Daesung FineTec’s Convertible Bond Issuance: What Happened?

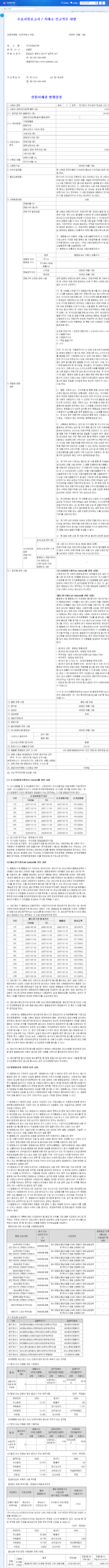

Daesung FineTec will issue its third unregistered, unsecured private convertible bonds worth 7 billion KRW. The conversion price is 1,253 KRW, with a coupon rate of 0% and a maturity rate of 5.0%. Conversion requests can be made starting September 18, 2026. The main investors are AOne Asset Management affiliated funds.

Why Issue Convertible Bonds?: Background and Objectives

Daesung FineTec plans to secure operating funds through this convertible bond issuance and invest in business expansion and R&D. This is interpreted as an attempt to alleviate short-term liquidity burdens and secure long-term growth engines.

Impact of the Convertible Bond Issuance: Opportunities and Risks

- Positive Impacts:

- Securing Short-Term Liquidity

- Investment in Business Expansion and R&D

- Potential Capital Increase Effect

- Negative Impacts:

- Increased Debt Ratio and Financial Burden

- Possibility of Stock Dilution

- Deterioration of Investor Sentiment Due to Poor Performance

- Interest Rate Fluctuation Risk

Investor Action Plan: What to Watch

Investors should closely monitor the following:

- Fund Usage Plans and Implementation Results

- Progress of the Monolith Merger and Synergy Effects

- Whether the Fine Blanking Business Unit Improves Performance

- Growth and Profitability of the Renewable Energy Business

- Impact of Exchange Rate and Interest Rate Fluctuations

Daesung FineTec’s future business strategies and performance improvement will be crucial factors in investment decisions.

Frequently Asked Questions (FAQ)

What are convertible bonds?

Convertible bonds are issued as debt but give the holder the right to convert them into shares of the issuing company’s stock after a predetermined period. Investors can receive bond interest or convert to stock to aim for capital gains.

What are Daesung FineTec’s main businesses?

Daesung FineTec operates in automotive parts manufacturing (Fine Blanking) and renewable energy. Fine Blanking is a technology that produces parts using precision dies.

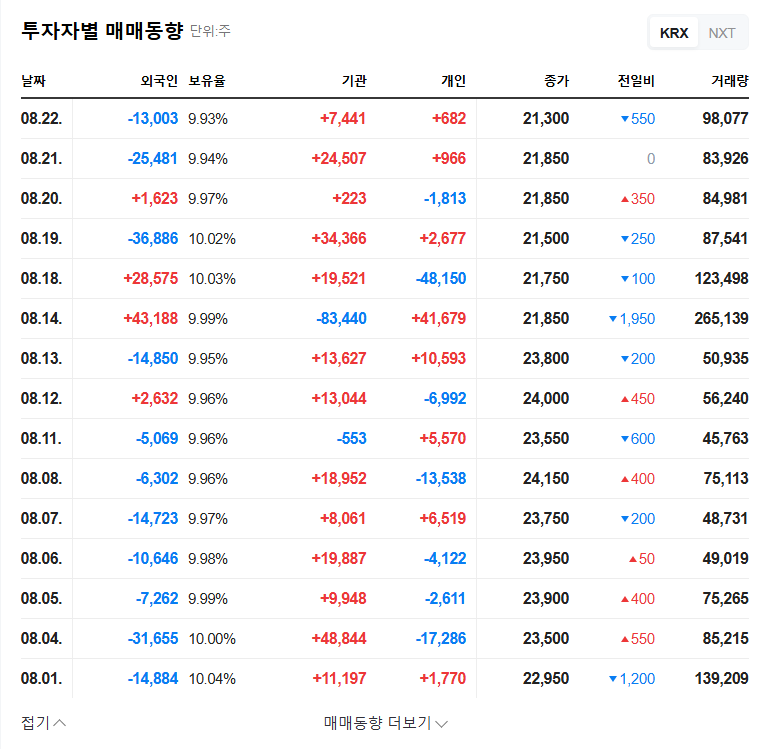

How will this convertible bond issuance affect the stock price?

In the short term, expectations for funding may positively influence the stock price. However, in the long term, the potential for stock dilution due to the conversion of convertible bonds into shares could negatively impact the price.