1. Aizinet H1 2025 Performance: Stalling Growth Engine

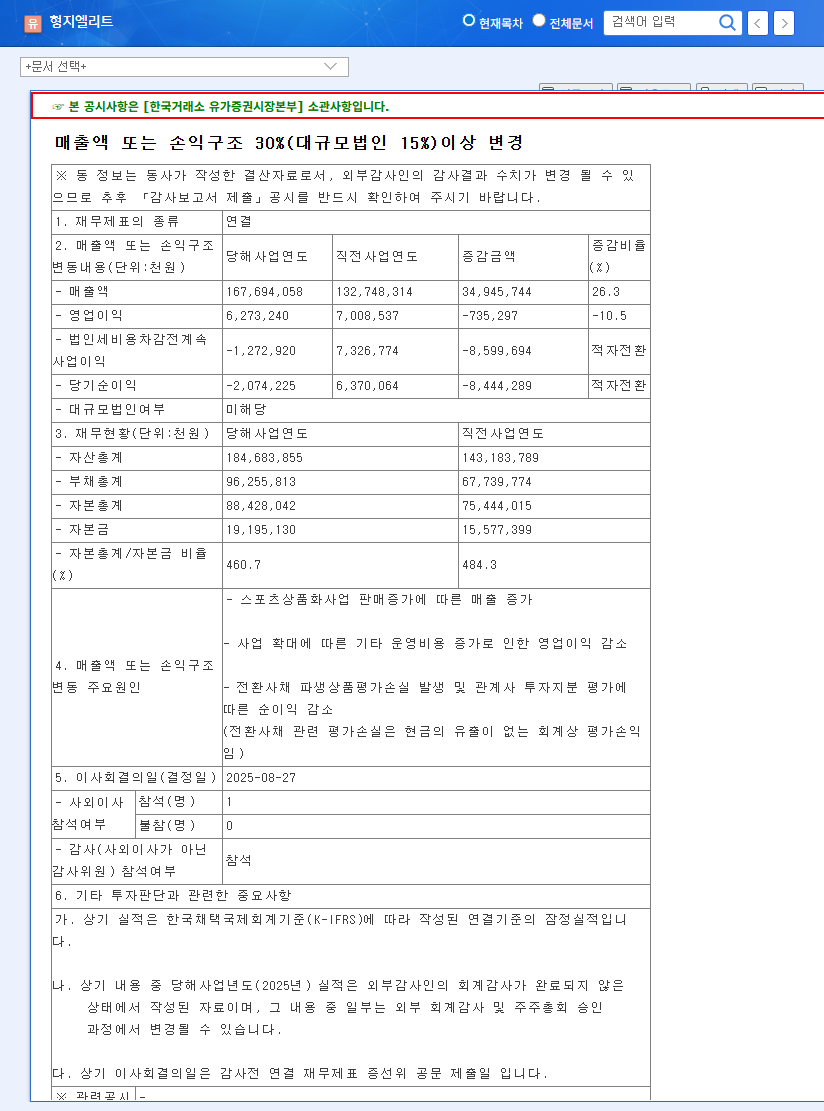

Aizinet’s H1 2025 revenue declined year-over-year, with the company swinging to an operating loss. The sharp drop in B2B solutions revenue is particularly alarming, suggesting increased competition and a weakening of Aizinet’s market position.

2. Causes of Decline: B2B Struggles and Lack of Diversification

Aizinet’s underperformance stems from a combination of declining B2B sales and an over-reliance on insurance commission revenue. Slowing growth in its ‘Bodoc’ platform and challenges in expanding new business lines have further squeezed profitability.

3. Aizinet’s Future: Navigating Uncertainty

Aizinet still has the potential to rebound, leveraging the growing insurtech market and its AI capabilities. However, the company must address its B2B challenges, diversify revenue streams, and continue to innovate.

4. Investor Action Plan: Proceed with Caution

Investors should closely monitor Aizinet’s upcoming earnings releases and management’s strategic adjustments. A cautious approach is warranted until clear signs of B2B recovery, improved profitability, and new growth drivers emerge.

Frequently Asked Questions

What is Aizinet’s core business?

Aizinet is an insurtech company providing the AI and MyData powered insurance platform ‘Bodoc’ and digital transformation solutions for insurance companies.

How did Aizinet perform in H1 2025?

Aizinet reported poor performance with declining revenue and an operating loss, primarily driven by weakness in its B2B solutions segment.

Should I invest in Aizinet?

The short-term outlook is negative. Caution is advised until there are clear signs of B2B recovery and improved profitability.