In a significant market development, It’s Hanbul, the largest shareholder of NeopharmCO.,LTD. (092730), has signaled strong confidence by increasing its ownership stake. This move is more than a simple transaction; it’s a strategic action that could unlock significant Neopharm investment potential. For savvy investors, this raises critical questions: What does this mean for Neopharm’s stock price? And how does it align with the company’s solid financial health and position in the burgeoning derma-cosmetics market? This comprehensive Neopharm stock analysis will delve into the details of this development, examine the company’s fundamentals, and provide a clear action plan for potential investors.

The Catalyst: It’s Hanbul’s Strategic Stake Increase

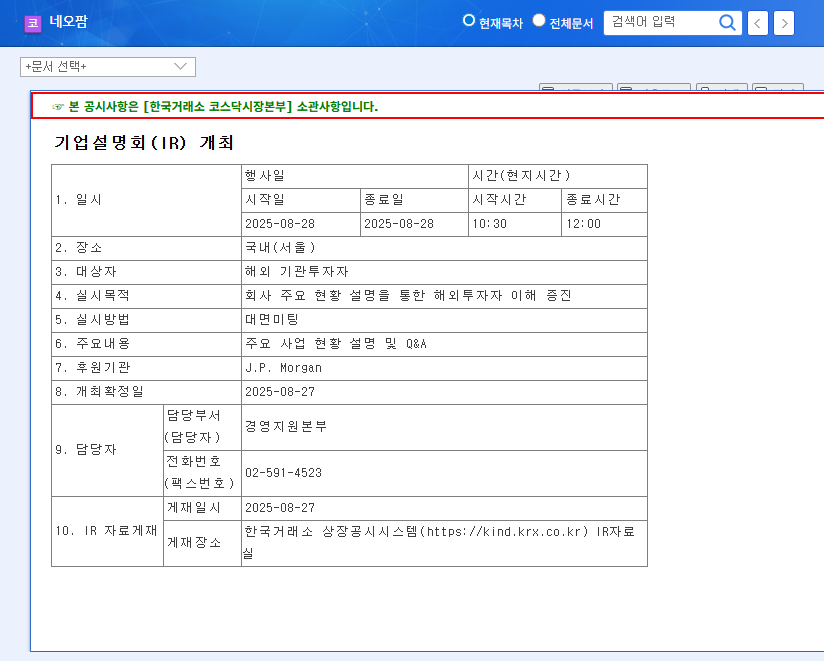

On October 28, 2025, a key filing revealed that It’s Hanbul executed a series of open-market purchases. According to the official disclosure (Source: DART), the company acquired an additional 162,672 shares of Neopharm. This transaction increased its total ownership from 40.34% to 41.34%, a full 1.00 percentage point rise. The stated purpose was unambiguous: to strengthen its management influence. This is a clear and deliberate move by the parent company to consolidate control and steer Neopharm’s future direction, a classic signal that often precedes strategic growth initiatives.

This strategic It’s Hanbul stake increase is a powerful vote of confidence in Neopharm’s underlying value and future prospects, contrasting sharply with the stock’s recent downward trend and presenting a potential turning point for investors.

Beyond the Headlines: Analyzing Neopharm’s Robust Fundamentals

The timing of this acquisition is particularly compelling when viewed alongside Neopharm’s impressive financial health. The company isn’t just a passive asset; it’s a high-performing engine of growth.

Stellar H1 2025 Financial Performance

Neopharm’s performance in the first half of 2025 showcases its market strength and operational efficiency:

- •Consolidated Revenue: KRW 63.59 billion, an impressive 8.07% increase year-over-year.

- •Consolidated Operating Profit: KRW 14.79 billion, a substantial 14.68% jump year-over-year.

- •Consolidated Net Income: KRW 14.20 billion, soaring by 18.42% year-over-year.

This growth is fueled by the powerful brand equity of its flagship product, Atopalm, and its strong positioning within the rapidly expanding global derma-cosmetics market. Financially, the company is on exceptionally solid ground, with a remarkably low debt-to-equity ratio of just 8.43%. For more on this metric, corporate finance experts at Investopedia provide excellent guides. Furthermore, Neopharm is actively pursuing future growth by diversifying into high-potential sectors like pet care and healthcare.

Resilience in the Face of Macroeconomic Headwinds

While global economic conditions present challenges, Neopharm appears well-insulated. With an export ratio of only 16%, its exposure to exchange rate volatility is limited. Stable interest rate environments benefit its financing costs, and its raw material procurement strategy mitigates the direct impact of fluctuating oil and shipping prices. This resilience makes its steady growth even more attractive. For more on sector trends, you can read our complete analysis of the derma-cosmetics market.

The Impact on Neopharm Stock Analysis and Future Outlook

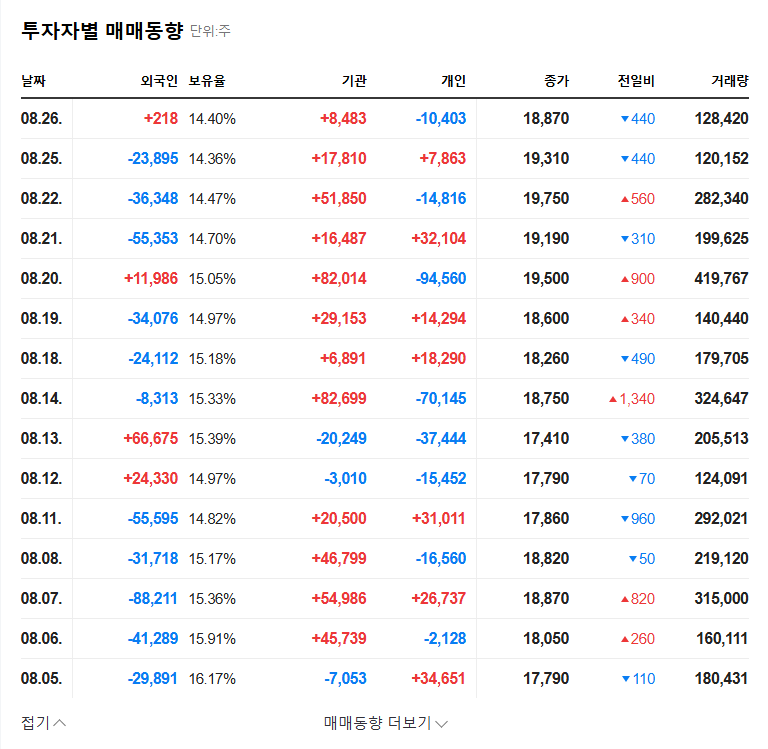

The combination of a major shareholder buying spree and rock-solid fundamentals creates a compelling investment thesis.

- •Enhanced Management Stability: Increased control by It’s Hanbul ensures management stability and a long-term strategic vision, reducing uncertainty for investors.

- •Expectations of Synergy: Tighter integration could lead to powerful business synergies, from shared R&D and marketing resources to expanded distribution channels, driving down costs and boosting revenue.

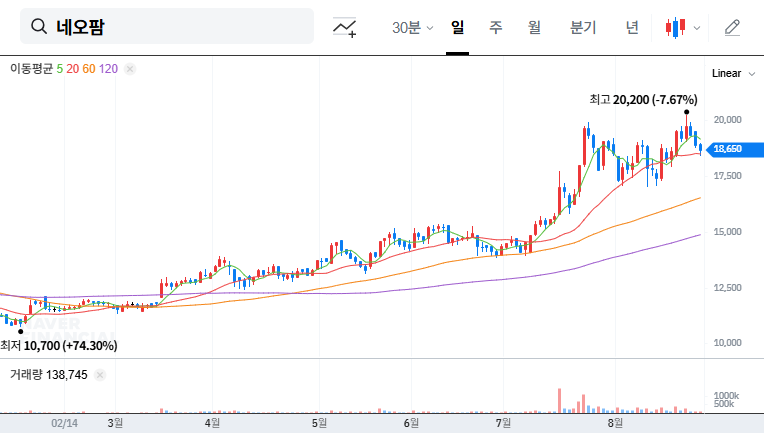

- •Positive Stock Price Momentum: Insider buying is a classic bullish signal. It can attract market attention and potentially lead to a re-rating of the stock, including expectations for a management premium.

Strategic Investor Action Plan for Neopharm (092730)

Given these factors, investors should consider a two-pronged approach to maximizing the Neopharm investment potential.

For the Short-Term Trader

The immediate focus should be on the momentum generated by the stake increase. A short-term play could capitalize on the market’s positive reaction and the potential for a quick stock price appreciation. Key variables to watch are the trading volume and any further announcements of share acquisitions by It’s Hanbul.

For the Long-Term Investor

A long-term perspective is equally, if not more, compelling. The investment thesis here is built on Neopharm’s strong fundamentals, the untapped potential for synergies with its parent company, and the growth trajectory of its new ventures in pet care and healthcare. Patient investors can look beyond short-term volatility and focus on the company’s ability to generate sustained value over time.

Frequently Asked Questions (FAQ)

Q1: What are the key details of the It’s Hanbul stake increase?

It’s Hanbul acquired 162,672 shares of Neopharm (092730), raising its ownership by 1.00%p to 41.34%. This was done to exert greater management influence.

Q2: How does this impact Neopharm’s stock price outlook?

It is a strong positive signal. In the short term, it can boost the stock price. In the long term, the combination of strong fundamentals and strategic alignment with its parent company significantly enhances Neopharm’s investment attractiveness.

Q3: How strong are Neopharm’s current financials?

Extremely strong. In H1 2025, the company saw double-digit growth in both operating profit (+14.68%) and net income (+18.42%), all while maintaining a very low debt-to-equity ratio of 8.43%.

Disclaimer: This content is for informational purposes only and is based on publicly available data. It does not constitute financial advice or a solicitation for investment. All investment decisions should be made based on your own research and judgment.