1. $50 Billion: What Did Korean Air Buy?

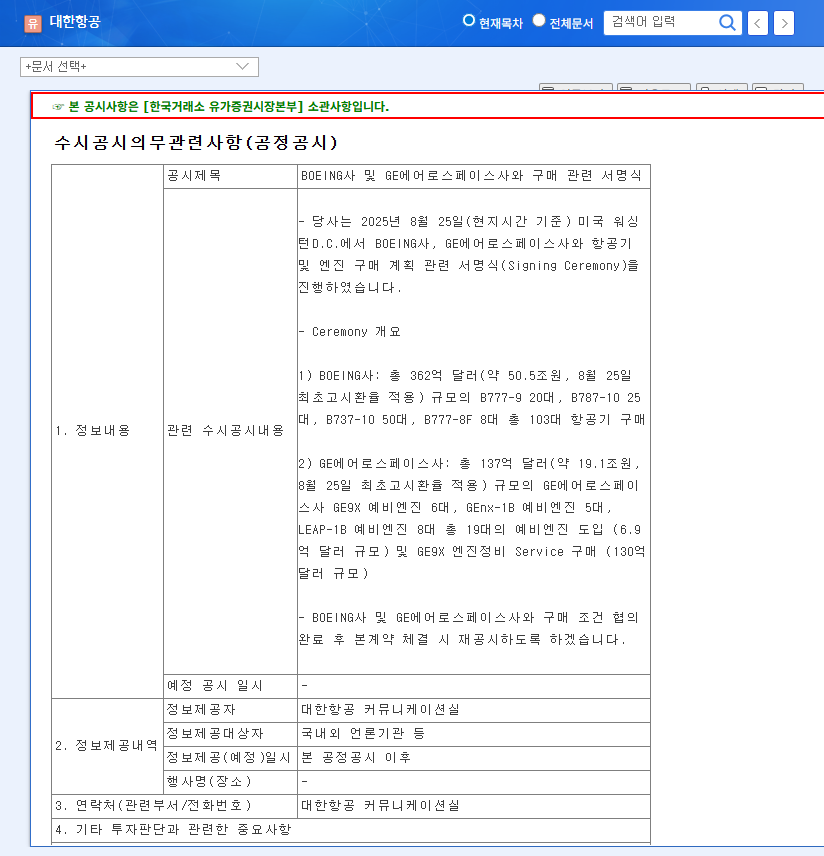

Korean Air’s order includes 103 aircraft, including B777-9s and B787-10s, along with 19 spare engines. This is a strategic investment aimed at boosting long-haul route competitiveness and expanding cargo operations.

2. Opportunity or Risk: Analyzing the Impact

Potential Upsides

- ✅ Future Growth Driver: New aircraft will expand route networks and increase capacity.

- ✅ Fuel Efficiency and Eco-Friendly Image: Modern aircraft will reduce fuel costs and carbon emissions.

- ✅ Long-Term Asset Appreciation: Replacing older aircraft will lead to lower depreciation expenses.

Potential Downsides

- ❌ Increased Financial Burden: The $50 billion investment puts significant strain on the company’s finances.

- ❌ Negative Cash Flow Impact: Large cash outflows are expected upon aircraft delivery.

- ❌ Exchange Rate and Interest Rate Risks: A stronger USD and rising interest rates could exacerbate the financial burden.

3. Investor Action Plan: Navigating the Uncertainty

Investors should focus on Korean Air’s long-term business competitiveness and financial improvements rather than short-term stock fluctuations. Key factors to monitor include:

- 👉 Funding plans and changes in debt-to-equity ratio

- 👉 Synergies from the Asiana Airlines merger

- 👉 Performance improvements resulting from new aircraft

- 👉 Fluctuations in macroeconomic variables like exchange rates, oil prices, and interest rates

Frequently Asked Questions

Why is Korean Air’s aircraft purchase significant?

This purchase is essential for replacing aging aircraft, improving fuel efficiency, and enhancing competitiveness. It is expected to play a crucial role in securing future growth and improving long-term profitability.

Is the $50 billion investment too large?

The substantial investment could increase the financial burden in the short term. However, if it contributes to long-term corporate value growth, it can be viewed positively. Investors should monitor funding plans and changes in financial soundness.

What should investors pay attention to?

Focus on long-term business competitiveness rather than short-term stock fluctuations. Monitor funding plans, synergies from the Asiana Airlines merger, the impact of new aircraft, and macroeconomic variables.