A significant development has emerged for patients with gastroesophageal reflux disease (GERD) and gastric ulcers. Onconic Therapeutics Inc. has officially secured product approval for Zacubo ODT (Orally Disintegrating Tablet), a groundbreaking new formulation of its P-CAB class drug, Zastaprazan. This approval is more than just a product line extension; it represents a major strategic move that enhances patient convenience, strengthens the company’s foothold in the competitive P-CAB market, and presents new considerations for investors. This analysis will explore the profound implications of the Zacubo ODT launch.

Official Approval: The Details on Zacubo ODT

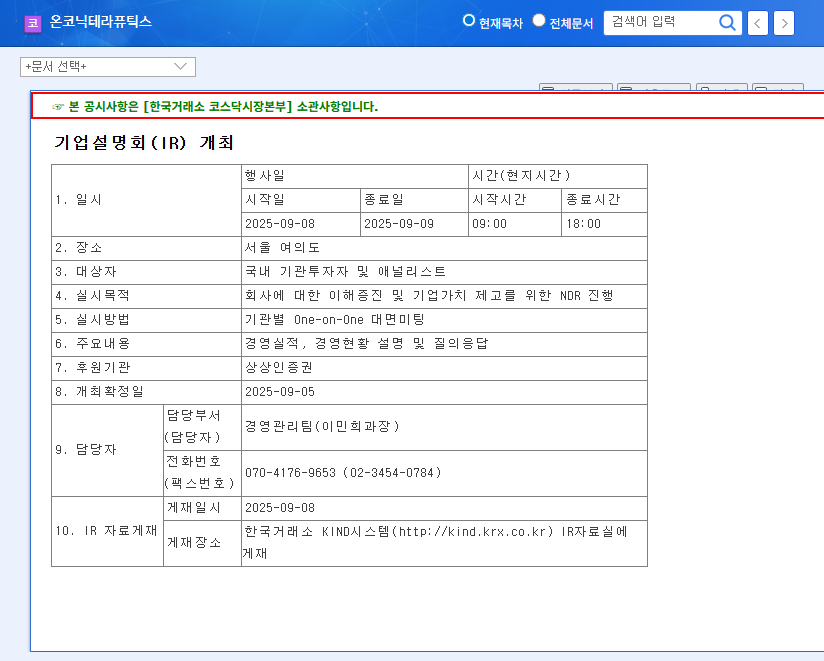

On October 30, 2025, Onconic Therapeutics announced that it received approval from the Ministry of Food and Drug Safety (MFDS) for ‘Zacubo Orally Disintegrating Tablet 20 mg’. This critical milestone, detailed in the company’s Official Disclosure (Source), adds a highly patient-centric option to its existing GERD treatment portfolio. The key advantage of Zacubo ODT is its ability to dissolve quickly in the mouth without water, a feature designed to significantly improve treatment adherence for specific patient populations.

Key Approval Information:

- •Product Name: Zacubo Orally Disintegrating Tablet 20 mg (Zastaprazan Citrate)

- •Indications: Erosive Esophagitis (GERD), Gastric Ulcers

- •Next Steps: Market launch pending insurance reimbursement listing.

The P-CAB Revolution and Patient-Centric Innovation

To understand the significance of this approval, it’s essential to recognize the shift in the GERD treatment landscape. For decades, Proton Pump Inhibitors (PPIs) were the standard of care. However, Potassium-Competitive Acid Blockers (P-CABs), like Zastaprazan, offer faster onset of action and more consistent acid suppression. The global P-CAB market is rapidly expanding as it replaces the legacy PPI market. Within this competitive arena, innovation in drug delivery is a key differentiator. By launching Zacubo ODT, Onconic Therapeutics is targeting a crucial unmet need: medication convenience.

This is particularly important for the growing elderly population and patients with dysphagia (difficulty swallowing), a common condition that can severely impact quality of life and medication compliance. As noted by authoritative sources like the Mayo Clinic, dysphagia can make taking traditional pills challenging. An ODT formulation directly addresses this problem, making Onconic Therapeutics a more attractive option for prescribers managing these patient groups.

The launch of Zacubo ODT is not merely a product line extension; it is a strategic move to capture a valuable, underserved patient segment and build a competitive moat based on user experience and superior convenience.

Investment Analysis: Opportunities and Considerations

From an investor’s perspective, the approval of Zacubo ODT presents several compelling opportunities balanced by manageable risks. This new formulation is expected to act as a significant growth catalyst for Onconic Therapeutics.

Potential Upside

- •Expanded Market Share: The ODT formulation can attract new patients who were previously non-compliant or struggled with tablet forms, directly expanding the total addressable market for the Zacubo brand. For more details, see our analysis of the P-CAB market landscape.

- •Revenue & Profitability Growth: Increased prescription volume is expected to directly boost top-line revenue and contribute to improving operating margins, building on the company’s recent positive financial performance.

- •Enhanced Brand Value: Successfully launching an innovative, patient-focused formulation elevates the company’s reputation and strengthens investor confidence in its R&D and commercialization capabilities.

Key Monitoring Points for Investors

While the outlook is positive, savvy investors should monitor several key factors that will determine the ultimate success of the launch:

- •Insurance Reimbursement Timeline: The speed and terms of the insurance listing are the most critical near-term hurdles. Delays could postpone revenue generation.

- •Market Adoption Rate: Monitor early prescription data to gauge how effectively the ODT formulation is complementing, rather than cannibalizing, the existing Zacubo tablet sales.

- •Competitive Response: The P-CAB market is dynamic. Keep an eye on how competitors react and whether they introduce similar patient-friendly formulations.

Frequently Asked Questions (FAQ)

What is Onconic Therapeutics Inc.’s ‘Zacubo ODT’?

Zacubo ODT is a new formulation of Zacubo (Zastaprazan), a P-CAB class medication from Onconic Therapeutics used for GERD and gastric ulcers. Its key feature is that it’s an orally disintegrating tablet, designed to dissolve in the mouth without water for easier administration.

Who will benefit most from Zacubo ODT?

The primary beneficiaries are patients who have difficulty swallowing pills, such as many elderly individuals and people with a medical condition called dysphagia. This formulation significantly improves convenience and treatment adherence for these groups.

How does this impact Onconic Therapeutics’ market position?

It strengthens the company’s competitive edge in the growing P-CAB market by offering a differentiated, patient-centric product. This is expected to drive market share growth, increase revenue, and enhance the overall brand value of the Zacubo franchise.