1. What Happened?

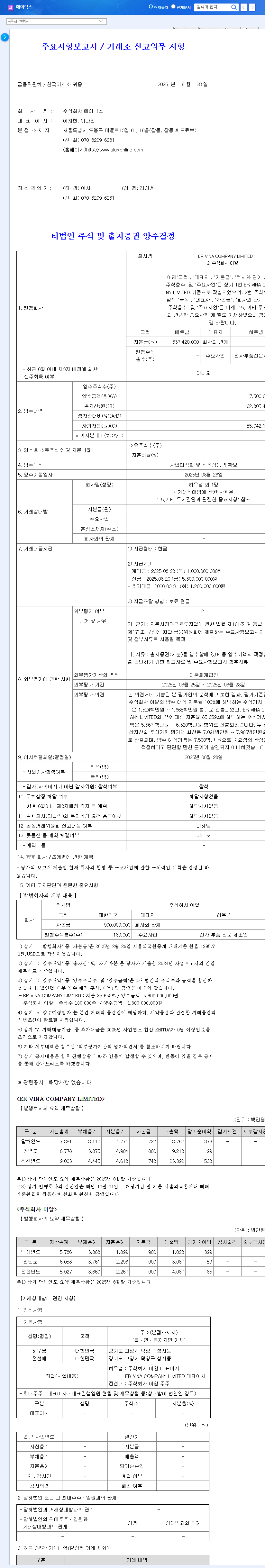

Daishin-Compa-Pathway New Technology Investment Association No. 1 acquired Alux’s convertible bonds (CB), securing a 5.96% stake. They acquired 862,812 shares through the CB acquisition on September 16, 2025, and stated their investment purpose as ‘simple investment’.

2. Why is it Important?

This investment can be interpreted as a positive external evaluation of Alux’s technology and growth potential. Coupled with the growth of the drone and AI edutech markets, it can raise expectations for Alux’s future value. However, Alux is currently experiencing declining sales and operating losses, so managing financial risks is a key challenge.

3. What’s Next?

- Positive Aspects: Strengthened financial stability through investment, accelerated business expansion and technology development, and increased market confidence are expected.

- Negative/Potential Aspects: The possibility of equity dilution due to CB conversion, continued short-term financial burden, and uncertainty about the investment association’s future course of action should be considered.

4. What Should Investors Do?

Investors should carefully analyze the growth potential and financial soundness of Alux’s drone, robot, and educational service businesses. It is especially important to continuously monitor profitability improvement, new technology commercialization and market expansion strategies, and the possibility of changes in the investment association’s investment objectives. This report is for reference in making investment decisions, and the final investment decision should be made at the investor’s own discretion.

Frequently Asked Questions (FAQ)

How will this CB investment affect Alux’s stock price?

In the short term, it is likely to have a positive impact. Investment attraction can increase confidence in the company and raise expectations for growth potential. However, the long-term stock price trend will depend on whether Alux improves its performance.

What is the outlook for Alux’s drone business?

There are many positive factors, such as in-house core component development, increasing exports to North America, and strengthened regulations on Chinese drones in the US. However, continuous observation is necessary due to risks such as increased competition and market volatility.

Is Alux’s financial status sound?

As of the first half of 2025, Alux recorded declining sales and operating losses, raising concerns about its financial soundness. Improving profitability is an urgent task.