What Happened?

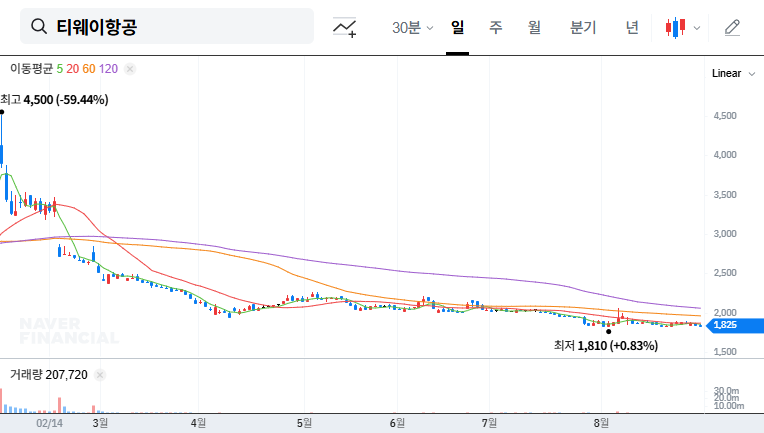

On August 29, 2025, T’way Air’s majority shareholder changed to Sono International through a third-party allocation paid-in capital increase. This decision aims to secure operating funds and improve the company’s financial structure.

Why the Change?

T’way Air is facing serious financial difficulties, including capital impairment, continuous operating losses, and a high debt ratio. External factors such as rising exchange rates, rising oil prices, and high interest rates are exacerbating the situation. To overcome these challenges, T’way Air secured investment from and transferred management rights to Sono International.

What’s Next?

Positive Outlook

- Expected improvement in financial structure and resolution of capital impairment through secured funds

- Potential for enhanced management stability and expertise with Sono International’s involvement

- Expected synergy with Sono International’s travel and leisure business

Negative Outlook and Risks

- Uncertainty about actual financial and operational improvement despite secured funds

- Increased pressure on management performance under the new majority shareholder

- Intensifying competition in the LCC market and continued macroeconomic uncertainty

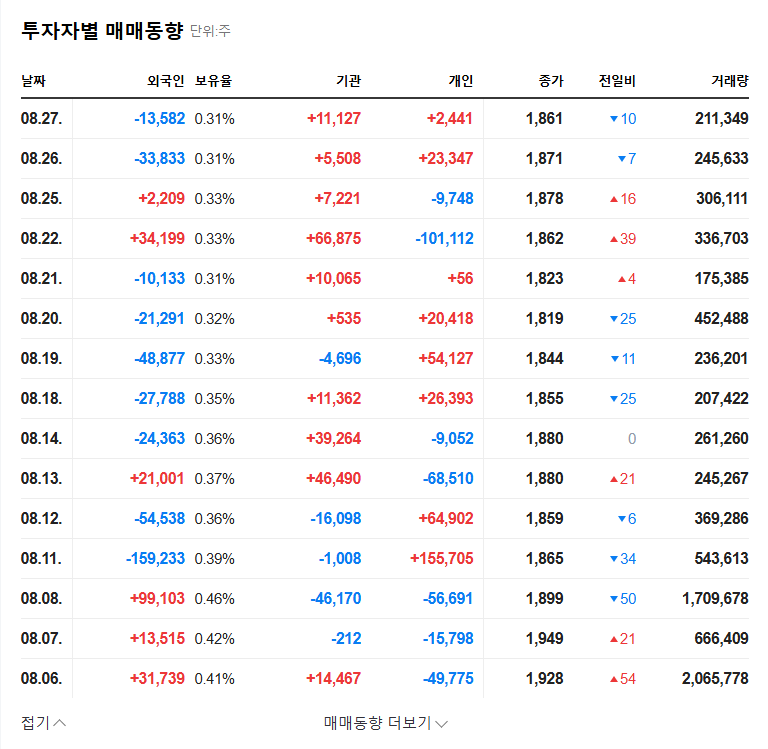

What Should Investors Do?

Investors considering T’way Air should carefully examine the following:

- Monitor the progress and results of the capital increase and the use of funds

- Check for improvements in operating performance and the new management’s strategy and execution capabilities

- Continuously assess the impact of macroeconomic variables such as exchange rates, oil prices, and interest rates

While the change in majority shareholder is a potentially positive sign, it’s crucial for investors to focus on long-term fundamental improvements rather than short-term stock price fluctuations.

Who is the new majority shareholder of T’way Air?

Sono International.

Why did the majority shareholder change?

The change occurred through a third-party allocation paid-in capital increase to secure operating funds and improve T’way Air’s financial structure.

What are T’way Air’s main financial challenges?

Capital impairment, continuous operating losses, and a high debt ratio. External challenges include rising exchange rates, oil prices, and interest rates.

What is the outlook for T’way Air after the change?

There are expectations for improved financial structure and management stability, but actual performance improvement remains uncertain. Risks include intensifying competition and macroeconomic uncertainty.