The recent WITS Co., Ltd. capital increase has sent ripples through the investment community. On October 30, 2025, the company announced a significant financial maneuver aimed at fueling its next phase of expansion. While this move signals ambition and confidence, it also raises valid questions for current and prospective shareholders about share dilution and short-term stock performance. This comprehensive analysis will dissect the decision, explore its underlying strategy, and provide a clear roadmap for investors navigating this pivotal moment.

We will examine the fundamentals of WITS, the specifics of the capital injection, the potential effects on corporate value, and what this means for the WITS stock price. Whether you’re a long-term holder or considering a new position, this report offers the essential insights you need.

The Details of the WITS Capital Increase

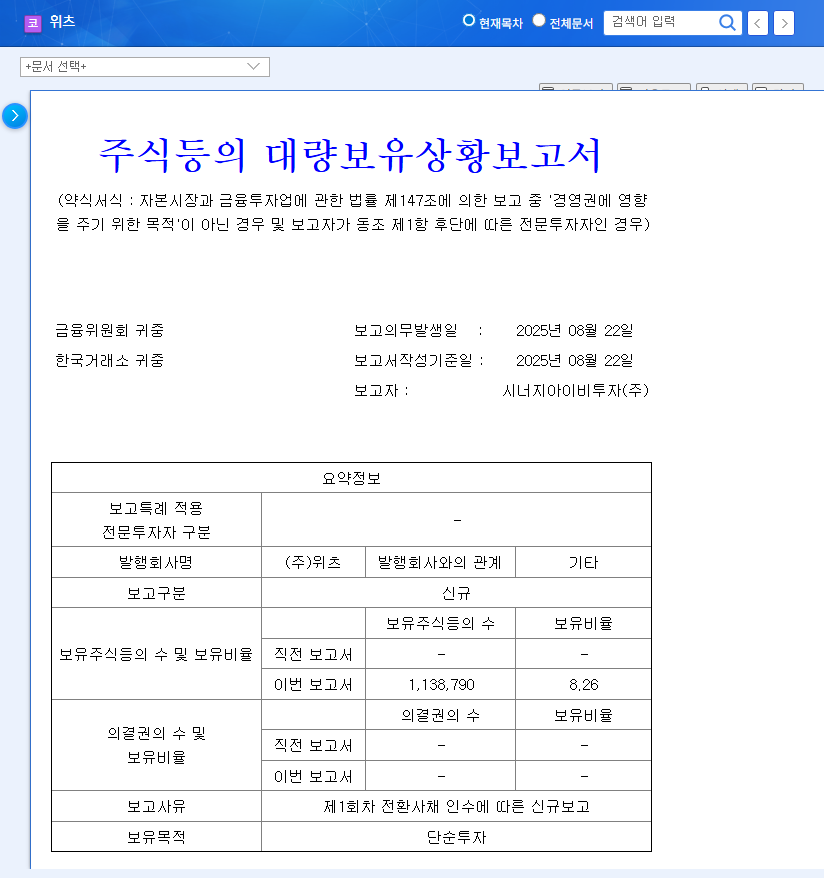

According to the major disclosure filed on October 30, 2025, WITS Co., Ltd. has finalized a decision for a third-party allotment capital increase. The move is designed to raise approximately 5.45 billion KRW to fortify its financial standing and accelerate growth initiatives. You can view the Official Disclosure (Source) for complete regulatory details. Here are the key transaction points:

- •Total Capital Raised: Approximately 5.45 billion KRW.

- •New Shares Issued: 665,000 common shares.

- •Issuance Price: 8,196 KRW per share.

- •Key Strategic Investors: GS Energy and GS Neotech.

- •Key Dates: Payment on November 14, 2025; New shares listed on December 3, 2025.

Why Now? WITS’s Growth Strategy & Financial Imperatives

The timing of this capital increase is not arbitrary. It’s a calculated response to both immense opportunities and pressing financial needs. WITS aims to solidify its position in high-growth sectors while addressing underlying financial vulnerabilities.

Fueling High-Growth Business Engines

WITS has established two powerful growth drivers. The first is its electronics business, particularly the mobile wireless charging receiver (Rx) module segment, which remains a stable revenue generator. The second, and more explosive, is its automotive electronics division. Since incorporating its subsidiary in 2024, revenue from infotainment systems has surged. Key contracts with KG Mobility and Hyundai Kefico for EV chargers signal a robust future pipeline. The secured funds are earmarked for R&D and facility investments to capitalize on this momentum.

Addressing Financial Health Concerns

Despite impressive profit growth—with operating profit up 74.4%—the company’s financial health has shown signs of strain. A credit rating downgrade to BB+ in April 2025 and negative operating cash flow highlighted a need for liquidity. This capital injection directly addresses these concerns by providing necessary working capital, improving the balance sheet, and paving the way for a potential credit rating recovery.

A capital increase is a double-edged sword for investors. It can unlock immense future value by funding growth, but it often comes with the short-term pain of share dilution. The key is whether the long-term vision justifies the immediate cost.

Potential Impacts on WITS’s Stock Price and Value

A thorough WITS investor analysis requires a balanced look at both the upside and the downside of this capital raise.

The Bull Case: Positive Catalysts

- •Accelerated Growth: The funds will directly support the highest potential areas—automotive electronics and EV charging—potentially supercharging revenue growth.

- •Strategic Alliances: The involvement of GS Energy and GS Neotech is more than just a cash infusion; it’s a vote of confidence that can lead to valuable business synergies and enhanced corporate credibility.

- •Improved Financials: The capital injection will immediately improve the debt-to-equity ratio and bolster financial stability, creating a stronger foundation for the company.

- •Limited Dilution Impact: The issuance price of 8,196 KRW is only a minor discount from the prevailing market price, which may help minimize immediate concerns about the effects of share dilution.

The Bear Case: Potential Risks

- •Inevitable Share Dilution: The addition of 665,000 new shares will dilute the ownership stake of existing shareholders, a primary concern following any capital increase.

- •Short-Term Price Pressure: It is common for a stock to face downward pressure around the payment and listing dates as the market absorbs the new supply of shares.

- •Execution Risk: The success of this move hinges on management’s ability to deploy the new capital effectively. Poor execution could negate the benefits and harm long-term value.

Investment Strategy & Outlook for WITS Shareholders

Given the factors at play, a prudent investment strategy is essential. The WITS Co., Ltd. capital increase presents a classic risk/reward scenario.

- •Short-Term Caution: Avoid impulsive decisions. Monitor the stock’s behavior closely around the payment date (Nov 14) and listing date (Dec 03) for potential volatility and buying opportunities.

- •Mid-to-Long-Term Focus: The true value will be realized over time. Focus on the company’s execution. Are they hitting milestones in the automotive and EV sectors? Is profitability improving as promised?

- •Monitor External Factors: Keep an eye on key macroeconomic indicators, such as interest rates and raw material prices, as they can significantly impact WITS’s profitability and overall market sentiment.

In conclusion, if WITS’s management team successfully leverages this capital to execute its ambitious growth strategy, long-term investors are likely to be rewarded. Patience and diligent monitoring will be key to successful investment outcomes.