The recent news of Daishin Securities acquiring a significant stake in Nextchip Co., Ltd. through convertible bonds has sent ripples through the investment community. This move raises a critical question: is this a vote of confidence that could rescue Nextchip from its financial turmoil, or is it merely a speculative play that adds more uncertainty to the company’s future? This comprehensive analysis delves into the official disclosure, Nextchip’s financial health, and the strategic implications for investors considering Nextchip stock.

The Catalyst: Daishin Securities’ Strategic Stake

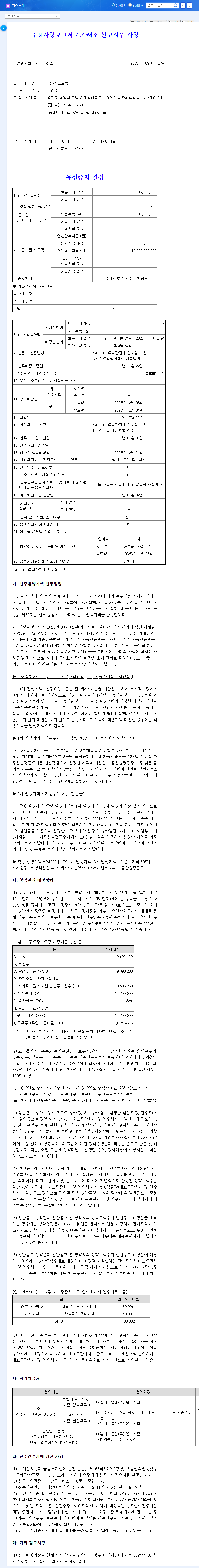

On November 10, 2025, a pivotal development unfolded as Daishin Securities filed a ‘Report on the Status of Large Shareholdings.’ This report, submitted for simple investment purposes, confirmed their acquisition of Nextchip’s convertible bonds, resulting in a reported 9.21% stake. You can view the Official Disclosure on DART for complete details. Typically, when a reputable securities firm takes a notable position in a company, the market interprets it as a positive sign of underlying value. However, to truly understand the potential of Nextchip stock, we must look beyond this single event and scrutinize the company’s precarious financial foundation.

Unpacking Nextchip’s Financial Crisis

While the Daishin Securities news might spark short-term optimism, the reality for Nextchip Co., Ltd. is one of severe financial vulnerability. A clear-eyed view of its balance sheet reveals significant red flags that any prudent investor must consider.

As of the first half of 2025, Nextchip is in a state of capital impairment, with total liabilities exceeding total assets. This is a critical warning sign regarding the company’s long-term solvency.

Key Financial Weaknesses

- •Capital Impairment: With liabilities of KRW 46.64 billion surpassing assets of KRW 44.96 billion, the company is technically insolvent, a major concern for financial stability.

- •Persistent Losses: The company posted a significant operating loss of KRW 7.45 billion and a net loss of KRW 10.49 billion in H1 2025, continuing a troubling trend of unprofitability.

- •Declining Revenue: Sales have plummeted, with core products like automotive Image Signal Processors (ISP) and AHD solutions underperforming. New ventures in robotics and drones have yet to contribute meaningfully to the top line.

Despite securing KRW 30 billion via convertible bonds in 2023 and a KRW 7.6 billion rights offering in 2025, these measures have been insufficient to resolve the deep-seated capital impairment issue. Continuous heavy investment in R&D, while necessary for future growth, further strains the company’s cash flow in the short term.

Market Opportunity vs. Current Performance

The irony for Nextchip Co., Ltd. is that it operates in sectors with immense growth potential. The disconnect between market opportunity and the company’s financial results is at the heart of the investment dilemma.

High-Growth Automotive Semiconductors

The market for automotive semiconductors is booming, fueled by the rapid adoption of Advanced Driver-Assistance Systems (ADAS) and the progression toward fully autonomous vehicles. Global safety mandates, such as Europe’s GSR II, are making features like driver monitoring and advanced cameras standard, creating sustained demand for Nextchip’s core technologies. For more context, you can read our Guide to Investing in the Semiconductor Sector.

The Double-Edged Sword of Convertible Bonds

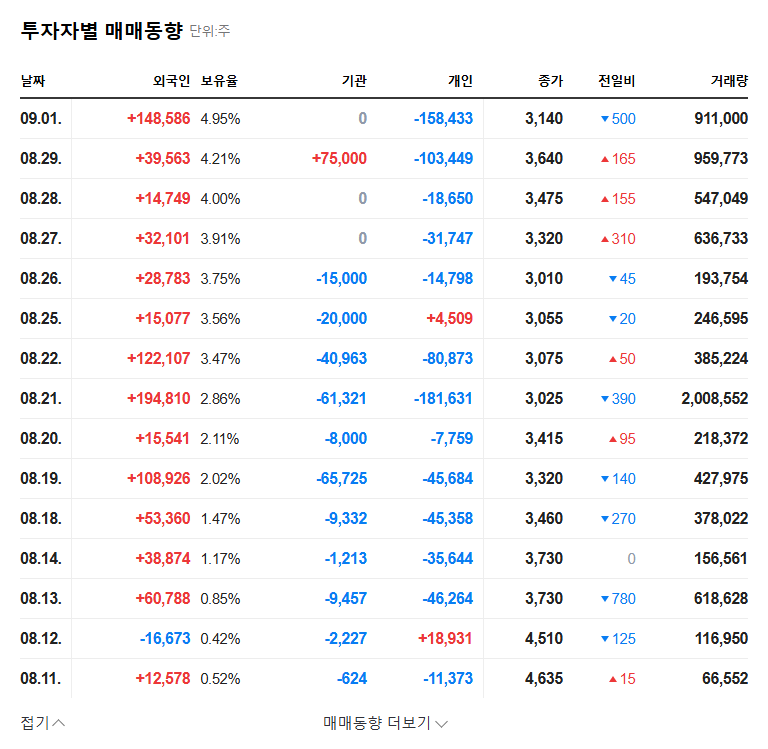

Daishin’s investment was made through convertible bonds, a hybrid security that acts like a bond but can be converted into company stock. While this provides Nextchip with crucial funding, it presents a future risk. If Daishin converts these bonds to stock, it will increase the number of outstanding shares, potentially diluting the value for existing shareholders. Understanding how convertible bonds work is essential for any Nextchip stock investor. This mechanism adds another layer of volatility and is a key factor to monitor.

Investor Action Plan: Navigating the Uncertainty

Investing in Nextchip at this juncture is a high-risk, high-reward proposition. The involvement of Daishin Securities provides a glimmer of credibility, but it doesn’t erase the fundamental financial challenges. A prudent investment decision requires careful monitoring of several key areas.

Key Monitoring Points:

- •Path to Profitability: Watch for tangible signs of operational turnaround, such as improved margins, cost controls, and rising sales revenue.

- •New Business Traction: Look for concrete revenue generation from the robotics and drone sectors, moving from potential to actual performance.

- •Daishin’s Next Moves: Closely track whether Daishin converts its bonds, sells its stake, or becomes more actively involved in the company’s strategy.

- •Capital Structure: Monitor for any additional fundraising efforts, as resolving the capital impairment is non-negotiable for long-term survival.

Ultimately, investors must prioritize Nextchip’s fundamental recovery over short-term market hype. The road ahead is uncertain, but for those with a high tolerance for risk, the potential alignment with the growing automotive semiconductors market could offer significant upside if the company can navigate its financial crisis.

Frequently Asked Questions (FAQ)

Why did Daishin Securities invest in Nextchip Co., Ltd.?

Daishin Securities acquired Nextchip’s Convertible Bonds for simple investment purposes. This suggests their analysis identified significant potential long-term value in the company, possibly tied to its technology and market position, despite its current financial state.

What is Nextchip’s current financial status?

As of H1 2025, Nextchip is in a state of capital impairment (liabilities exceed assets) and is experiencing continuous operating and net losses, along with a significant year-over-year decrease in sales revenue.

How could the CB acquisition affect Nextchip’s stock price?

In the short term, it may boost investor sentiment and the stock price. However, in the long term, if the bonds are converted to stock, it could lead to share dilution, potentially putting downward pressure on the stock price.