What Happened? Analyzing the Hanwha Ocean Production Halt

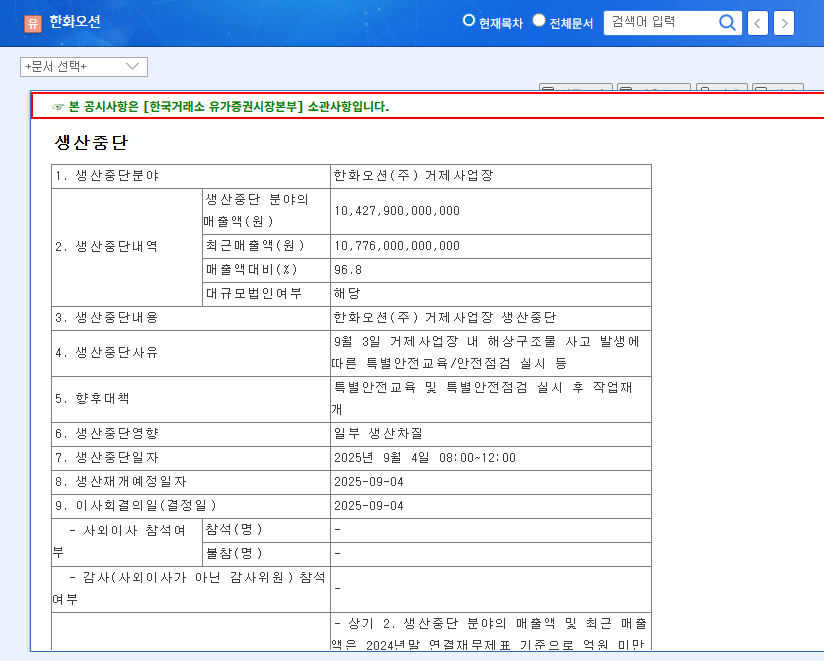

On September 4, 2025, Hanwha Ocean suspended some production, including winch load testing operations for offshore structures and vessels under construction, due to a major accident. The halted operations represent a significant portion of the company’s business, amounting to 10.948 trillion KRW, or 10.2% of total sales. While operations are targeted to resume on September 19, the actual date depends on the accident investigation and safety measures.

Why Does the Halt Matter? Assessing Short & Long-Term Impacts

Short-term impacts: The production disruption is likely to negatively impact Q3 earnings and put downward pressure on the stock price. The heightened focus on safety concerns could also damage the company’s image.

- Revenue Decrease: Expected delay/decrease in revenue recognition of 10.948 trillion KRW.

- Increased Stock Volatility: Negative investor sentiment could drive stock price down.

- Safety Concerns: Damage to company image and potential negative impact on future orders.

Long-term impacts: Beyond immediate revenue loss, Hanwha Ocean faces potential risks including recovery costs, potential litigation, penalties for delayed projects, and decreased new orders.

- Financial Burden: Increased financial strain from revenue loss, recovery costs, and potential compensations.

- Operational Disruptions: Delays in project delivery and potential decrease in new orders.

- Weakened Investor Confidence: Concerns about recurring incidents and management uncertainty could erode investor confidence.

What’s the Market Context? Analyzing the Global Shipbuilding Market & Macroeconomic Environment

The global shipbuilding market is currently relatively strong, driven by demand for eco-friendly vessels. However, the current high-interest rate and high-exchange rate environment could exacerbate Hanwha Ocean’s financial burdens. Moreover, if this accident escalates into a broader industry safety concern, investor sentiment towards the entire shipbuilding sector could weaken.

What Should Investors Do? An Action Plan

Investors should closely monitor Hanwha Ocean’s disclosures and its response to the accident. The company’s transparency, thorough investigation, implementation of preventative measures, and proactive communication with shareholders will be key to its stock price recovery. Maintaining confidence in the company’s long-term growth strategy is also crucial.

Frequently Asked Questions (FAQ)

Will this accident affect Hanwha Ocean’s long-term growth?

While a short-term impact is inevitable, Hanwha Ocean’s fundamental growth strategy is expected to remain largely unchanged. However, the effectiveness of the company’s response and preventative measures will significantly impact its future value.

What actions should investors take now?

Investors should carefully review the company’s public disclosures and IR materials and pay close attention to management’s statements regarding the accident and subsequent actions. A cautious approach and close monitoring of the situation are recommended rather than hasty investment decisions.

When will Hanwha Ocean’s stock price recover?

The stock price recovery timeline depends on several factors, including the accident investigation results, recovery efforts, and market reaction. The company’s proactive response and transparent communication are expected to positively influence the recovery process.