1. Hanmi Semiconductor’s IR Presentation: What Was Announced?

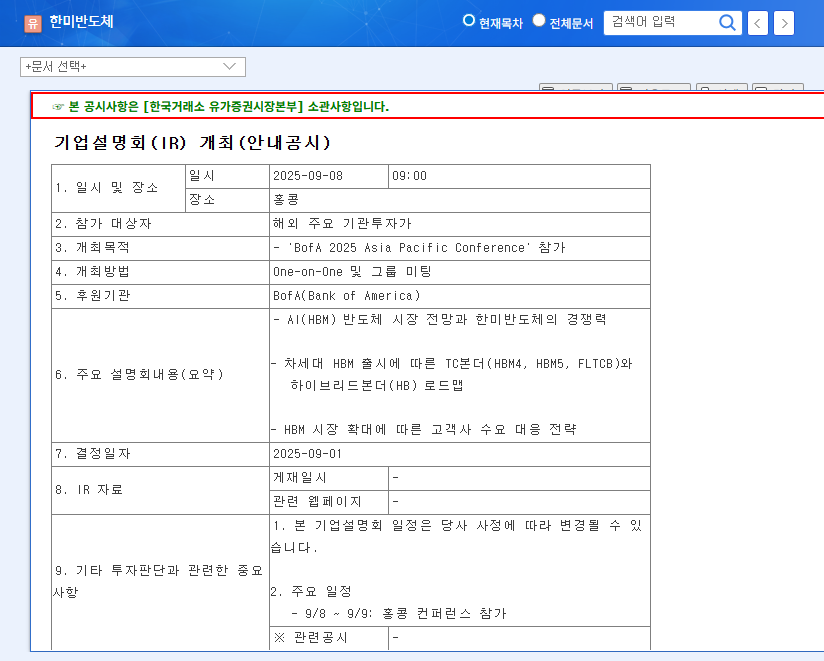

Hanmi Semiconductor presented its outlook on the AI (HBM) semiconductor market, the roadmap for next-generation HBM (HBM4, HBM5, FLTCB) and hybrid bonders (HB), and its customer response strategy for the expanding HBM market. Building on remarkable performance growth in the first half of 2025 (revenue +63% YoY, operating profit +178% YoY), the company expressed confidence in its future growth.

2. Why It Matters: The Growth of the AI Chip Market

The AI chip market is experiencing explosive growth, and the demand for HBM, in particular, is increasing sharply. Hanmi Semiconductor, a supplier of key HBM/AI equipment such as ‘DUAL TC BONDER’ and ‘6-SIDE INSPECTION,’ is expected to directly benefit from this market growth.

3. What’s Next?: Positive Outlook and Potential Risks

This IR presentation will serve as a critical opportunity for Hanmi Semiconductor to impress investors with its technological leadership and future growth potential. However, it’s crucial to be mindful of potential risks, including falling short of market expectations and macroeconomic uncertainties.

- Positive Impacts: Strengthened AI market leadership, disclosure of the next-generation technology roadmap, increased growth visibility, and potential stock price momentum.

- Potential Risks: Failing to meet market expectations, macroeconomic uncertainty, and unforeseen issues.

4. Investor Action Plan: Gather and Analyze Information

Investors should carefully review the IR materials and make investment decisions based on market conditions and competitor analysis. It is particularly important to gather additional information on the next-generation HBM technology development roadmap and customer acquisition strategy.

Frequently Asked Questions

What is Hanmi Semiconductor’s main business?

Hanmi Semiconductor primarily manufactures semiconductor manufacturing equipment, specializing in supplying essential equipment for HBM/AI semiconductor production. Key products include ‘DUAL TC BONDER’ and ‘6-SIDE INSPECTION.’

What is HBM?

HBM (High Bandwidth Memory) is a high-performance memory used in fields requiring large amounts of data processing, such as AI semiconductors.

What should investors be aware of when investing in Hanmi Semiconductor?

While the AI semiconductor market has high growth potential, the competitive landscape and technological changes are rapid, requiring continuous attention and analysis. Investors should also be mindful of macroeconomic conditions and market volatility.