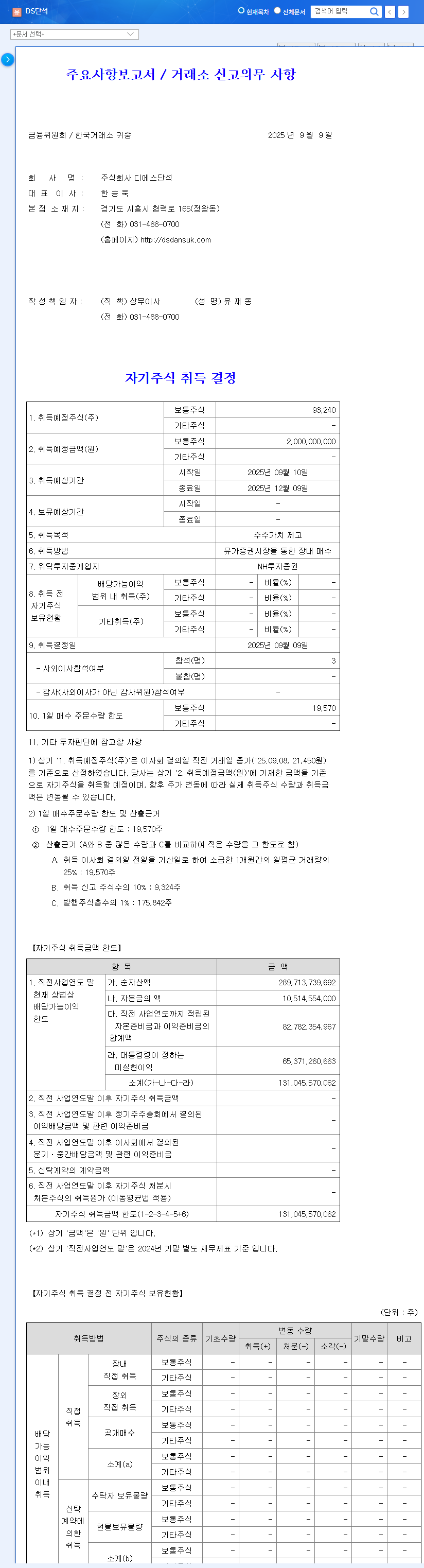

The company will be participating in the Daishin New Growth Industry Corporate Day, with the IR session set for 1:10 PM. The primary goals are to enhance shareholder value and foster transparent communication. For official details, please refer to the company’s Official Disclosure (Source: DART).

DSdanseok at a Glance: A Circular Economy Pioneer

DSdanseok has positioned itself as a leader in the circular economy, a model focused on eliminating waste and promoting the continual use of resources. This forward-thinking approach is not just environmentally responsible but also aligns with global ESG (Environmental, Social, and Governance) investment trends. The company’s core operations are segmented into three high-potential areas:

- •Bioenergy: This segment, which constitutes over 52% of revenue, focuses on producing biofuels like Sustainable Aviation Fuel (SAF) and bio-marine fuel from renewable sources, catering to the growing demand for greener energy solutions in transportation.

- •Battery Recycling: A significant growth engine (36% of revenue), this division recycles both lead-acid batteries and is expanding into the lucrative secondary (lithium-ion) battery market, driven by the global surge in electric vehicles (EVs).

- •Plastic Recycling: This unit focuses on creating value from plastic waste, a critical component of a sustainable future, though it currently represents a smaller portion of the company’s revenue.

Analyzing the Impact of the DSdanseok IR

The Investor Relations event can serve as a powerful catalyst for the company’s stock price, creating both short-term volatility and setting the long-term trajectory. Investors should monitor the event for key announcements and management tone.

Short-Term Stock Price Reaction

Immediately following the DSdanseok IR, the market will react to the information presented. A clear, confident roadmap for improving bioenergy profitability and a detailed expansion plan for the battery recycling segment could trigger a positive sentiment shift and a rally in the stock. Conversely, any ambiguity or failure to address concerns about profitability and debt could lead to a sell-off. The Q&A session will be particularly revealing, as management’s ability to handle tough questions will be a key indicator of their preparedness.

Mid-to-Long-Term Value Creation

Beyond the initial reaction, the true impact lies in execution. If DSdanseok’s management delivers on the promises made during the IR, it can build lasting investor trust and drive sustained corporate value. Key performance indicators to watch in the quarters following the IR will include margin improvements in the bioenergy sector, securing new contracts in battery recycling, and progress on debt reduction. Consistent and transparent communication, as explained by authoritative sources like Harvard Business Review, is fundamental to long-term valuation.

The core challenge for DSdanseok is to translate its compelling green-tech narrative into consistent financial performance. This IR is their platform to prove that their growth strategy is not just visionary, but also viable and profitable.

A Smart DSdanseok Investment Strategy

Developing a sound DSdanseok investment strategy requires a balanced view of its strengths and weaknesses. While the company’s alignment with ESG trends is a major advantage, investors must critically assess its financial health and operational efficiency.

Key Questions for Investors to Consider:

- •Profitability Plan: Does management present a credible plan to reverse the operating loss in the bioenergy segment? Look for specifics on cost control and product innovation.

- •Battery Recycling Roadmap: How detailed is the growth plan for secondary battery recycling? Are there clear targets for capacity, market share, and revenue? For more context, you can read our Deep Dive into the Battery Recycling Market.

- •Financial Discipline: What is the strategy for managing the high debt ratio and improving cash flow? A clear deleveraging plan is essential for long-term stability.

- •Macro-Risk Mitigation: How is the company prepared to handle volatility in exchange rates, interest rates, and raw material prices?

In conclusion, the DSdanseok IR is more than just a presentation; it’s a critical stress test of the company’s strategy and leadership. For diligent investors, it offers a unique opportunity to look beyond the headlines and assess the fundamental, long-term value of a company at the heart of the sustainable economy. The feasibility and specificity of the plans presented will be the ultimate determinant of investor confidence and the future of DSdanseok stock.