The landscape for STIC Investments (KRX: 026890) has been dramatically altered. In a significant move that has captured the market’s attention, Align Partners Asset Management, a prominent shareholder activist fund, has not only increased its holdings but has explicitly declared its intention to influence management. This event marks a critical turning point for the company, its leadership, and most importantly, its shareholders. Understanding the nuances of this development is key to navigating the opportunities and risks that lie ahead for STIC Investments stock.

This comprehensive analysis will delve into the core of this situation, examining the motivations behind Align Partners’ move, the current financial health of STIC Investments, and the potential ripple effects of this new era of shareholder activism. We will provide a clear-eyed view of both the potential upside and the inherent risks to help you make informed investment decisions.

The Catalyst: Align Partners Declares ‘Management Influence’

On October 30, 2025, the market received a clear signal of change. Align Partners Asset Management filed a disclosure announcing it had raised its stake in STIC Investments from 6.64% to 7.63%. While the 0.99 percentage point increase is notable, the truly pivotal detail was the change in holding purpose to ‘management influence.’ This is a formal declaration under financial regulations that the shareholder intends to play an active role in the company’s governance and strategic direction. The official filing can be reviewed directly via Korea’s DART system (Official Disclosure).

Understanding the Key Players

Who is Align Partners Asset Management?

Align Partners Asset Management is not just any investor; they are one of South Korea’s most effective and visible shareholder activists. Their playbook typically involves identifying undervalued companies with strong underlying assets but inefficient management or poor corporate governance. They then take a meaningful stake and publicly campaign for changes designed to unlock shareholder value, such as demanding board seats, advocating for higher dividend payouts, or pushing for strategic reviews. Their track record suggests they are a persistent and influential force, as seen in previous high-profile campaigns in the Korean market. To learn more about activist strategies, you can explore resources from reputable financial publications like The Wall Street Journal’s coverage of shareholder activism.

A Financial Snapshot of STIC Investments

To understand why Align Partners sees potential, we must look at STIC Investments’ fundamentals. The company is a major player in the private equity space, but its recent performance presents a mixed picture:

- •Strengths: The firm boasts a massive 10.2 trillion KRW in Assets Under Management (AUM) and an exceptionally sound financial structure, with a consolidated debt ratio of just 8.3% as of H1 2025. This indicates low financial risk and a stable operational base.

- •Weaknesses: The most glaring issue is a recent decline in profitability. The company reported a turnaround to an operating and net loss, primarily due to lower performance fees and rising investment costs. This disconnect between strong assets and weak recent profitability is precisely the kind of situation that attracts activist investors.

When an activist investor like Align Partners makes a move, it’s a clear signal that the status quo is no longer an option. The key question for STIC Investments is whether this pressure will forge a diamond or shatter the glass.

Strategic Impact Analysis for Shareholders

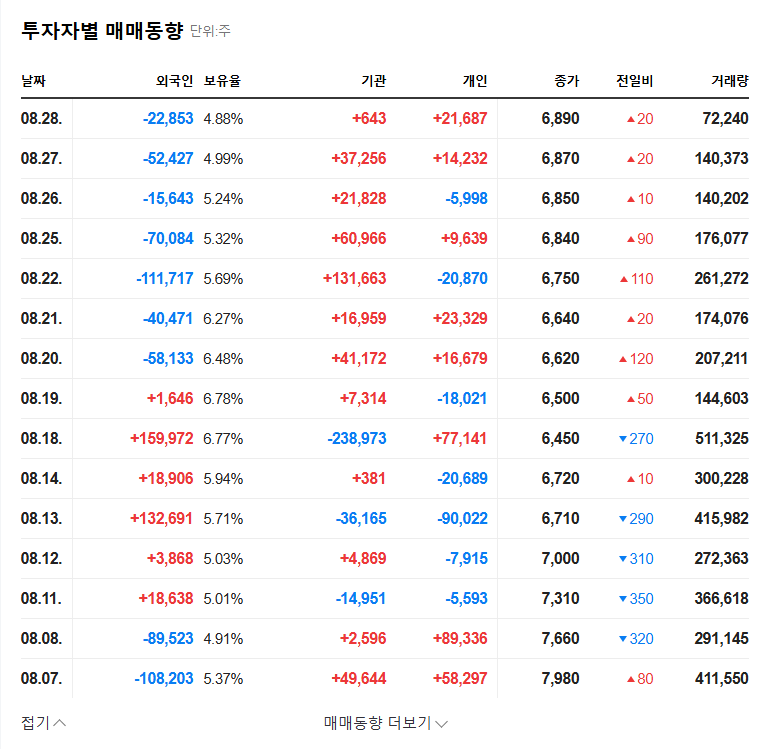

The declaration of management influence is expected to increase stock volatility and trading volume as the market digests the news. But the long-term impact on STIC Investments stock depends on how this dynamic plays out.

Potential Upside for STIC Investments

- •Enhanced Governance: External pressure can lead to greater management transparency and accountability, which often results in better long-term corporate value.

- •Improved Capital Allocation: Align Partners may push for more shareholder-friendly policies, such as increased dividends, share buybacks, or the sale of non-core assets to focus on profitability.

- •Operational Efficiency: The activist’s scrutiny could force management to address the root causes of the recent losses and streamline operations, boosting the bottom line.

Key Risks and Headwinds

- •Management Distraction: A prolonged and hostile dispute between Align Partners and the incumbent management team could divert focus and resources away from core business operations.

- •Short-Term Volatility: The uncertainty created by a potential proxy fight or public battle could lead to significant short-term swings in the stock price.

- •Fundamental Weakness: If the company’s profitability issues are deeper than anticipated, activist pressure alone may not be enough to fix the underlying problems, causing the initial excitement to fade.

Strategic Outlook for Investors

Investors should approach STIC Investments with a clear strategy. Short-term traders may look to capitalize on momentum and news-driven volatility. However, long-term investors should adopt a more cautious, wait-and-see approach. The key will be to monitor whether Align Partners’ involvement translates into tangible improvements in corporate governance and, most importantly, a return to profitability. For more on building a portfolio, consider our guide on understanding private equity investments.

In conclusion, Align Partners’ increased stake is a game-changing event for STIC Investments. While it introduces positive momentum and the potential for significant value creation, it also brings uncertainty. Careful due diligence and continuous monitoring of performance metrics will be essential for any investor considering a position.