Investors in Orum Therapeutics, Inc. (475830) are closely analyzing a recent disclosure that has sparked considerable market debate. An official Report on Major Shareholder Holdings revealed a significant shift in ownership stakes, including a reduction by a key figure with management influence. This news has created a classic dilemma: is this a signal of internal doubt, creating short-term pressure on Orum Therapeutics stock, or merely a transient event that presents a buying opportunity for those focused on the company’s impressive long-term growth potential?

This comprehensive analysis will dissect the Orum Therapeutics shareholder report, evaluate the company’s robust fundamentals, explore the immediate and future impacts, and provide a strategic action plan for investors. Our goal is to equip you with the insights needed to navigate the current volatility and make well-informed decisions.

Deconstructing the Major Shareholder Report

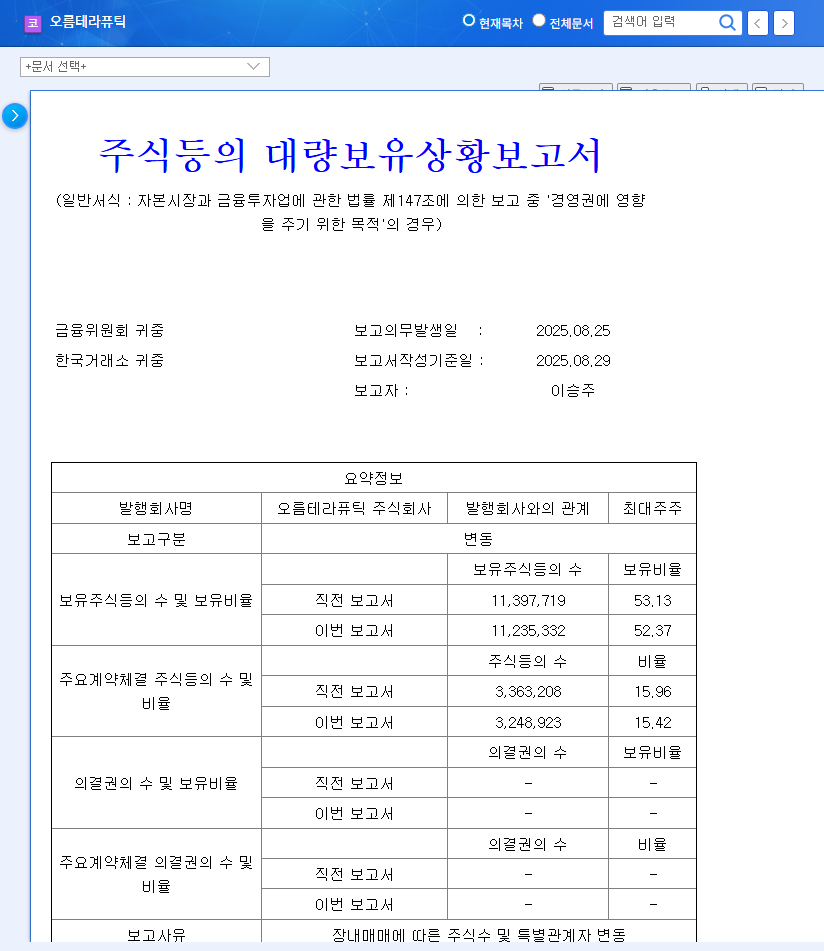

On November 7, 2025, Orum Therapeutics released a mandatory disclosure detailing changes in the holdings of its principal shareholders. As detailed in the Official Disclosure filed with DART, the key takeaways are:

- •Stake Reduction by Key Figure: Mr. Lee Seung-joo, identified as a reporting representative with management influence, reduced his personal shareholding from 48.60% to 46.67%.

- •Broad-Based Selling: The change was not isolated. It occurred via open market sales involving multiple venture capital funds and other major shareholders liquidating a substantial number of shares in a concentrated period.

Why Orum Therapeutics’ Fundamentals Remain Compelling

Despite the market’s reaction to the shareholder news, it is crucial to separate ownership changes from the company’s intrinsic operational value. The core fundamentals of Orum Therapeutics remain exceptionally strong.

Groundbreaking Technology and Pipeline

Orum’s competitive edge is built on two innovative platforms: Antibody-Drug Conjugates (ADC) and its proprietary TPD² (Dual-precision Targeted Protein Degradation) technology. The TPD² platform is particularly noteworthy as it aims to eliminate disease-causing proteins entirely, a next-generation approach to cancer therapy. The immense potential of this technology has been validated by major industry players:

- •A major technology transfer agreement for the ORM-6151 candidate with Bristol Myers Squibb (BMS).

- •A significant out-licensing deal for the TPD² platform with Vertex Pharmaceuticals.

These partnerships not only provide non-dilutive funding but also serve as powerful external validation of Orum’s scientific leadership. Progress on these and other pipeline candidates continues smoothly, setting the stage for future revenue streams and value creation. For more information on navigating this sector, you can review our complete guide to biotech investing.

The core investment thesis for Orum Therapeutics hinges on whether you believe the short-term market noise from share sales outweighs the long-term, fundamental value of its groundbreaking pipeline and validated technology.

Analyzing the Market Impact

Short-Term: Heightened Volatility and Negative Sentiment

In the immediate term, the large-scale selling by insiders and early investors is an undeniable headwind. The market often interprets such moves as a negative signal, leading to downward pressure on the Orum Therapeutics stock price. This can create a cycle of weakened investor sentiment, particularly as it raises questions about management stability, even if unfounded. It’s also common for venture funds to realize profits after a successful IPO and lock-in period, a factor that contributes to selling pressure but doesn’t necessarily reflect on the company’s future prospects.

Mid-to-Long-Term: A Focus on Milestones and Value

Looking beyond the immediate noise, the long-term outlook is dictated by execution. The shareholder reshuffle is only a negative if it signals deeper issues. However, all current evidence suggests the company’s technological foundation is sound. A temporary dip in the stock price could, therefore, be viewed as an attractive entry point for new investors with a longer time horizon. Future value will be driven by clinical trial data, regulatory approvals from bodies like the Food and Drug Administration (FDA), and the potential for new partnerships.

Investor Strategy: Navigating the Volatility

Given the circumstances, a differentiated approach is required based on your investment timeline.

- •For Short-Term Traders: Caution is paramount. The current negative sentiment and selling overhang could lead to further price declines. It may be wise to remain on the sidelines and monitor how the market absorbs the selling pressure before considering a new position.

- •For Long-Term Investors: The focus should remain on the fundamentals, which are unchanged. A stock price decline based on shareholder rotation, rather than a clinical or business setback, can represent a significant buying opportunity. The key is to continuously monitor clinical progress and company communications.

In conclusion, while the Orum Therapeutics shareholder report has introduced short-term uncertainty, the company’s innovative technology and strategic partnerships form a solid foundation for long-term growth. Prudent investors should avoid impulsive reactions and instead use this event to reassess their position based on the company’s powerful intrinsic value.