What Happened?: Soldefense Acquires 100% of Albisolution

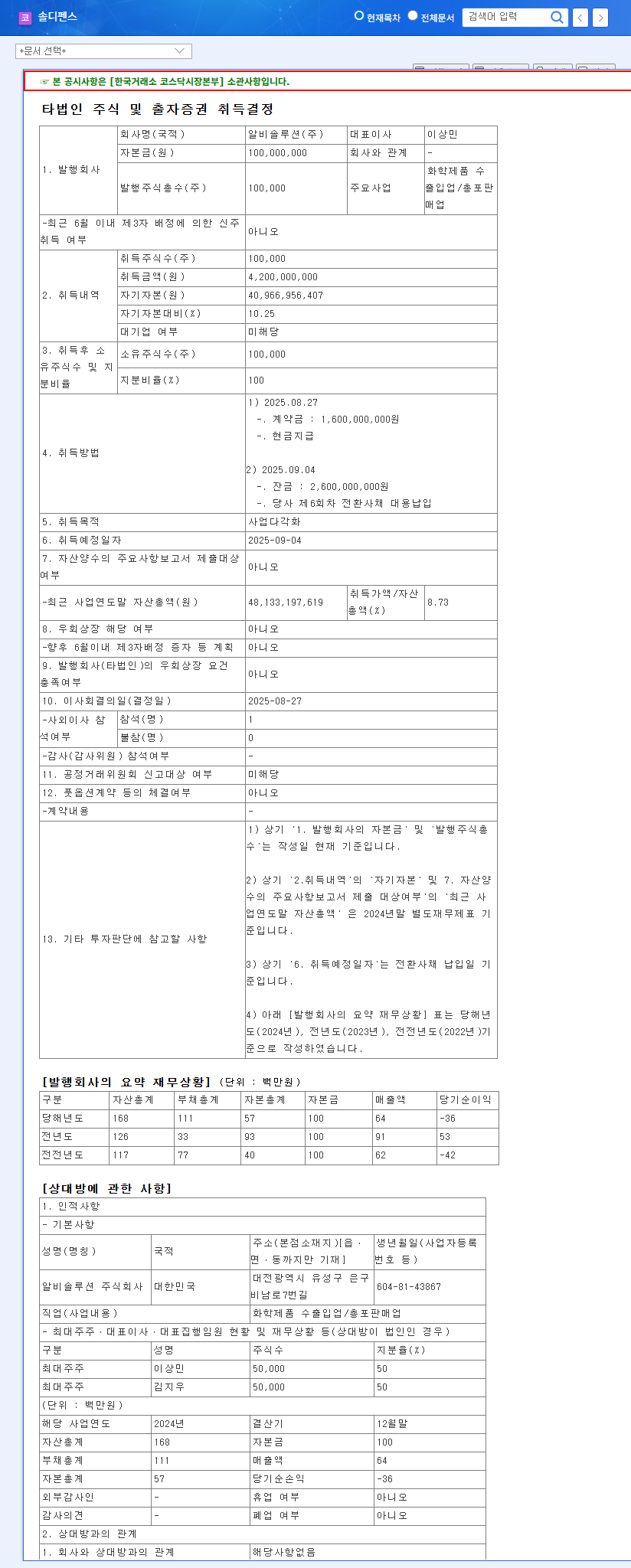

Soldefense announced the acquisition of 100% of Albisolution, a chemical import/export and firearms sales company, for 4.2 billion KRW. The acquisition is scheduled for September 4, 2025. Soldefense will pay 1.6 billion KRW in cash as a down payment, with the remaining 2.6 billion KRW to be paid using the company’s 6th series convertible bonds.

Why the Acquisition?: Business Diversification and New Growth Engines

Soldefense aims to diversify its business and secure new growth engines through this acquisition. This is likely a strategic move to find a breakthrough amidst declining sales and profitability over the past three years.

What’s Next?: Delisting Risk vs. Diversification Opportunity

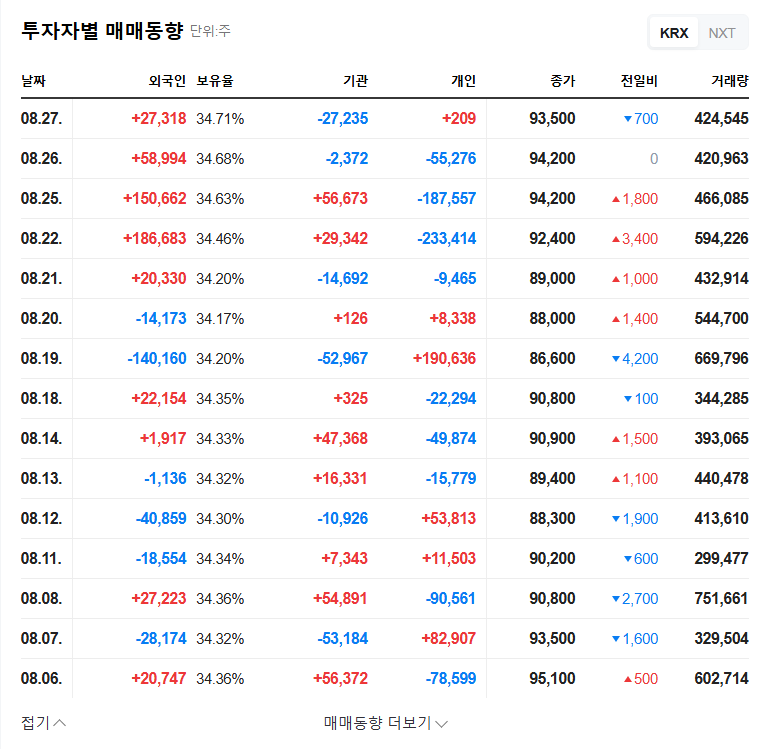

This acquisition presents both a positive aspect of diversification and a negative aspect of delisting risk. Soldefense is currently under review for delisting due to allegations of embezzlement and breach of trust, along with a disclaimer of opinion from its auditor. Its trading is halted, and the possibility of delisting is very high. Whether the acquisition of Albisolution will lead to new growth remains uncertain, and the potential for synergy must be carefully evaluated. Furthermore, the possibility of equity dilution due to the issuance of convertible bonds should be considered.

What Should Investors Do?: Caution is Key, Monitor Delisting Status

- 1. Monitor Delisting Status: The delisting decision is the most critical factor for investment decisions. Investors should consistently monitor related disclosures and news.

- 2. Analyze Albisolution’s Business: Carefully analyze the target company’s business performance and potential synergy with Soldefense.

- 3. Review Soldefense’s Financials: Pay close attention to changes in Soldefense’s financial structure and cash flow after the acquisition.

- 4. Consider the Impact of Convertible Bonds: Analyze the terms of the convertible bond issuance and its potential impact on the stock price.

Why did Soldefense acquire Albisolution?

Soldefense acquired Albisolution to diversify its business and secure new growth engines.

What is Soldefense’s current trading status?

Trading in Soldefense’s stock is currently halted due to a delisting review.

What is the biggest risk for investors in Soldefense?

The possibility of delisting is the most significant risk.

What should investors pay attention to?

Investors should closely examine the delisting status, Albisolution’s business, Soldefense’s financials, and the impact of convertible bonds.