1. What was discussed at Solid’s IR?

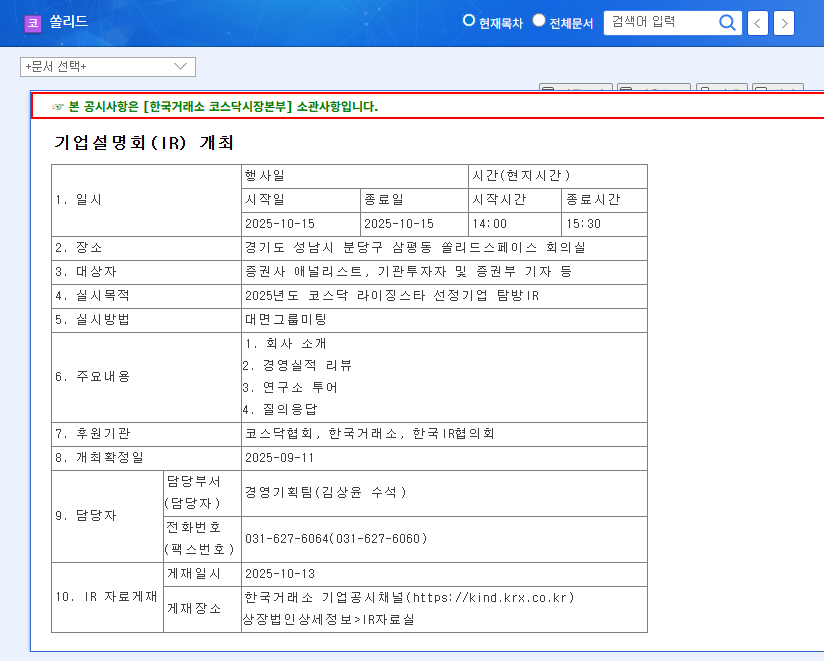

On October 15, 2025, Solid held an IR presentation to commemorate its selection as a KOSDAQ Rising Star. Through company introductions, reviews of business performance, lab tours, and Q&A sessions, Solid unveiled its growth strategies focusing on core businesses such as 5G, Open RAN, defense, and venture capital investments.

2. What are Solid’s growth drivers and the purpose of the IR?

- Robust telecommunications equipment business: The expansion of 5G networks and growth of the Open RAN market represent significant opportunities for Solid. AT&T’s investment plans in Open RAN are particularly noteworthy.

- Stable defense business: Solid’s involvement in TICN, TMMR, and military satellite communication equipment provides a solid revenue base.

- Future growth engine, venture capital: By registering as a new technology business finance company and actively investing, Solid aims to secure long-term growth momentum.

Solid aimed to actively communicate its growth potential and investment attractiveness, strengthening communication with investors through this IR presentation.

3. What’s next for Solid after the IR?

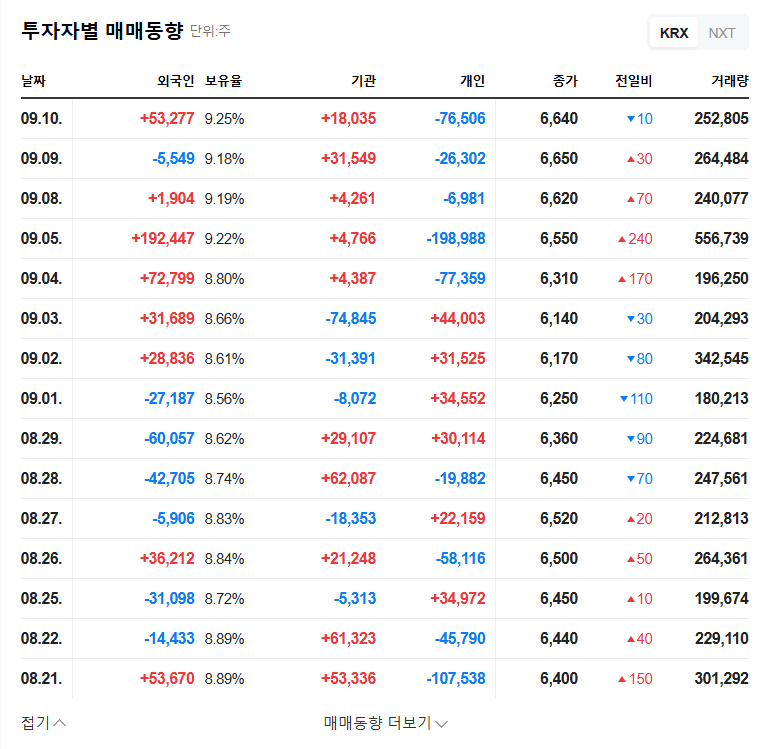

Positive Outlook: The IR presentation has the potential to attract investor attention and increase the likelihood of new investments. The performance of the Open RAN business, in particular, could serve as momentum for stock price appreciation.

Potential Risks: Presentation content falling short of market expectations or the disclosure of unforeseen negative news could negatively impact the stock price. Exchange rate volatility also requires continuous management.

4. Action Plan for Investors

- Thorough analysis of IR presentation content: Grasp key information such as 5G and Open RAN order status, overseas expansion strategies, and venture capital investment performance.

- Confirmation of exchange rate risk management capabilities: Examine the company’s response strategies to exchange rate fluctuations.

- Monitoring macroeconomic indicators: Continuously observe external factors such as interest rates, exchange rates, and the global economic situation.

- Maintain a long-term perspective: Evaluate venture capital investments from a long-term perspective. Make investment decisions considering the stable growth of core businesses.

Frequently Asked Questions (FAQ)

What are Solid’s main businesses?

Solid’s main businesses are telecommunications equipment (5G, Open RAN), defense, and venture capital investments.

What were the key takeaways from the IR presentation?

The IR presentation, commemorating Solid’s selection as a KOSDAQ Rising Star, highlighted its growth strategies and provided updates on its core businesses (5G, Open RAN, defense, and venture capital).

What should investors consider when investing in Solid?

Investors should consider market expectations, exchange rate volatility, and venture capital investment risks. A thorough analysis of the IR presentation content and macroeconomic indicators is crucial, and investment decisions should be made with a long-term perspective.