The intersection of artificial intelligence and biotechnology is creating unprecedented opportunities, and at the forefront of this revolution is PROTEINA CO.,LTD.. A recent announcement has solidified its position as a market leader: PROTEINA has been selected to spearhead a large-scale national project, a development that serves as a critical indicator for its future growth and overall investment value. This analysis delves into the core of PROTEINA’s strategy, its technological prowess in AI drug development, and the profound implications of this national project for the company and its investors.

We will provide a comprehensive overview of the essential information investors need, from PROTEINA’s foundational technology and financial health to the strategic opportunities and potential risks stemming from this pivotal event.

A Landmark Achievement: Securing the National Project Bid

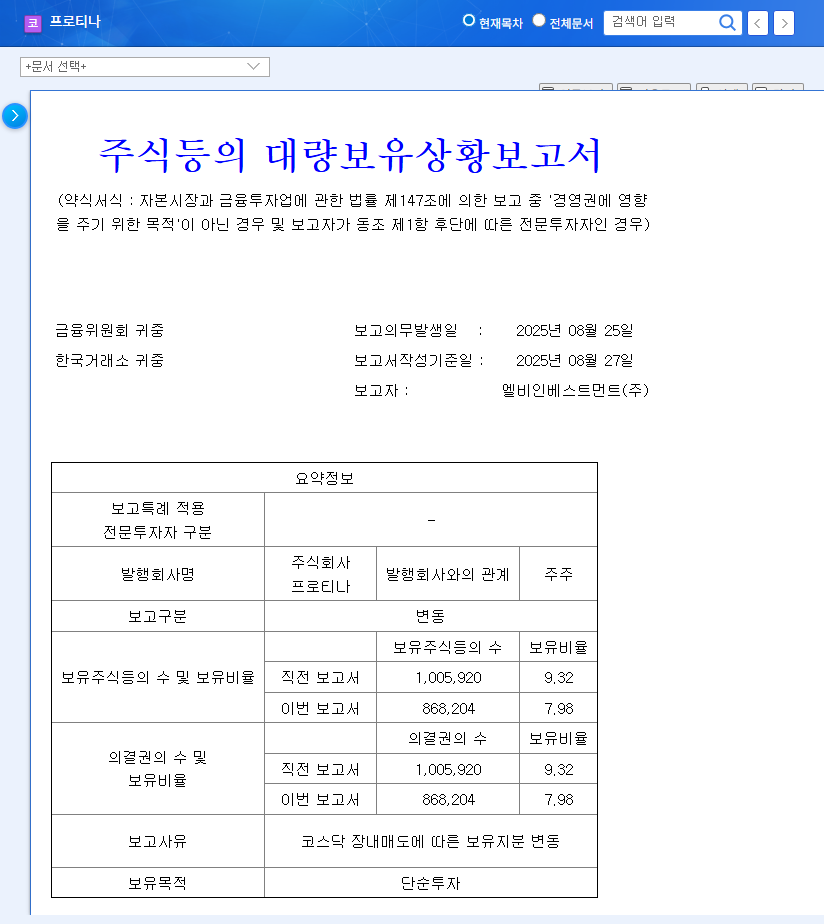

PROTEINA CO.,LTD. has officially been chosen as the lead institution for the ‘AI model-based antibody biobetter development and demonstration project’. This isn’t just a win; it’s a powerful endorsement of its innovative approach. The project, backed by a total budget of 46.965 billion KRW (with 30.3 billion KRW in government funding), is scheduled to run from October 2025 to December 2027. The primary objective is to build a high-speed, parallel antibody biopharmaceutical development pipeline. This pipeline will leverage a sophisticated feedback loop between AI-driven design and large-scale experimental data, promising to accelerate the discovery of new therapeutics. Further details can be found in the Official Disclosure (DART).

Company Fundamentals: Technology and Financial Trajectory

The Core Engine: The SPID Platform

At the heart of PROTEINA’s competitive advantage is its proprietary SPID Platform. This cutting-edge technology provides comprehensive solutions for protein-protein interaction (PPI) analysis and antibody development. Understanding PPI is fundamental to modern biology, as these interactions govern nearly every cellular process. By accurately mapping and analyzing these interactions, the SPID Platform enables a more precise and efficient approach to drug discovery, setting PROTEINA apart from competitors. This technological differentiation is crucial for any biotech investment thesis.

Financial Health and Growth Momentum

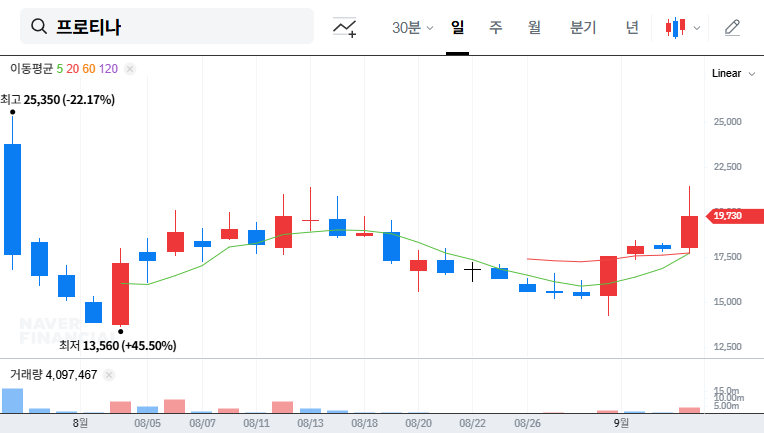

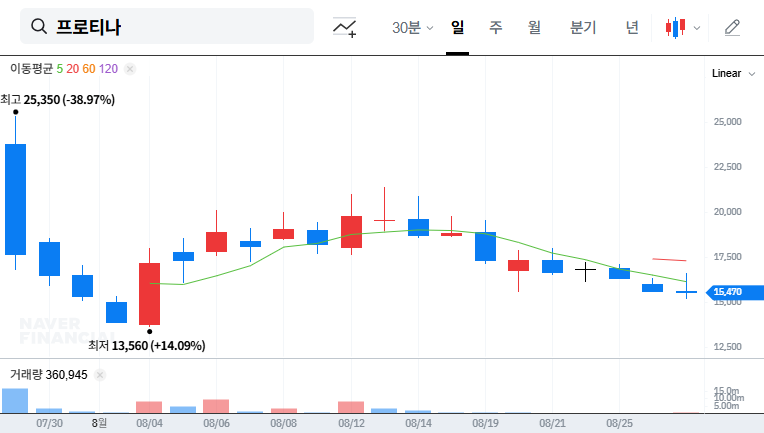

The first half of 2025 saw PROTEINA achieve explosive growth, with revenue soaring to 2.025 billion KRW—a 165.67% increase year-over-year. This surge was propelled by sales of its SPID Platform System and its PPI PathFinder® service. While the company posted an operating loss of -3.973 billion KRW, this marks a significant improvement from the -9.121 billion KRW loss in the previous year, signaling a clear path toward financial stability. The successful IPO on the KOSDAQ exchange in July 2025 provided a vital capital injection to fuel R&D and global market expansion, further strengthening the foundation for its PROTEINA AI drug development initiatives.

This national project selection is a Strong Positive signal for PROTEINA, validating its technology and securing a critical growth engine for the future. The government funding significantly de-risks R&D and enhances the probability of success for its new drug pipeline.

PROTEINA Investment Analysis: Opportunities vs. Risks

Positive Catalysts for Growth

The national project win unlocks several key opportunities that should be central to any PROTEINA investment analysis:

- •Technology Validation: Selection by a government body provides objective validation of PROTEINA’s technology and business model, boosting credibility in the market.

- •R&D Funding Secured: The 30.3 billion KRW in government funds will dramatically accelerate new drug development pipelines and fortify R&D capabilities without excessive shareholder dilution.

- •Enhanced Commercialization Potential: The project’s goals—including IND applications and technology transfers (L/O)—directly align with commercial outcomes. Combining AI with the SPID Platform will improve development speed and precision. For more on this trend, see the latest research on AI in Drug Discovery from leading institutions.

- •Market Leadership: The project reinforces PROTEINA’s potential to lead the innovative antibody biobetter development sector, a rapidly growing field.

Potential Risks and Investor Considerations

A prudent investor must also consider the potential challenges:

- •Financial Contribution: PROTEINA must self-fund 13.635 billion KRW. This represents a significant portion of its equity, requiring careful financial management and alignment with funds raised during the IPO.

- •Long-Term Horizon: The project concludes in late 2027, meaning a direct impact on short-term financials is unlikely. The investment thesis is contingent on achieving long-term project milestones.

- •Macroeconomic Factors: With a high proportion of revenue in USD, the company is exposed to currency fluctuations. Global interest rates and economic conditions are also important variables.

Conclusion: An Investor’s Path Forward

The selection of PROTEINA for this national project is a powerful validation of its strategy and a significant de-risking event for its long-term R&D roadmap. While short-term stock price appreciation is possible due to positive sentiment, the real value lies in the successful execution of the project. Investors should closely monitor project progress, the company’s management of its financial contribution, and any announcements regarding technology transfers or commercialization milestones. To learn more about the industry, read our guide on Understanding the Global Proteomics Market.

By successfully leveraging its SPID Platform within this government-backed initiative, PROTEINA has a clear opportunity to establish an enduring leadership position in the global AI-based drug development arena, offering a compelling long-term growth story for investors.