1. What Happened?

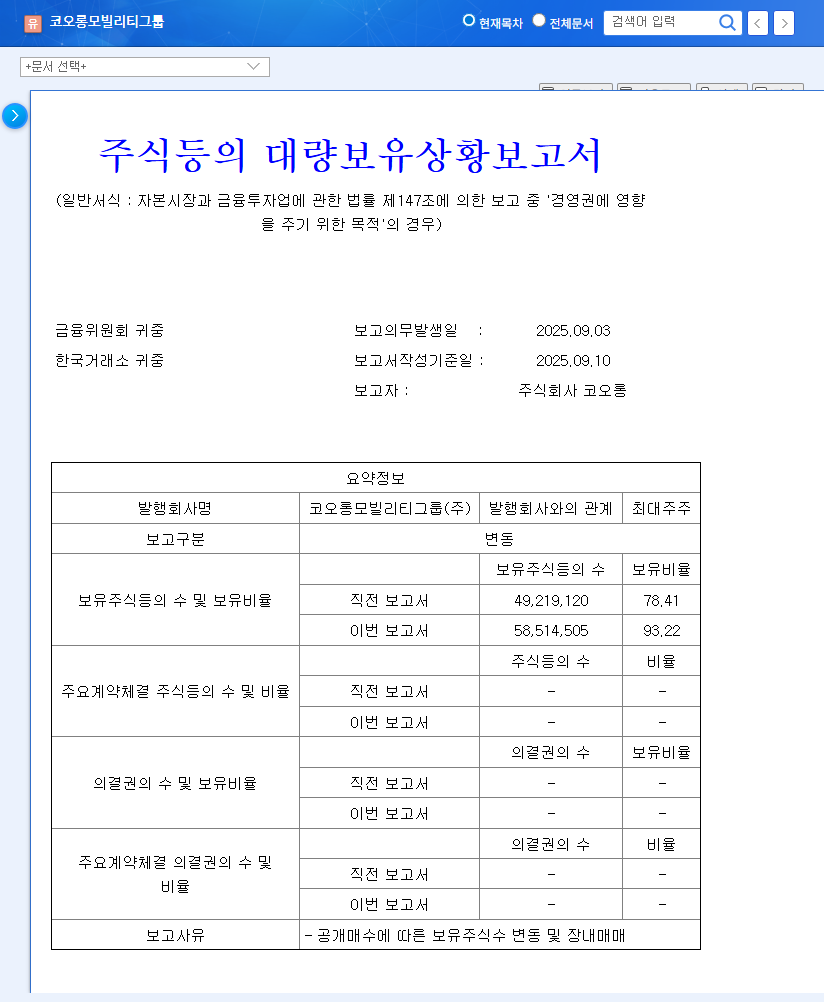

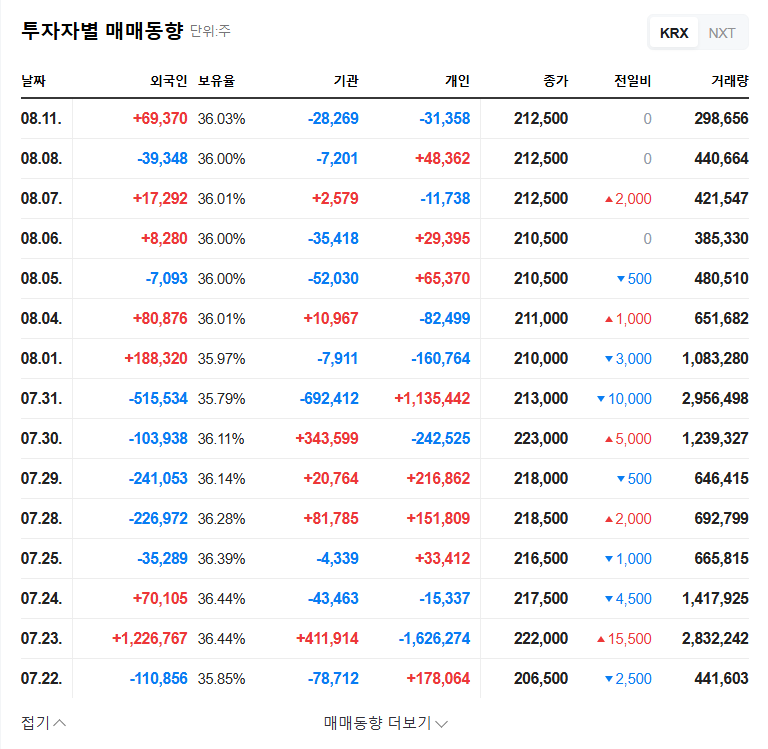

Kolon increased its stake in Kolon Mobility Group from 78.41% to 93.22% through a tender offer and on-market purchases. The stated purpose of this acquisition is to influence management.

2. Why This Decision?

This move solidifies Kolon’s control over Kolon Mobility Group. It signals their intent to strengthen management control, enabling them to pursue long-term business strategies and efficiently implement shareholder value enhancement policies like treasury stock cancellation and share swaps with Kolon Corp.

3. What’s Next?

- Positive Impacts:

- Management stabilization and faster decision-making

- Expected implementation of shareholder value enhancement policies

- Increased market confidence

- Negative Impacts/Potential Risks:

- Potential weakening of minority shareholder rights

- Concerns about short-term liquidity decrease

- Fundamental risks like high debt ratio and intensified market competition

While a short-term price increase is anticipated due to this ‘management defense’ event, long-term stock performance hinges on fundamental improvements.

4. What Should Investors Do?

Instead of reacting to short-term price fluctuations, investors should carefully analyze Kolon Mobility Group’s fundamentals, financial health, and market competitiveness, making investment decisions with a long-term perspective. Continuous monitoring of macroeconomic conditions and trends in the import car market is crucial.

Does an increase in majority shareholder stake always positively impact the stock price?

Not necessarily. While short-term price increases can occur due to expectations of management stability, sustained price growth requires underlying improvements in the company’s performance.

What are the key investment points for Kolon Mobility Group?

Consider factors like market share in the import car market, improvements in financial structure, new business ventures and their performance.

What are the key risks to consider before investing?

Be aware of risks like high debt-to-equity ratio, increasing competition in the import car market, and macroeconomic uncertainties.