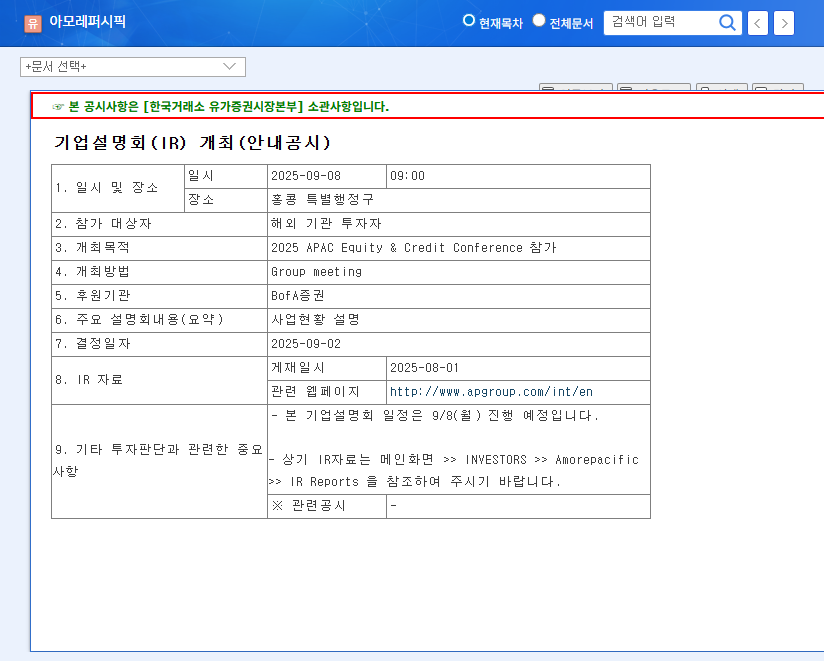

Recent corporate disclosures, like the one from AMOREPACIFIC Holdings Corp. regarding its treasury stock disposal, often fly under the radar. However, for the discerning investor, these events serve as a crucial entry point for a deeper evaluation of a company’s strategic health and future trajectory. While the disposal itself, announced on November 6, 2025, is minor, it prompts a vital question: What is the true fundamental value and long-term investment potential of AMOREPACIFIC Holdings Corp. stock in today’s dynamic market?

This comprehensive analysis moves beyond the headline to dissect the company’s robust H1 2025 performance, identify key growth drivers, and weigh them against potential risks. We’ll provide clear insights to help you make more informed decisions about your investment in AMOREPACIFIC Holdings Corp.

The Treasury Stock Disposal: A Minor Event

On November 6, 2025, AMOREPACIFIC Holdings Corp. announced the disposal of 2,124 treasury shares, valued at approximately KRW 100 million. The stated purpose was to provide performance-based bonuses for employees. You can view the Official Disclosure on the DART system for full details.

While using stock for employee compensation can align interests and boost morale, the scale of this transaction is negligible. It has no material impact on the total number of outstanding shares or the company’s overall valuation. Therefore, investors should view this as a routine operational matter rather than a significant signal for the stock’s direction. The real story lies within the company’s core business fundamentals.

While the treasury stock disposal is a non-event for the market, the underlying fundamentals of AMOREPACIFIC Holdings Corp. present a compelling mix of robust international growth and persistent domestic challenges, warranting a neutral but watchful investment stance.

Core Fundamentals: Growth vs. Headwinds

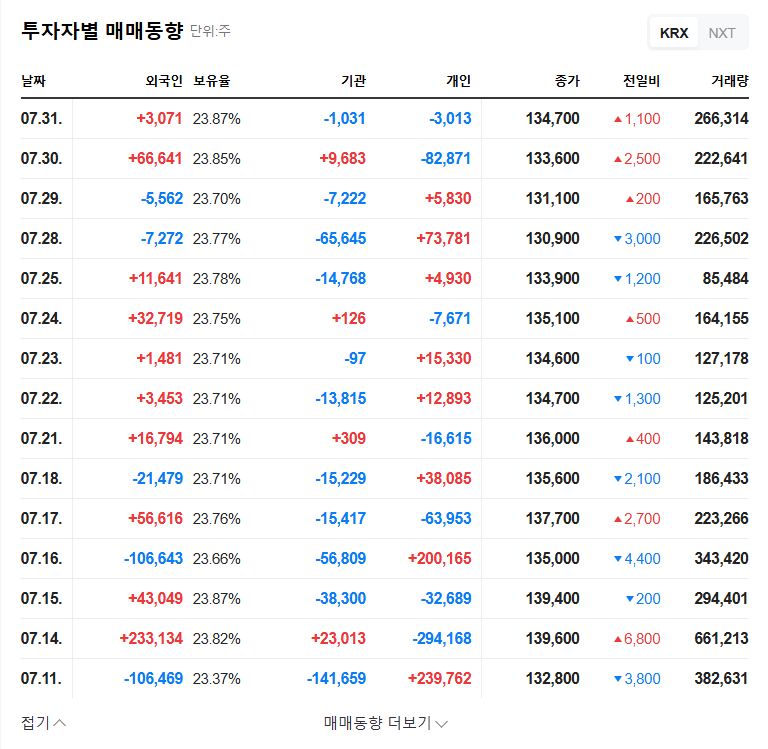

To truly assess the investment value of AMOREPACIFIC Holdings Corp., we must look at its financial performance and strategic positioning. The first half of 2025 painted a promising picture, with sales reaching KRW 2,259.7 billion (a 12.3% year-over-year increase) and operating profit soaring to KRW 209 billion (a 119.4% increase).

Positive Fundamentals: The Growth Engines

- •Explosive Overseas Growth: The international business surged by an impressive 26.6%, serving as the primary performance driver. This was fueled by a successful restructuring of the China business and the strategic acquisition of the popular brand COSRX, which has resonated with a global audience. This diversification reduces reliance on any single market.

- •Strong Brand Equity: In its home market, luxury brands like Sulwhasoo and Hera maintain a powerful competitive moat. Furthermore, the expansion of AESTURA into the derma-specialized category is tapping into a high-growth segment, showcasing the company’s ability to innovate and capture new Korean beauty trends.

- •Shareholder-Friendly Actions: Beyond operations, the company’s commitment to R&D and past decisions on treasury stock cancellation are positive signals for those focused on long-term shareholder value enhancement.

Negative Fundamentals & Risks to Monitor

- •Intense Domestic Competition: The South Korean cosmetics market is hyper-competitive. The rise of agile indie brands and shifting consumer preferences pose a constant threat, as evidenced by the sales decline in some subsidiaries like Innisfree.

- •China Market Volatility: While restructuring has helped, the Chinese market remains sensitive to fierce local competition and rapid shifts in consumer sentiment. Any geopolitical or economic shifts could impact this key region.

- •Macroeconomic Pressures: Global factors cannot be ignored. A strengthening won against the dollar could erode profitability from overseas sales. Additionally, volatility in raw material prices could increase production costs, squeezing margins. Investors should monitor the global macroeconomic environment closely.

2025 Investor Action Plan for AMOREPACIFIC Stock

Given the balance of strong growth drivers and tangible risks, our outlook for AMOREPACIFIC Holdings Corp. is Neutral. This rating suggests that while the stock is not a clear ‘buy’ for aggressive growth seekers, it holds potential for patient, long-term investors who are confident in its international expansion strategy. Investors should focus on the company’s fundamental performance rather than minor events.

Your strategy should involve continuous monitoring of key performance indicators. Pay close attention to quarterly reports for updates on overseas market growth, particularly in North America and emerging markets beyond China. Evaluate the company’s initiatives to revitalize its domestic brands and gain market share. Finally, keep an eye on macroeconomic trends like exchange rates and commodity prices, which can significantly influence profitability.