The recent LG H&H Q3 2025 earnings report sent a wave of concern through the investment community. As a cornerstone of the Korean consumer goods market, LG Household & Health Care’s significant miss on key financial metrics has triggered questions about its short-term stability and long-term growth trajectory. This comprehensive LG H&H stock analysis unpacks the disappointing results, explores the underlying causes of the underperformance, and outlines a clear LG H&H investment strategy for navigating the path ahead.

For investors holding or considering a position in LG H&H, understanding the nuances of this performance dip is critical. We’ll delve into macroeconomic pressures, segment-specific challenges, and the crucial factors that will dictate the company’s recovery and future stock performance.

The Q3 2025 Earnings Shock: By the Numbers

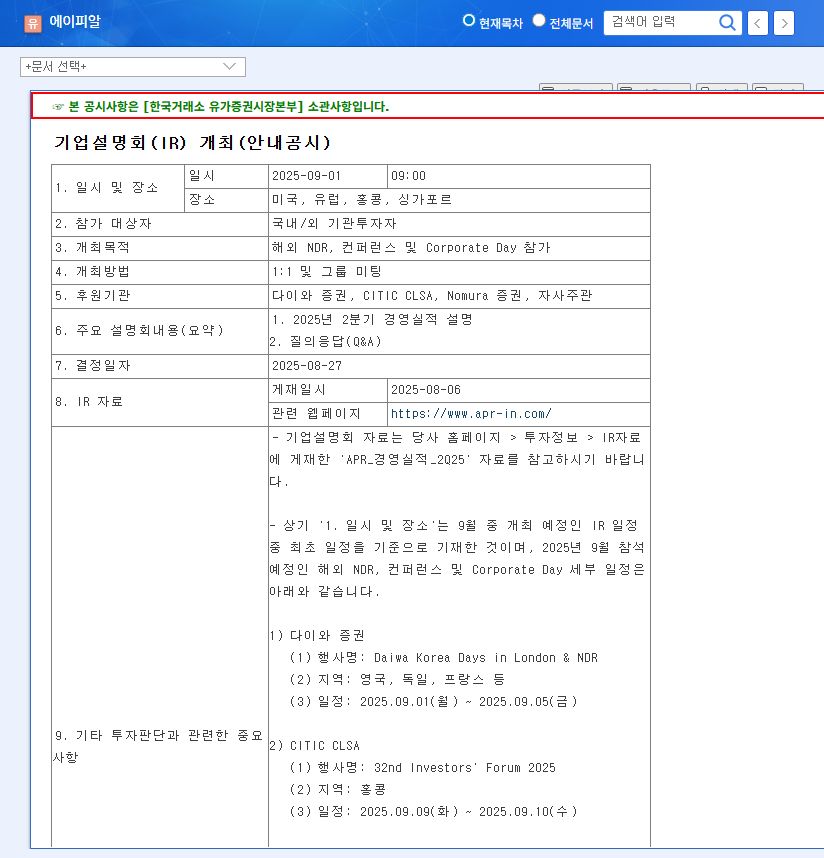

On November 10, 2025, LG H&H released its preliminary Q3 earnings, which fell alarmingly short of market consensus estimates. The official figures, as detailed in their public filing (Source: DART), reveal a troubling trend:

- •Revenue: KRW 1.58 trillion, a 2.0% decrease from the KRW 1.615 trillion estimate.

- •Operating Profit: KRW 46.2 billion, a significant 15.1% miss compared to the KRW 54.4 billion estimate.

- •Net Profit: KRW 18.2 billion, a staggering 41.5% plunge below the KRW 31.1 billion estimate.

While the revenue dip was a concern, the dramatic collapse in operating and net profit has understandably spooked investors. This points to severe margin compression, where the costs of doing business are rising much faster than sales, eroding the company’s core profitability.

Dissecting the LG H&H Q3 2025 Earnings Underperformance

This poor performance wasn’t caused by a single issue but rather a perfect storm of external pressures and internal challenges across all of the company’s business segments.

Crippling Macroeconomic Headwinds

The global economic environment created significant hurdles for LG H&H in Q3:

- •Weak Consumer Sentiment: Persistently high interest rates globally have tightened household budgets, leading to reduced discretionary spending on beauty and premium home products.

- •Adverse Exchange Rates: A strong US dollar against the Korean Won (KRW) inflated the cost of imported raw materials, directly squeezing profit margins.

- •Rising Input Costs: Surging oil prices increased costs for logistics, distribution, and petroleum-based packaging, particularly impacting the Refreshment (beverage) segment.

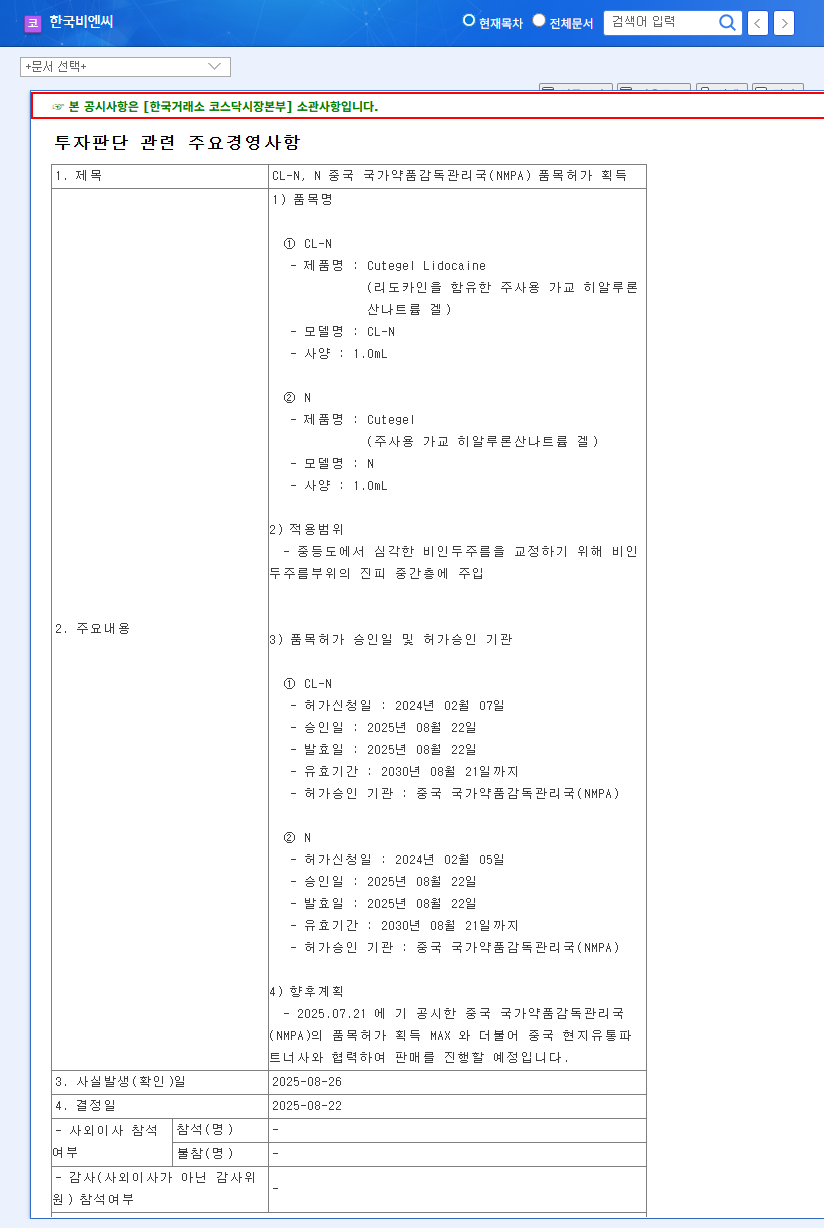

Segment-Specific Weaknesses Exposed

No division was immune to the downturn, with the crucial Beauty segment facing the most intense pressure.

- •Beauty (Cosmetics): The engine of LG H&H’s growth is sputtering. Despite strength in its luxury brands like ‘The History of Whoo’, the company is losing ground in the hyper-competitive Chinese market. A slow recovery in global travel retail and weaker-than-expected performance in new markets compounded the issue. For more context, see our complete analysis of the Korean cosmetics market.

- •HDB (Household & Daily Beauty): As a mature business, the HDB segment struggled to generate enough growth to compensate for the Beauty division’s woes. While it remains a market leader, its limited growth potential was evident in these results.

- •Refreshment (Beverages): The stable demand for its Coca-Cola brand couldn’t shield this segment from margin erosion. The aforementioned currency and raw material price volatility directly hit its bottom line, turning a stable revenue stream into a less profitable one.

The Q3 earnings miss is a clear negative signal. Investors should brace for significant short-term downward pressure on LG H&H’s stock price as the market recalibrates its valuation based on these weakened fundamentals.

Revised Investment Strategy & Future Outlook

While LG H&H maintains a sound financial structure with a low debt-to-equity ratio, declining profitability is a major concern. The company’s future stock performance hinges on its ability to navigate current challenges and reignite growth. An effective LG H&H investment strategy must be cautious and observant.

Key Catalysts for Recovery to Monitor

- •Q4 & 2026 Guidance: Watch closely for signs of a rebound in the next earnings report and management’s strategy for the upcoming year.

- •Geographic Diversification: Success in North American and Japanese markets is now paramount to reduce reliance on the volatile Chinese market.

- •Innovation Pipeline: The market reception of new products, particularly in high-margin areas like beauty devices (‘LG Pra.L’), will be a crucial indicator.

Recommendation: Cautious Hold

Given the short-term headwinds and stock price vulnerability, a ‘buy’ recommendation is premature. We advise a cautious ‘Hold’ for existing investors. New investors should wait for clear evidence of a turnaround, such as a stabilized Chinese market share and improved profit margins, before initiating a position. The risk of further decline is tangible until management presents a convincing recovery plan.

Frequently Asked Questions (FAQ)

Q1: What was the main reason for the LG H&H Q3 2025 earnings miss?

A1: It was a combination of factors, primarily a slowdown in the high-profit Beauty segment due to intense competition in China, coupled with rising raw material and logistics costs that squeezed profitability across all divisions.

Q2: How will this underperformance affect the LG H&H stock price?

A2: The stock is expected to face significant downward pressure in the short term. The substantial miss in profit expectations signals deep-seated issues that will likely lead to weakened investor confidence and a lower valuation.

Q3: Is LG H&H still a good long-term investment?

A3: The company has strong brands and a solid financial foundation, but its long-term appeal now depends on its ability to adapt. A successful diversification away from China and innovation in new product categories are essential for a positive long-term outlook.