Recent market volatility has placed a spotlight on SMCG CO.,Ltd (460870), particularly after news emerged that a major institutional investor, Truston Asset Management, significantly reduced its holdings. This development has understandably triggered a wave of concern among investors, raising critical questions about the company’s future stock trajectory and underlying value. Is this a signal of fundamental weakness, or a market overreaction creating a potential opportunity? This comprehensive SMCG stock analysis aims to dissect the company’s intrinsic value by examining its H1 2025 earnings, core business strengths, and the broader market forces at play.

We will explore the implications of the Truston Asset Management stake sale, weigh macroeconomic variables, and provide a clear investment strategy for both short-term and long-term investors. Join us as we uncover the true state and future potential of SMCG.

The Catalyst: Truston Asset Management’s Stake Reduction

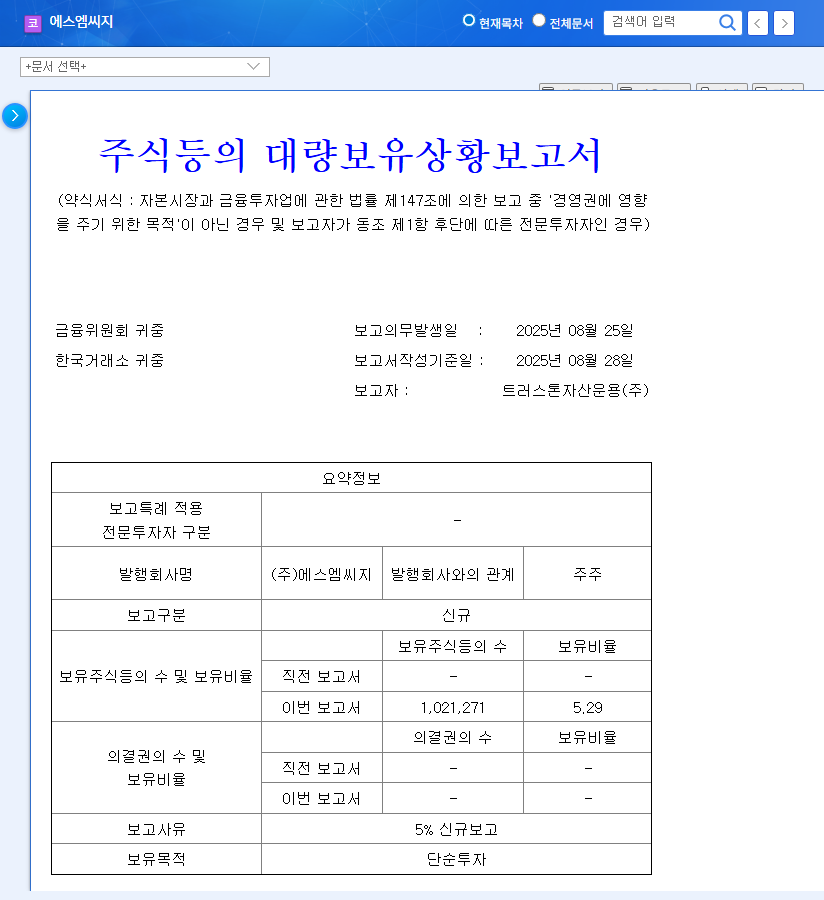

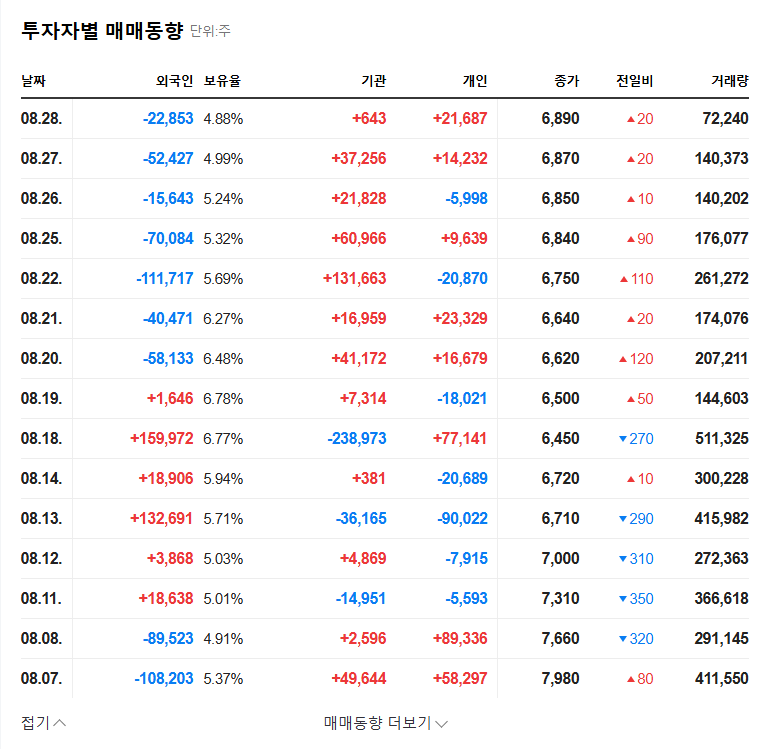

On November 5, 2025, a key disclosure shook investor confidence in SMCG CO.,Ltd (460870). Truston Asset Management, a prominent domestic asset manager, filed a ‘Report on the Status of Large Shareholdings’ revealing a significant change in its investment. According to the official disclosure, which can be viewed here: Official Disclosure (DART), Truston reduced its stake from 5.29% down to 2.31%. This 2.98 percentage point decrease was executed via market and off-market transactions between October 29 and November 4, 2025. The stated purpose was ‘simple investment,’ suggesting this may be a portfolio rebalancing rather than a vote of no-confidence in SMCG’s core business.

While any large stake sale can create short-term selling pressure, it is crucial to analyze whether this move reflects a change in the company’s fundamentals or simply an institutional strategy shift.

Fundamental Analysis of SMCG CO.,Ltd (460870)

To understand the long-term picture, we must look beyond the recent news and into the company’s core operations and financial health.

Core Business: A Leader in K-Beauty Packaging

SMCG specializes in manufacturing high-quality cosmetic glass containers and provides comprehensive full-packaging Original Design Manufacturing (ODM) services. The company’s competitive edge is built on several key pillars:

- •Eco-Friendly Innovation: SMCG leverages proprietary, eco-friendly glass materials and unique manufacturing technologies, positioning it perfectly to meet the growing global demand for sustainable packaging and ESG-conscious products.

- •Global Client Network: The company has cultivated strong, long-term relationships with major global beauty brands, giving it a stable and diverse revenue base.

- •Favorable Market Trends: SMCG is a direct beneficiary of the global expansion of K-beauty packaging, the shift to online retail, and the premiumization of cosmetics. Our internal analysis of the beauty market confirms these are durable, long-term trends.

H1 2025 Financial Performance: A Mixed Picture

The H1 2025 financial report for SMCG CO.,Ltd (460870) reveals a period of strategic investment and transition. While sales showed growth, profitability faced headwinds. Revenue climbed to 29.289 billion KRW, a positive sign of continued demand. However, operating profit fell to 2.729 billion KRW. This compression in margins is primarily attributed to increased costs associated with new business investments and significant facility expansions aimed at future growth. The company reported a net loss, though the deficit narrowed compared to the previous year. On a brighter note, the KOSDAQ listing significantly improved the financial structure by reducing debt and increasing equity, thereby bolstering long-term stability.

Navigating Macroeconomic Headwinds

Like any global manufacturer, SMCG is exposed to macroeconomic variables. Fluctuations in currency exchange rates can be a double-edged sword, boosting export revenue but also increasing raw material import costs. Furthermore, rising interest rates in key markets, as reported by institutions like the Federal Reserve, could increase borrowing costs and dampen overall investment sentiment. Managing these external risks will be critical for SMCG’s performance in the coming quarters.

Future Outlook & Investment Strategy

Despite short-term pressures, the long-term growth potential for SMCG CO.,Ltd (460870) remains compelling. The company’s technological advantages in sustainable cosmetic glass containers and its strong global footing are significant assets. The key challenge is navigating the current phase of investment. Investors must see a clear return on the recent capital expenditures through improved profitability and efficiency.

Actionable Advice for Investors

- •For Short-Term Traders: The volatility caused by the Truston sale presents risks. A cautious approach is advised. Closely monitor institutional trading flows and upcoming earnings releases for signs of stabilization before entering a position.

- •For Long-Term Investors: Focus on the fundamental growth story. The current price dip could be an entry point, but it’s contingent on the company demonstrating a clear path back to net profitability. Monitor the performance of new facilities and management’s strategy for debt reduction.

Frequently Asked Questions (FAQ)

Q1: Is Truston’s stake sale a major red flag for SMCG’s value?

Not necessarily. Given the ‘simple investment’ purpose and the ~3% scale, it is more likely a portfolio management decision by Truston than a direct indictment of SMCG’s long-term prospects. However, it does create short-term market uncertainty that investors must acknowledge.

Q2: What is SMCG’s strongest competitive advantage?

SMCG’s primary advantage lies in its proprietary eco-friendly technology for producing cosmetic glass containers. This aligns perfectly with the powerful ESG and sustainability trends in the global beauty industry, giving it a distinct edge over competitors.

Q3: What are the key risks to watch when investing in SMCG?

The most significant risks are the temporary slowdown in profitability due to high investment costs, a relatively high debt burden, and exposure to macroeconomic volatility (interest rates and currency fluctuations). Investors should monitor upcoming earnings reports for evidence that these risks are being effectively managed.