This comprehensive IS DONGSEO financial analysis dives into the company’s recent landmark contract win. In a market fraught with uncertainty, high interest rates, and sluggish construction activity, IS DONGSEO has secured a major ₩341.3 billion redevelopment deal. This pivotal move sparks critical questions: Can this contract reverse recent financial declines and become a true catalyst for growth? What are the underlying risks and rewards for potential investors?

We will dissect the core details of the Wondae 2-ga Redevelopment Project, evaluate the company’s fundamental health, analyze market expectations, and outline a strategic approach for a medium to long-term IS DONGSEO investment. This analysis provides the clarity needed to make informed decisions in today’s complex economic landscape.

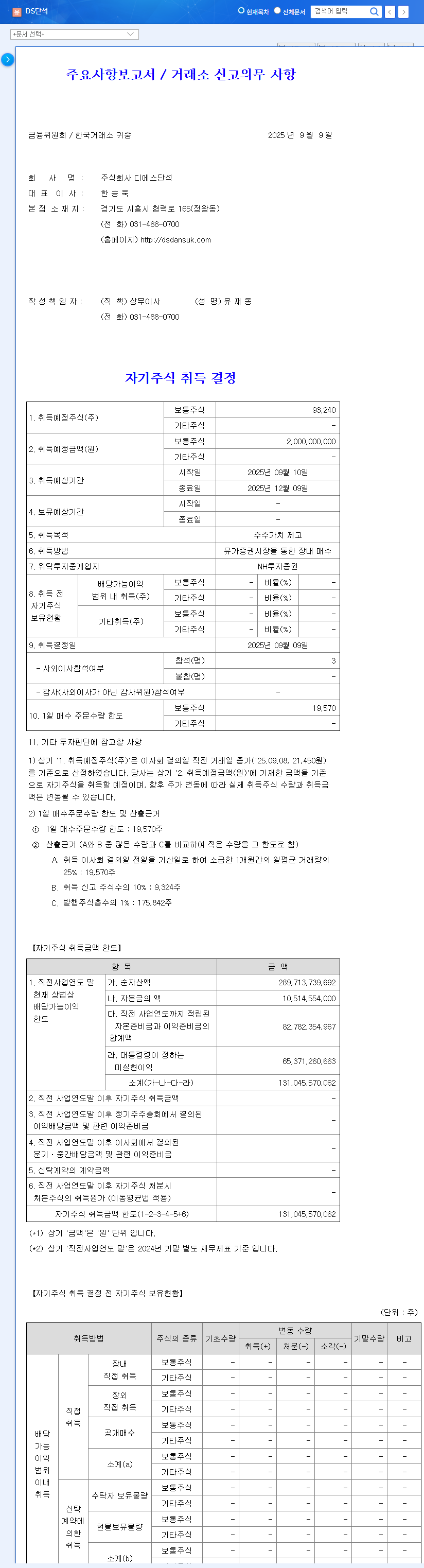

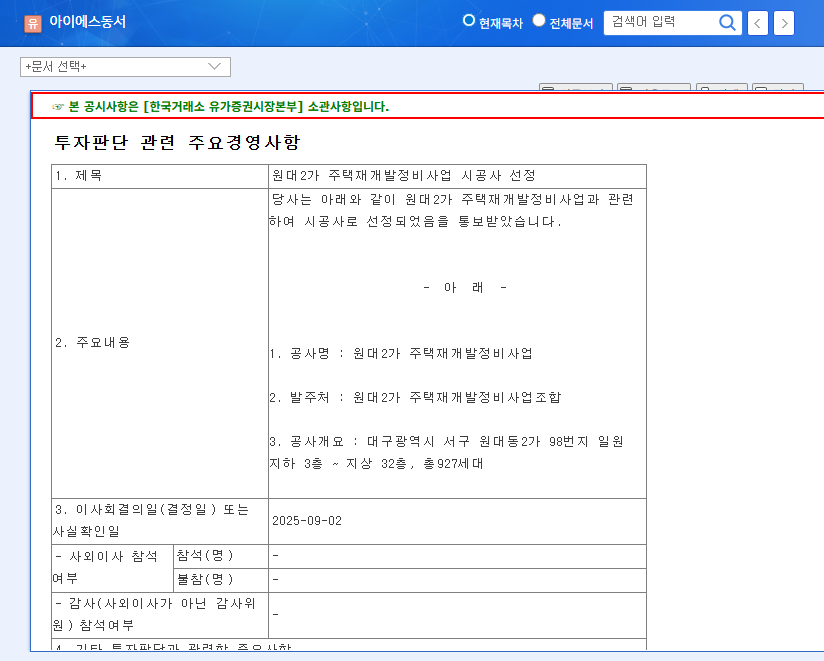

The ₩341.3 Billion Redevelopment Contract: A Detailed Breakdown

Key Contract Details: Wondae 2-ga Redevelopment Project

IS DONGSEO has officially announced the signing of a massive single sales and supply contract for the Wondae 2-ga Redevelopment Project, located in Seo-gu, Daegu Metropolitan City. This project is poised to become a significant pillar for the company’s future revenue streams and growth momentum. The details, as per the official disclosure, are as follows:

- •Contracting Party: Wondae 2-ga Redevelopment Project Association

- •Contract Scope: Full construction order for the redevelopment project.

- •Supply Area: 98, Wondae-dong 2-ga, Seo-gu, Daegu, South Korea

- •Contract Amount: A substantial ₩341.3 billion

- •Percentage of Revenue: Represents an impressive 22.54% of recent annual revenue.

- •Contract Period: June 1, 2029 – June 1, 2032 (3-year duration)

This contract is scheduled to make a material contribution to IS DONGSEO’s revenue starting in 2029, reinforcing its construction portfolio and setting the stage for improved performance in the coming decade.

IS DONGSEO Financial Analysis: Fundamentals & Growth Impact

Current Corporate Health: Strengths and Weaknesses

Based on recent financial reports, IS DONGSEO presents a mixed but intriguing picture for investors:

Positive Aspects:

- •Environmental Business Growth: The company’s push into future-proof sectors, particularly battery recycling, is a key growth driver that diversifies it beyond traditional construction.

- •Effective Cost Management: Despite falling sales, an improved operating profit margin signals strong internal controls and enhanced business efficiency.

- •Stable Financial Structure: A healthy and well-managed debt-to-equity ratio indicates sound financial discipline.

Factors to Consider:

- •Construction Sector Headwinds: The broader construction market remains challenged by high costs and interest rates, which could delay a full recovery. For more on market trends, see reports from sources like Reuters Business.

- •Declining Financial Metrics: Key indicators like sales, operating profit, and net profit have trended downwards since 2022, raising valid concerns about short-term profitability.

- •Macroeconomic Risks: Global variables such as exchange rate volatility and raw material price inflation could place pressure on overall operations.

For investors, the key takeaway is not just the deal itself, but the company’s ability to execute flawlessly and manage costs effectively amidst market volatility over the next five years. This contract provides a visible long-term revenue stream, acting as a crucial bridge to future growth.

Market Expectations & Key Risks for Investors

The Investor Perspective on the IS DONGSEO Redevelopment Deal

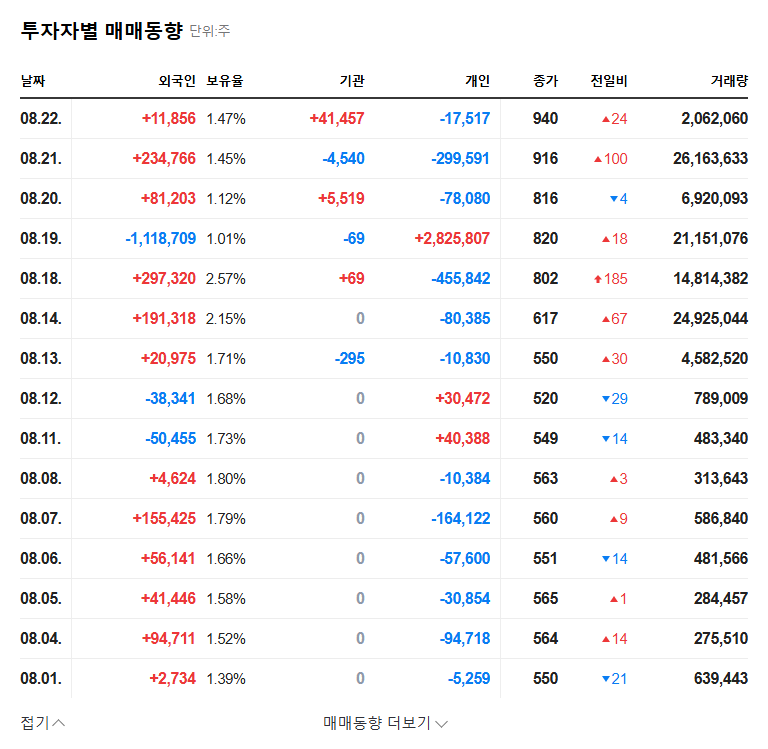

While this large-scale contract is a clear positive, its impact is nuanced. Because revenue recognition does not begin until 2029, the immediate effect on the stock price may be limited. The market will likely focus more on near-term construction market recovery and progress in the company’s diversified business portfolio, such as its environmental ventures. To learn more about diversification strategies, you can read our guide on evaluating corporate fundamentals.

The redevelopment sector is fiercely competitive. Success for IS DONGSEO hinges on demonstrating superior technology, cost competitiveness, and project management capabilities to outperform rivals and protect margins.

Conclusion: A Strategic Long-Term Investment Outlook

Final Assessment and Investment Strategy

The IS DONGSEO redevelopment deal is a vital strategic win that secures a significant future growth engine. In a challenging climate, this ₩341.3 billion contract is a powerful positive signal. However, investors should adopt a patient, long-term perspective. The key risk factors—market uncertainty until 2029, potential cost inflation, and recent financial performance—necessitate careful monitoring.

This contract should not be viewed as a trigger for a short-term price surge, but as a foundational piece of the company’s long-term value proposition. When combined with IS DONGSEO’s ESG initiatives and its promising environmental business, the successful execution of this project could mark a major turning point. The most rational approach is to evaluate this IS DONGSEO investment opportunity by tracking its strategic execution and financial improvements over the medium-to-long term. Full details of the contract can be found in the Official Disclosure (DART Source).